Exam 13: Return, Risk, and the Security Market Line

Exam 1: Introduction to Corporate Finance71 Questions

Exam 2: Financial Statements, Taxes, and Cash Flow81 Questions

Exam 3: Working With Financial Statements96 Questions

Exam 4: Long-Term Financial Planning and Growth80 Questions

Exam 5: Introduction to Valuation: The Time Value of Money68 Questions

Exam 6: Discounted Cash Flow Valuation132 Questions

Exam 7: Interest Rates and Bond Valuation129 Questions

Exam 8: Stock Valuation119 Questions

Exam 9: Net Present Value and Other Investment Criteria115 Questions

Exam 10: Making Capital Investment Decisions108 Questions

Exam 11: Project Analysis and Evaluation106 Questions

Exam 12: Some Lessons From Capital Market History98 Questions

Exam 13: Return, Risk, and the Security Market Line109 Questions

Exam 14: Cost of Capital100 Questions

Exam 15: Raising Capital93 Questions

Exam 16: Financial Leverage and Capital Structure Policy98 Questions

Exam 17: Dividends and Payout Policy103 Questions

Exam 18: Short-Term Finance and Planning109 Questions

Exam 19: Cash and Liquidity Management101 Questions

Exam 20: Credit and Inventory Management97 Questions

Exam 21: International Corporate Finance99 Questions

Exam 22: Behavioral Finance: Implications for Financial Management45 Questions

Exam 23: Enterprise Risk Management68 Questions

Exam 24: Options and Corporate Finance106 Questions

Exam 25: Option Valuation79 Questions

Exam 26: Mergers and Acquisitions89 Questions

Exam 27: Leasing72 Questions

Select questions type

The common stock of Manchester & Moore is expected to earn 13 percent in a recession,6 percent in a normal economy,and lose 4 percent in a booming economy.The probability of a boom is 5 percent while the probability of a recession is 45 percent.What is the expected rate of return on this stock?

(Multiple Choice)

4.8/5  (44)

(44)

Which one of the following statements related to risk is correct?

(Multiple Choice)

4.9/5  (47)

(47)

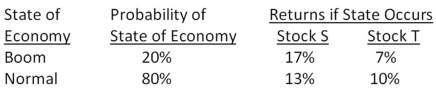

What is the variance of the returns on a portfolio that is invested 60 percent in stock S and 40 percent in stock T?

(Multiple Choice)

4.8/5  (33)

(33)

You have $10,000 to invest in a stock portfolio.Your choices are Stock X with an expected return of 13 percent and Stock Y with an expected return of 8 percent.Your goal is to create a portfolio with an expected return of 12.4 percent.All money must be invested.How much will you invest in stock X?

(Multiple Choice)

4.8/5  (41)

(41)

Which one of the following risks is irrelevant to a well-diversified investor?

(Multiple Choice)

4.9/5  (28)

(28)

You have a portfolio consisting solely of stock A and stock B.The portfolio has an expected return of 9.8 percent.Stock A has an expected return of 11.4 percent while stock B is expected to return 6.4 percent.What is the portfolio weight of stock A?

(Multiple Choice)

4.8/5  (37)

(37)

The expected return on a stock given various states of the economy is equal to the:

(Multiple Choice)

4.8/5  (38)

(38)

How many diverse securities are required to eliminate the majority of the diversifiable risk from a portfolio?

(Multiple Choice)

4.8/5  (37)

(37)

The risk-free rate of return is 3.9 percent and the market risk premium is 6.2 percent.What is the expected rate of return on a stock with a beta of 1.21?

(Multiple Choice)

4.9/5  (38)

(38)

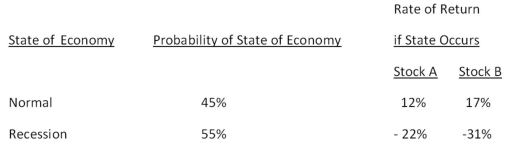

You are comparing stock A to stock B.Given the following information,what is the difference in the expected returns of these two securities?

(Multiple Choice)

4.9/5  (36)

(36)

Explain how the beta of a portfolio can equal the market beta if 50 percent of the portfolio is invested in a security that has twice the amount of systematic risk as an average risky security.

(Essay)

4.9/5  (41)

(41)

The intercept point of the security market line is the rate of return which corresponds to:

(Multiple Choice)

4.7/5  (32)

(32)

The common stock of United Industries has a beta of 1.34 and an expected return of 14.29 percent.The risk-free rate of return is 3.7 percent.What is the expected market risk premium?

(Multiple Choice)

4.7/5  (36)

(36)

The common stock of Jensen Shipping has an expected return of 14.7 percent.The return on the market is 10.8 percent and the risk-free rate of return is 3.8 percent.What is the beta of this stock?

(Multiple Choice)

4.9/5  (45)

(45)

Which of the following statements are correct concerning diversifiable risks?

I.Diversifiable risks can be essentially eliminated by investing in thirty unrelated securities.

II.There is no reward for accepting diversifiable risks.

III.Diversifiable risks are generally associated with an individual firm or industry.

IV.Beta measures diversifiable risk.

(Multiple Choice)

4.8/5  (29)

(29)

Thayer Farms stock has a beta of 1.12.The risk-free rate of return is 4.34 percent and the market risk premium is 7.92 percent.What is the expected rate of return on this stock?

(Multiple Choice)

4.9/5  (31)

(31)

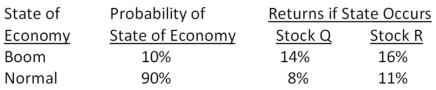

What is the standard deviation of the returns on a portfolio that is invested 52 percent in stock Q and 48 percent in stock R?

(Multiple Choice)

5.0/5  (40)

(40)

The returns on the common stock of New Image Products are quite cyclical.In a boom economy,the stock is expected to return 32 percent in comparison to 14 percent in a normal economy and a negative 28 percent in a recessionary period.The probability of a recession is 25 percent while the probability of a boom is 20 percent.What is the standard deviation of the returns on this stock?

(Multiple Choice)

4.8/5  (40)

(40)

The market has an expected rate of return of 11.2 percent.The long-term government bond is expected to yield 5.8 percent and the U.S.Treasury bill is expected to yield 3.9 percent.The inflation rate is 3.6 percent.What is the market risk premium?

(Multiple Choice)

4.9/5  (35)

(35)

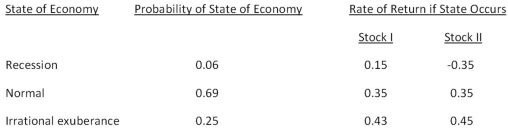

Consider the following information on Stocks I and II:  The market risk premium is 8 percent,and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

The market risk premium is 8 percent,and the risk-free rate is 3.6 percent.The beta of stock I is _____ and the beta of stock II is _____.

(Multiple Choice)

4.8/5  (31)

(31)

Showing 61 - 80 of 109

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)