Exam 10: Game Theory: Inside Oligopoly

Exam 1: The Fundamentals of Managerial Economics145 Questions

Exam 2: Market Forces: Demand and Supply149 Questions

Exam 3: Quantitative Demand Analysis167 Questions

Exam 4: The Theory of Individual Behavior183 Questions

Exam 5: The Production Process and Costs186 Questions

Exam 6: The Organization of the Firm157 Questions

Exam 7: The Nature of Industry124 Questions

Exam 8: Managing in Competitive, Monopolistic, and Monopolistically Competitive Markets147 Questions

Exam 9: Basic Oligopoly Models135 Questions

Exam 10: Game Theory: Inside Oligopoly142 Questions

Exam 11: Pricing Strategies for Firms With Market Power140 Questions

Exam 12: The Economics of Information147 Questions

Exam 13: Advanced Topics in Business Strategy90 Questions

Exam 14: A Managers Guide to Government in the Marketplace112 Questions

Select questions type

Refer to the following game. Firm B Firm A Low Price High Price Low Price (10,9) (15,8) High Price (-10,7) (11,11) What are the Nash equilibrium strategies for firm A and firm B,respectively,in a one-shot game?

(Multiple Choice)

4.8/5  (40)

(40)

Refer to the normal-form game of advertising shown below. Firm B Firm A Advertise Do Not Advertise Advertise \ 0,\ 0 \ 175,\ 10 Do Not Advertise \ 10,\ 175 \ 125,\ 125 Suppose there is a 50 percent chance that the advertising game depicted in Figure 10-17 will end next period.The collusive agreement {(not advertise,not advertise)} is:

(Multiple Choice)

4.8/5  (47)

(47)

Suppose that you are a manager.You are considering whether or not to monitor employees with the payoffs in the normal-form game shown below. Worker Manager Work Shirk Monitor -1,1 1,-1 Don't Monitor 1,-1 -1,1 Management and a labor union are bargaining over how much of a $50 surplus to give to the union.The $50 is divisible up to one cent.The players have one shot to reach an agreement.Management has the ability to announce what it wants first,and then the labor union can accept or reject the offer.Both players get zero if the total amounts asked for exceed $50.If you were the labor union,which type of "rules of play" would you prefer to divide the $50 surplus?

(Multiple Choice)

4.9/5  (41)

(41)

The following depicts a normal-form game of price competition. Firm B Firm A Low Price High Price Low Price 0,0 25,-5 High Price -5,25 10,10 Suppose the game is infinitely repeated,and the interest rate is 5 percent.Both firms agree to charge a high price,provided no player has charged a low price in the past.If both firms stick to this agreement,then the present value of firm B's payoffs are:

(Multiple Choice)

4.8/5  (35)

(35)

There are two existing firms in the market for computer chips.Firm A knows how to reduce the production costs for the chip and is considering whether to adopt the innovation or not.Innovation incurs a fixed setup cost of C,while increasing the revenue.However,once the new technology is adopted,another firm,B,can adopt it with a smaller setup cost of C/3.If A innovates and B does not,A earns $30 in revenue while B earns $10.If A innovates and B does likewise,both firms earn $20 in revenue.If neither firm innovates,both earn $10.Under what condition will firm A innovate?

(Multiple Choice)

4.8/5  (46)

(46)

Refer to the normal-form game of price competition shown below. Firm B Firm A C D A 50,50 500-x,200 B 100,500-x 50,50 For what values of x is strategy (B,D)the only Nash equilibrium of the game?

(Multiple Choice)

4.9/5  (36)

(36)

Consider the following information for a simultaneous move game: If you advertise and your rival advertises,you each will earn $5 million in profits.If neither of you advertises,you will each earn $10 million in profits.However,if one of you advertises and the other does not,the firm that advertises will earn $15 million and the non-advertising firm will earn $1 million.If you and your rival plan to be in business for only one year,the Nash equilibrium is:

(Multiple Choice)

4.9/5  (34)

(34)

The following provides information for a one-shot game. Firm B Firm A Low Price High Price Low Price (2,2) (10,-8) High Price (-8,10) (15,15) What are the dominant strategies for firm A and firm B respectively?

(Multiple Choice)

4.7/5  (23)

(23)

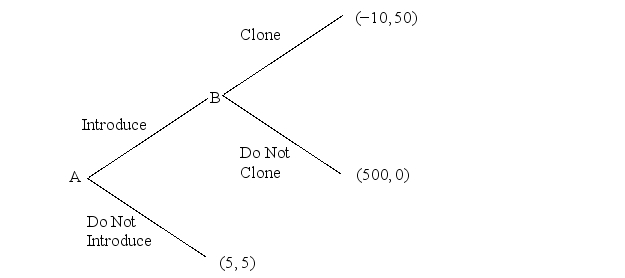

Refer to the normal-form game of price competition shown below.  Firm A must decide whether or not to introduce a new product.If firm A introduces a new product,firm B must decide whether or not to clone the product.The payoff structure of the game is depicted in Figure 10-12.The subgame perfect Nash equilibrium to this game is:

Firm A must decide whether or not to introduce a new product.If firm A introduces a new product,firm B must decide whether or not to clone the product.The payoff structure of the game is depicted in Figure 10-12.The subgame perfect Nash equilibrium to this game is:

(Multiple Choice)

4.9/5  (38)

(38)

Refer to the following game. Firm B Firm A Low Price High Price Low Price (10,9) (15,8) High Price (-10,7) (11,11) What are the secure strategies for firm A and firm B respectively?

(Multiple Choice)

4.9/5  (36)

(36)

Suppose Philips and Toshiba are the first companies to introduce digital versatile disk (DVD)machines to the market.Studies by the firms suggest that consumers who purchase consumer electronics are very brand-loyal.To capture future loyalties,each firm will attempt to maximize its initial market share,for one time only,by setting prices.An economist has estimated the initial market share of each firm under different pricing scenarios.Her results are captured in the following payoff matrix:

Toshiba Philips Strategy =\ 250 =\ 500 =\ 1,000 =\ 250 60\%,40\% 75\%,25\% 95\%,5\% =\ 500 25\%,75\% 90\%,10\% 75\%,25\% =\ 1,000 5\%,95\% 25\%,75\% 70\%,30\% a.Given this scenario,if you were in charge of pricing at Philips,what price would you charge?

b.What market share would you anticipate as a result of your pricing strategy?

(Essay)

4.8/5  (39)

(39)

In the early 1990s,there was considerable uncertainty in the computer industry about whether the dominant operating system for future personal computers would be IBM's OS/2 or Microsoft's Windows.Ultimately,Windows emerged as the dominant system despite the fact that several trade publications viewed OS/2 as the superior system.Why do you think this outcome prevailed?

(Essay)

4.8/5  (47)

(47)

You are the owner-operator of the Better Gas Station in a small southeastern town.Over the past 20 years,you and your rival have successfully kept prices at a very high level.You recently learned that your competitor is retiring and closing his station in two weeks.What should you do today?

Why?

(Essay)

4.8/5  (34)

(34)

According to a spokesperson for cereal maker Kellogg," for the past several years,our individual company growth has come out of the other fellow's hide."

a.What implications does this statement have for the level of advertising in the cereal industry?

b.Using the following hypothetical payoff matrix,explain how trigger strategies can be used to support the collusive level of advertising in an infinitely repeated game.For what values of the interest can collusion be sustained?

(Essay)

4.8/5  (45)

(45)

Refer to the normal-form game of price competition in the payoff matrix below. Firm B Firm A Low Price High Price Low Price 0,0 50,-10 High Price -10,50 20,20 Suppose the game is infinitely repeated,and the interest rate is 10 percent.Both firms agree to charge a high price,provided no player has charged a low price in the past.If both firms stick to this agreement,then the present value of firm A's payoffs are:

(Multiple Choice)

4.9/5  (30)

(30)

Refer to the normal-form game of advertising shown below. Firm B Firm A Advertise Do Not Advertise Advertise \ 0,\ 0 \ 175,\ 10 Do Not Advertise \ 10,\ 175 \ 125,\ 125 Suppose there is a 20 percent chance that the advertising game depicted in Figure 10-17 will end next period.What is the present value to firm B of cheating on the collusive strategy {do not advertise,do not advertise}?

(Multiple Choice)

4.8/5  (36)

(36)

There are two existing firms in the market for computer chips.Firm A knows how to reduce the production costs for the chip and is considering whether to adopt the innovation or not.Innovation incurs a fixed setup cost of C,while increasing the revenue.However,once the new technology is adopted,another firm,B,can adopt it with a smaller setup cost of C/3.If A innovates and B does not,A earns $30 in revenue while B earns $10.If A innovates and B does likewise,both firms earn $20 in revenue.If neither firm innovates,both earn $10.Under what condition will firm B have an incentive to adopt if firm A adopts the innovation?

(Multiple Choice)

4.9/5  (33)

(33)

Showing 121 - 140 of 142

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)