Exam 13: Return, Risk, and the Security Market Line

Exam 1: Introduction to Corporate Finance71 Questions

Exam 2: Financial Statements, Taxes, and Cash Flow81 Questions

Exam 3: Working With Financial Statements96 Questions

Exam 4: Long-Term Financial Planning and Growth80 Questions

Exam 5: Introduction to Valuation: The Time Value of Money68 Questions

Exam 6: Discounted Cash Flow Valuation132 Questions

Exam 7: Interest Rates and Bond Valuation129 Questions

Exam 8: Stock Valuation119 Questions

Exam 9: Net Present Value and Other Investment Criteria115 Questions

Exam 10: Making Capital Investment Decisions108 Questions

Exam 11: Project Analysis and Evaluation106 Questions

Exam 12: Some Lessons From Capital Market History98 Questions

Exam 13: Return, Risk, and the Security Market Line109 Questions

Exam 14: Cost of Capital100 Questions

Exam 15: Raising Capital93 Questions

Exam 16: Financial Leverage and Capital Structure Policy98 Questions

Exam 17: Dividends and Payout Policy103 Questions

Exam 18: Short-Term Finance and Planning109 Questions

Exam 19: Cash and Liquidity Management101 Questions

Exam 20: Credit and Inventory Management97 Questions

Exam 21: International Corporate Finance99 Questions

Exam 22: Behavioral Finance: Implications for Financial Management45 Questions

Exam 23: Enterprise Risk Management68 Questions

Exam 24: Options and Corporate Finance106 Questions

Exam 25: Option Valuation79 Questions

Exam 26: Mergers and Acquisitions89 Questions

Exam 27: Leasing72 Questions

Select questions type

Which one of the following is a risk that applies to most securities?

(Multiple Choice)

4.9/5  (35)

(35)

You own a portfolio equally invested in a risk-free asset and two stocks.One of the stocks has a beta of 1.9 and the total portfolio is equally as risky as the market.What is the beta of the second stock?

(Multiple Choice)

4.8/5  (40)

(40)

You own a stock that you think will produce a return of 11 percent in a good economy and 3 percent in a poor economy.Given the probabilities of each state of the economy occurring,you anticipate that your stock will earn 6.5 percent next year.Which one of the following terms applies to this 6.5 percent?

(Multiple Choice)

4.8/5  (43)

(43)

Your portfolio is comprised of 40 percent of stock X,15 percent of stock Y,and 45 percent of stock Z.Stock X has a beta of 1.16,stock Y has a beta of 1.47,and stock Z has a beta of 0.42.What is the beta of your portfolio?

(Multiple Choice)

4.9/5  (43)

(43)

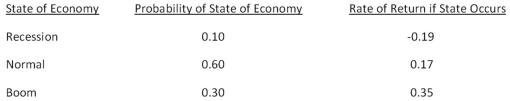

What is the expected return and standard deviation for the following stock?

(Multiple Choice)

4.9/5  (45)

(45)

At a minimum,which of the following would you need to know to estimate the amount of additional reward you will receive for purchasing a risky asset instead of a risk-free asset?

I.asset's standard deviation

II.asset's beta

III.risk-free rate of return

IV.market risk premium

(Multiple Choice)

4.9/5  (29)

(29)

According to CAPM,the amount of reward an investor receives for bearing the risk of an individual security depends upon the:

(Multiple Choice)

4.9/5  (34)

(34)

The expected return on a portfolio considers which of the following factors?

I.percentage of the portfolio invested in each individual security

II.projected states of the economy

III.the performance of each security given various economic states

IV.probability of occurrence for each state of the economy

(Multiple Choice)

5.0/5  (32)

(32)

The expected return on JK stock is 15.78 percent while the expected return on the market is 11.34 percent.The stock's beta is 1.51.What is the risk-free rate of return?

(Multiple Choice)

4.8/5  (44)

(44)

Which one of the following will be constant for all securities if the market is efficient and securities are priced fairly?

(Multiple Choice)

4.9/5  (41)

(41)

Jerilu Markets has a beta of 1.09.The risk-free rate of return is 2.75 percent and the market rate of return is 9.80 percent.What is the risk premium on this stock?

(Multiple Choice)

4.8/5  (41)

(41)

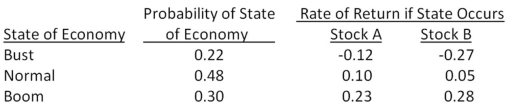

Suppose you observe the following situation:  Assume the capital asset pricing model holds and stock A's beta is greater than stock B's beta by 0.21.What is the expected market risk premium?

Assume the capital asset pricing model holds and stock A's beta is greater than stock B's beta by 0.21.What is the expected market risk premium?

(Multiple Choice)

4.9/5  (40)

(40)

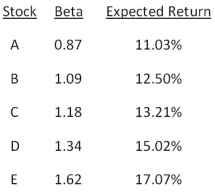

Which one of the following stocks is correctly priced if the risk-free rate of return is 3.2 percent and the market rate of return is 11.76 percent?

(Multiple Choice)

4.8/5  (35)

(35)

The expected return on a portfolio:

I.can never exceed the expected return of the best performing security in the portfolio.

II.must be equal to or greater than the expected return of the worst performing security in the portfolio.

III.is independent of the unsystematic risks of the individual securities held in the portfolio.

IV.is independent of the allocation of the portfolio amongst individual securities.

(Multiple Choice)

4.8/5  (30)

(30)

Which one of the following is the best example of a diversifiable risk?

(Multiple Choice)

4.8/5  (35)

(35)

Showing 41 - 60 of 109

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)