Exam 5: Activity-Based Costing: A Tool to Aid Decision Making

Exam 1: Managerial Accounting and the Business Environment48 Questions

Exam 2: Cost Terms, Concepts, and Classifications93 Questions

Exam 3: Systems Design: Job-Order Costing108 Questions

Exam 4: Systems Design: Process Costing162 Questions

Exam 5: Activity-Based Costing: A Tool to Aid Decision Making124 Questions

Exam 6: Cost Behaviour: Analysis and Use107 Questions

Exam 7: Cost-Volume-Profit Relationships141 Questions

Exam 8: Variable Costing: A Tool for Management135 Questions

Exam 9: Budgeting134 Questions

Exam 10: Standard Costs and Overhead Analysis211 Questions

Exam 11: Reporting for Control200 Questions

Exam 12: Relevant Costs for Decision Making139 Questions

Exam 13: Capital Budgeting Decisions180 Questions

Exam 14: Financial Statement Analysis200 Questions

Select questions type

Which of the following types of costs present the greatest difficulty in efforts to trace them to products and services?

(Multiple Choice)

4.9/5  (46)

(46)

Which of the following activity levels is an example of the clerical activity associated with processing purchase orders to produce an order for a standard product?

(Multiple Choice)

4.9/5  (36)

(36)

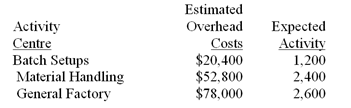

Eaker Company uses activity-based costing to compute product costs for external reports.The company has three activity cost pools and applies overhead using predetermined overhead rates for each activity cost pool.Estimated costs and activities for the current year are presented below for the three activity centres:

Actual costs and activities for the current year were as follows:

Actual costs and activities for the current year were as follows:

Required:

a) How much total overhead was applied to products during the year?

b) By how much was overhead overapplied or underapplied? (Be sure to clearly label your answer as to whether the overhead was overapplied or underapplied for each activity centre as well as for the total.)

Required:

a) How much total overhead was applied to products during the year?

b) By how much was overhead overapplied or underapplied? (Be sure to clearly label your answer as to whether the overhead was overapplied or underapplied for each activity centre as well as for the total.)

(Essay)

4.8/5  (39)

(39)

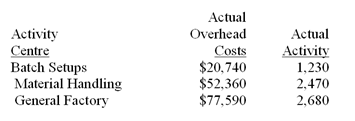

Daba Company manufactures two products,Product F and Product G.During the current year,the company expects to produce and sell 1,400 units of Product F and 1,800 units of Product G.The company uses activity-based costing to compute unit product costs for external reports.Data relating to the company's three activity cost pools are given below for the current year:

Required:

Using the activity-based costing approach, determine the overhead cost per unit for each product.

Required:

Using the activity-based costing approach, determine the overhead cost per unit for each product.

(Essay)

4.9/5  (39)

(39)

Changing a cost accounting system is likely to meet with little resistance in an organization since it is a technical matter of little interest to individuals outside of the accounting department.

(True/False)

4.9/5  (37)

(37)

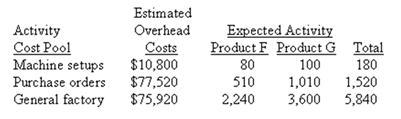

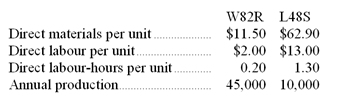

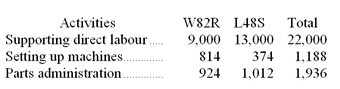

(Appendix 5B)Werger Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHs).The company has two products,W82R and L48S,about which it has provided the following data:

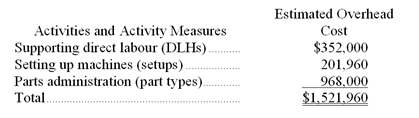

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labour-hours for the year is 22,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,521,960 and the company's estimated total direct labour-hours for the year is 22,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

Required:

a. Determine the unit product cost of each of the company's two products under the traditional costing system.

b. Determine the unit product cost of each of the company's two products under activity-based costing system.

Required:

a. Determine the unit product cost of each of the company's two products under the traditional costing system.

b. Determine the unit product cost of each of the company's two products under activity-based costing system.

(Essay)

4.9/5  (38)

(38)

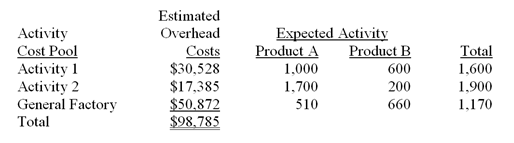

Addy Company has two products: A and B. The annual production and sales of Product A is 1,700 units and of Product B is 1,100 units. The company has traditionally used direct labour hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labour hours per unit, and Product B requires 0.6 direct labour hours per unit. The total estimated overhead for next period is $98,785.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three factory overhead activity cost pools—Activity 1, Activity 2, and General Factory—with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-(Appendix 5B)The overhead cost per unit of Product B under the activity-based costing system is closest to which of the following?

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-(Appendix 5B)The overhead cost per unit of Product B under the activity-based costing system is closest to which of the following?

(Multiple Choice)

4.7/5  (38)

(38)

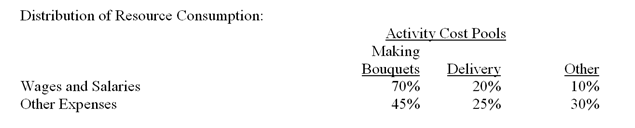

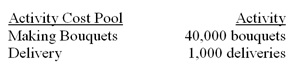

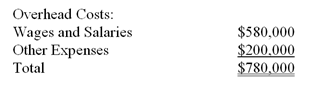

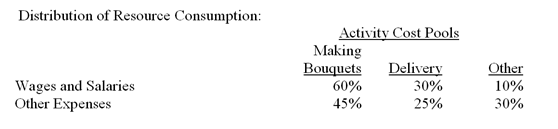

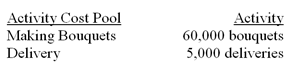

Foster Florist specializes in large floral bouquets for hotels and other commercial spaces. The company has provided the following data concerning its annual overhead costs and its activity-based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

-What would be the total overhead cost per bouquet according to the activity-based costing system,rounded to the nearest whole cent? In other words,what would be the overall activity rate for the Making Bouquets activity cost pool?

-What would be the total overhead cost per bouquet according to the activity-based costing system,rounded to the nearest whole cent? In other words,what would be the overall activity rate for the Making Bouquets activity cost pool?

(Multiple Choice)

4.9/5  (38)

(38)

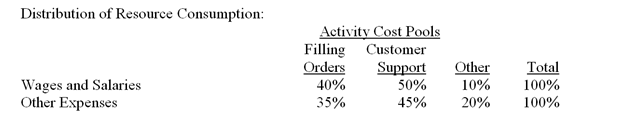

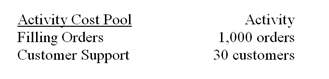

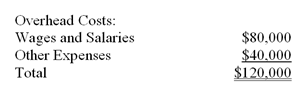

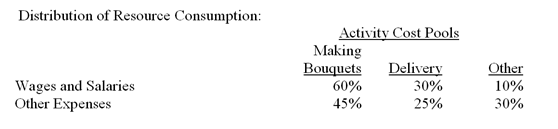

Escalona Company is a wholesale distributor that uses activity-based costing for all of its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity-based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows

-What would be the total overhead cost per order according to the activity-based costing system,rounded to the nearest whole cent? In other words,what would be the overall activity rate for the Filling Orders activity cost pool?

-What would be the total overhead cost per order according to the activity-based costing system,rounded to the nearest whole cent? In other words,what would be the overall activity rate for the Filling Orders activity cost pool?

(Multiple Choice)

4.8/5  (31)

(31)

Activity-based costing uses a number of activity cost pools,each of which is allocated to products on the basis of direct labour hours.

(True/False)

4.9/5  (48)

(48)

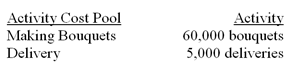

Forse Florist specializes in large floral bouquets for hotels and other commercial spaces. The company has provided the following data concerning its annual overhead costs and its activity-based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

-What would be the total overhead cost per delivery according to the activity-based costing system,rounded to the nearest whole cent? In other words,what would be the overall activity rate for the Deliveries activity cost pool?

-What would be the total overhead cost per delivery according to the activity-based costing system,rounded to the nearest whole cent? In other words,what would be the overall activity rate for the Deliveries activity cost pool?

(Multiple Choice)

4.8/5  (39)

(39)

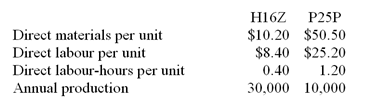

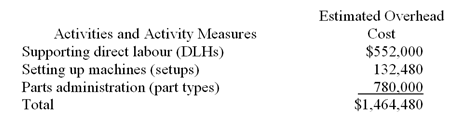

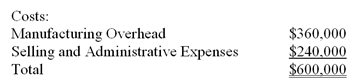

(Appendix 5B)Welk Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHs).The company has two products,H16Z and P25P,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,464,480 and the company's estimated total direct labour-hours for the year is 24,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,464,480 and the company's estimated total direct labour-hours for the year is 24,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

Required:

a. Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b. Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Required:

a. Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b. Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

(Essay)

5.0/5  (36)

(36)

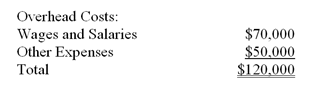

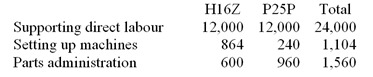

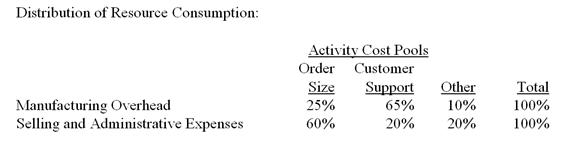

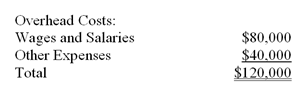

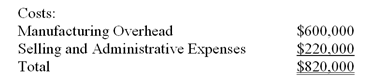

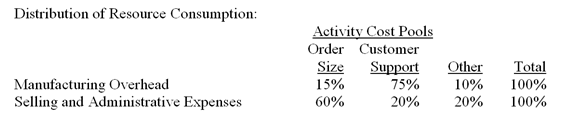

Dideda Company uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools.

-How much cost,in total,would be allocated in the first-stage allocation to the Order Size activity cost pool?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools.

-How much cost,in total,would be allocated in the first-stage allocation to the Order Size activity cost pool?

(Multiple Choice)

4.9/5  (39)

(39)

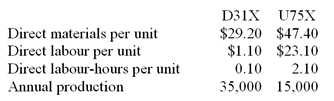

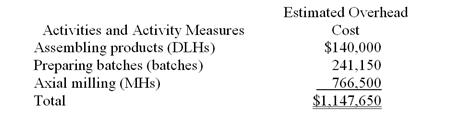

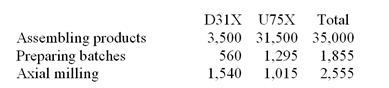

(Appendix 5B)Bullie Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHs).The company has two products,D31X and U75X,about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $1,147,650 and the company's estimated total direct labour-hours for the year is 35,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $1,147,650 and the company's estimated total direct labour-hours for the year is 35,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

Required:

a. Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b. Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

Required:

a. Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system.

b. Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system.

(Essay)

4.8/5  (44)

(44)

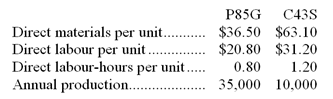

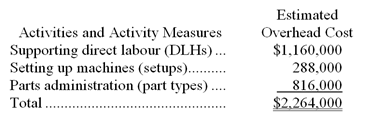

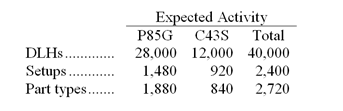

Koszyk Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labour-hours (DLHs). The company has two products, P85G and C43S, about which it has provided the following data:

The company's estimated total manufacturing overhead for the year is $2,264,000 and the company's estimated total direct labour-hours for the year is 40,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

The company's estimated total manufacturing overhead for the year is $2,264,000 and the company's estimated total direct labour-hours for the year is 40,000.

The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below:

-(Appendix 5B)The total cost of a unit of product C43S under the activity-based costing system is closest to:

-(Appendix 5B)The total cost of a unit of product C43S under the activity-based costing system is closest to:

(Multiple Choice)

4.8/5  (28)

(28)

Forse Florist specializes in large floral bouquets for hotels and other commercial spaces. The company has provided the following data concerning its annual overhead costs and its activity-based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

-What would be the total overhead cost per bouquet according to the activity-based costing system,rounded to the nearest whole cent? In other words,what would be the overall activity rate for the Making Bouquets activity cost pool?

-What would be the total overhead cost per bouquet according to the activity-based costing system,rounded to the nearest whole cent? In other words,what would be the overall activity rate for the Making Bouquets activity cost pool?

(Multiple Choice)

4.9/5  (32)

(32)

Dierich Company uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity-based costing system:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools.

-How much cost,in total,should not be allocated to orders and products in the second stage of the allocation process if the activity-based costing system is used for internal decision making?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. You have been asked to complete the first-stage allocation of costs to the activity cost pools.

-How much cost,in total,should not be allocated to orders and products in the second stage of the allocation process if the activity-based costing system is used for internal decision making?

(Multiple Choice)

4.8/5  (39)

(39)

Acton Company has two products: A and B. The annual production and sales of Product A is 800 units and of Product B is 500 units. The company has traditionally used direct labour hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labour hours per unit, and Product B requires 0.2 direct labour hours per unit. The total estimated overhead for next period is $92,023.

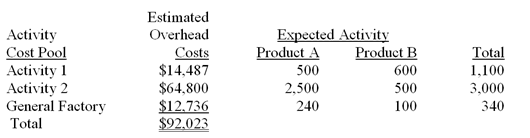

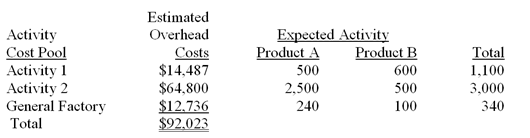

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools—Activity 1, Activity 2, and General Factory—with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-The overhead cost per unit of Product A under the activity-based costing system is closest to which of the following?

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-The overhead cost per unit of Product A under the activity-based costing system is closest to which of the following?

(Multiple Choice)

4.8/5  (37)

(37)

Acton Company has two products: A and B. The annual production and sales of Product A is 800 units and of Product B is 500 units. The company has traditionally used direct labour hours as the basis for applying all manufacturing overhead to products. Product A requires 0.3 direct labour hours per unit, and Product B requires 0.2 direct labour hours per unit. The total estimated overhead for next period is $92,023.

The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools—Activity 1, Activity 2, and General Factory—with estimated overhead costs and expected activity as follows:

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-The overhead cost per unit of Product B under the traditional costing system is closest to which of the following?

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labour hours.)

-The overhead cost per unit of Product B under the traditional costing system is closest to which of the following?

(Multiple Choice)

4.9/5  (34)

(34)

Showing 61 - 80 of 124

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)