Exam 5: The Stock Market

Exam 1: A Brief History of Risk and Return100 Questions

Exam 2: The Investment Process98 Questions

Exam 3: Overview of Security Types94 Questions

Exam 4: Mutual Funds and Other Investment Companies101 Questions

Exam 5: The Stock Market104 Questions

Exam 6: Common Stock Valuation102 Questions

Exam 7: Stock Price Behavior and Market Efficiency82 Questions

Exam 8: Behavioral Finance and the Psychology of Investing84 Questions

Exam 9: Interest Rates100 Questions

Exam 10: Bond Prices and Yields95 Questions

Exam 11: Diversification and Risky Asset Allocation84 Questions

Exam 12: Return, Risk, and the Security Market Line84 Questions

Exam 13: Performance Evaluation and Risk Management91 Questions

Exam 14: Futures Contracts97 Questions

Exam 15: Stock Options100 Questions

Exam 16: Option Valuation72 Questions

Exam 17: Projecting Cash Flow and Earnings100 Questions

Exam 18: Corporate and Government Bonds107 Questions

Exam 19: Global Economic Activity and Industry Analysis70 Questions

Exam 20: Mortgage-Backed Securities92 Questions

Select questions type

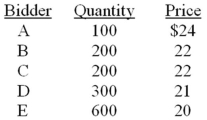

DT Metals is offering 700 shares in a Dutch auction IPO.The following bids have been received:  What will the gross proceeds be for this offering?

What will the gross proceeds be for this offering?

(Multiple Choice)

4.8/5  (46)

(46)

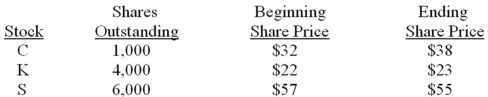

An index consists of the following securities.What is the value-weighted index return?

(Multiple Choice)

4.8/5  (36)

(36)

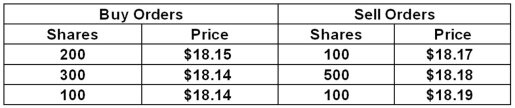

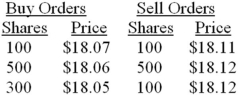

An order book displays the following information:  You place a market order to buy 100 shares.At what price will your order be executed?

You place a market order to buy 100 shares.At what price will your order be executed?

(Multiple Choice)

4.8/5  (38)

(38)

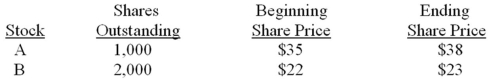

You have the following information:  You want the beginning price-weighted index of these two stocks to be 100.Given this,what is the ending index value?

You want the beginning price-weighted index of these two stocks to be 100.Given this,what is the ending index value?

(Multiple Choice)

4.8/5  (36)

(36)

Kelly wants to sell 600 shares of DeLux stock at the going market price after the stock reaches $42 a share.Which type of order should she place?

(Multiple Choice)

4.8/5  (35)

(35)

ML Underwriters paid an issuer $37,694,528 as IPO proceeds.The IPO offered 1.86 million shares of which 1.835 million were sold at an offer price of $21.85 a share.The underwriting spread was 7.25 percent.What type of underwriting was this?

(Multiple Choice)

4.9/5  (40)

(40)

Which one of the following is the primary flaw of a price-weighted index?

(Multiple Choice)

4.9/5  (37)

(37)

NASDAQ has which of the following characteristics?

I.trading floor

II.computer network

III.specialist system

IV.multiple market makers

(Multiple Choice)

4.8/5  (33)

(33)

When stocks are held in an index in proportion to their total company market value,the index is:

(Multiple Choice)

4.9/5  (38)

(38)

Marcus just placed a stop limit order to sell 100 shares at $21 stop,$18 limit.Which one of the following statements is correct concerning this order if the current market price is $16?

(Multiple Choice)

4.8/5  (47)

(47)

An order to sell that involves a preset trigger point is called a _____ order.

(Multiple Choice)

4.8/5  (32)

(32)

Which one of the following statements related to stock indexes is correct?

(Multiple Choice)

4.8/5  (32)

(32)

An order book displays the following information:  You place an order to sell 100 shares.At what price will your order be executed?

You place an order to sell 100 shares.At what price will your order be executed?

(Multiple Choice)

4.8/5  (48)

(48)

Which one of the following statements concerning the NYSE is correct?

(Multiple Choice)

4.7/5  (35)

(35)

Faith placed an order to sell 7,500 shares of stock she currently owned.As soon as the order reached the trading floor,the shares were immediately sold.Which type of order did Faith place?

(Multiple Choice)

4.8/5  (43)

(43)

A price-weighted index consists of stocks A,B,and C which are priced at $27,$11,and $18 a share,respectively.The current index divisor is 2.24.If stock B undergoes a 1-for-3 reverse stock split,the new index divisor will be:

(Multiple Choice)

5.0/5  (40)

(40)

A price-weighted index consists of stocks A,B,and C which are priced at $50,$35,and $15 a share,respectively.The current index divisor is 2.75.What will the new index advisor be if stock A undergoes a 5-for-1 stock split?

(Multiple Choice)

4.8/5  (38)

(38)

Describe the primary advantage and disadvantage of a limit sell order.

(Essay)

5.0/5  (33)

(33)

Showing 21 - 40 of 104

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)