Exam 18: The Predetermined Overhead Rate and Capacity

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

When the predetermined overhead rate is based on the level of activity at capacity,an item called the Cost of Unused Capacity may appear be treated as a period expense on income statements prepared for internal management use.

Free

(True/False)

4.8/5  (34)

(34)

Correct Answer:

True

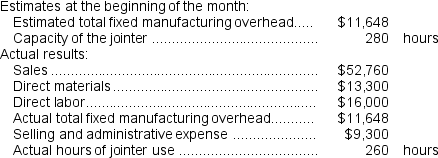

(Appendix 2B) Mausser Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated jointer. Additional information is provided below for the most recent month:

-The cost of unused capacity that would be reported as a period expense on the income statement prepared for internal management purposes would be closest to:

-The cost of unused capacity that would be reported as a period expense on the income statement prepared for internal management purposes would be closest to:

Free

(Multiple Choice)

4.8/5  (36)

(36)

Correct Answer:

C

(Appendix 2B) The management of Plitt Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity. The company's controller has provided an example to illustrate how this new system would work. In this example, the allocation base is machine-hours and the estimated amount of the allocation base for the upcoming year is 69,000 machine-hours. Capacity is 82,000 machine-hours and the actual level of activity for the year is assumed to be 72,400 machine-hours. All of the manufacturing overhead is fixed and both the estimated amount at the beginning of the year and the actual amount at the end of the year are assumed to be $4,130,340 per year. It is assumed that a number of jobs were worked on during the year, one of which was Job Q20L which required 470 machine-hours.

-If the company bases its predetermined overhead rate on the estimated amount of the allocation base for the upcoming year,then the amount of manufacturing overhead charged to Job Q20L is closest to:

Free

(Multiple Choice)

4.7/5  (39)

(39)

Correct Answer:

D

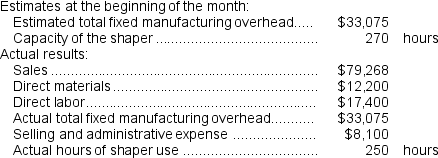

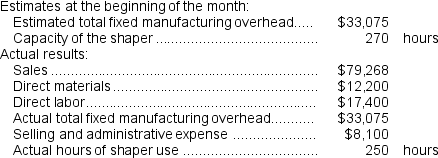

(Appendix 2B) Coble Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated shaper. Additional information is provided below for the most recent month:

-The cost of unused capacity that would be reported as a period expense on the income statement prepared for internal management purposes would be closest to:

-The cost of unused capacity that would be reported as a period expense on the income statement prepared for internal management purposes would be closest to:

(Multiple Choice)

4.8/5  (31)

(31)

(Appendix 2B) The management of Plitt Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity. The company's controller has provided an example to illustrate how this new system would work. In this example, the allocation base is machine-hours and the estimated amount of the allocation base for the upcoming year is 69,000 machine-hours. Capacity is 82,000 machine-hours and the actual level of activity for the year is assumed to be 72,400 machine-hours. All of the manufacturing overhead is fixed and both the estimated amount at the beginning of the year and the actual amount at the end of the year are assumed to be $4,130,340 per year. It is assumed that a number of jobs were worked on during the year, one of which was Job Q20L which required 470 machine-hours.

-If the company bases its predetermined overhead rate on capacity,what would be the cost of unused capacity reported on the income statement prepared for internal management purposes?

(Multiple Choice)

4.8/5  (37)

(37)

When the fixed costs of capacity are spread over the estimated activity of the period rather than the level of activity at capacity,the units that are produced must shoulder the costs of unused capacity.

(True/False)

4.7/5  (46)

(46)

The management of Garn Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity rather than on the estimated activity for the coming year.The Corporation's controller has provided an example to illustrate how this new system would work.In this example,the allocation base is machine-hours and the estimated activity for the upcoming year is 69,000 machine-hours.Capacity is 85,000 machine-hours.All of the manufacturing overhead is fixed and is $4,105,500 per year within the range of 69,000 to 85,000 machine-hours.If the Corporation bases its predetermined overhead rate on capacity but the actual level of activity for the year turns out to be 69,700 machine-hours,the cost of unused capacity shown on the income statement prepared for internal management purposes would be closest to:

(Multiple Choice)

4.9/5  (35)

(35)

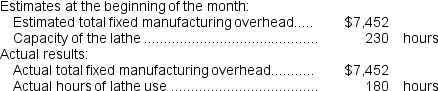

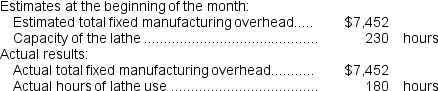

(Appendix 2B) Zackery Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated lathe. Additional information is provided below for the most recent month:

-The manufacturing overhead applied is closest to:

-The manufacturing overhead applied is closest to:

(Multiple Choice)

4.9/5  (49)

(49)

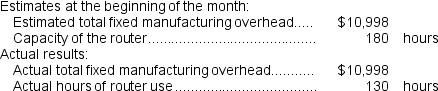

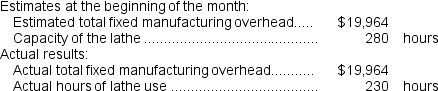

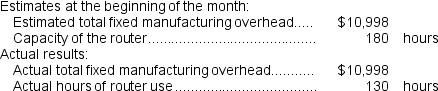

(Appendix 2B) Dunnings Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated router. Additional information is provided below for the most recent month:

-The manufacturing overhead applied is closest to:

-The manufacturing overhead applied is closest to:

(Multiple Choice)

4.8/5  (39)

(39)

(Appendix 2B) Zackery Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated lathe. Additional information is provided below for the most recent month:

-If the company bases its predetermined overhead rate on capacity,then the predetermined overhead rate is closest to:

-If the company bases its predetermined overhead rate on capacity,then the predetermined overhead rate is closest to:

(Multiple Choice)

4.8/5  (37)

(37)

Dowty Woodworking Corporation produces fine cabinets.The company uses a job-order costing system in which its predetermined overhead rate is based on capacity.The capacity of the factory is determined by the capacity of its constraint,which is an automated lathe.Additional information is provided below for the most recent month:

The manufacturing overhead applied is closest to:

The manufacturing overhead applied is closest to:

(Multiple Choice)

4.9/5  (39)

(39)

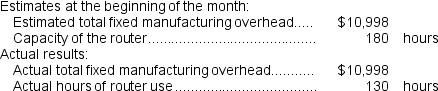

(Appendix 2B) Dunnings Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated router. Additional information is provided below for the most recent month:

-If the company bases its predetermined overhead rate on capacity,then the predetermined overhead rate is closest to:

-If the company bases its predetermined overhead rate on capacity,then the predetermined overhead rate is closest to:

(Multiple Choice)

4.9/5  (31)

(31)

(Appendix 2B) The management of Featheringham Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity. The company's controller has provided an example to illustrate how this new system would work. In this example, the allocation base is machine-hours and the estimated amount of the allocation base for the upcoming year is 62,000 machine-hours. Capacity is 75,000 machine-hours and the actual level of activity for the year is assumed to be 59,000 machine-hours. All of the manufacturing overhead is fixed and both the estimated amount at the beginning of the year and the actual amount at the end of the year are assumed to be $2,836,500 per year. It is assumed that a number of jobs were worked on during the year, one of which was Job Z77W which required 410 machine-hours.

-If the company bases its predetermined overhead rate on capacity,then the predetermined overhead rate is closest to:

(Multiple Choice)

4.8/5  (42)

(42)

(Appendix 2B) Coble Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated shaper. Additional information is provided below for the most recent month:

-The predetermined overhead rate based on hours at capacity is closest to:

-The predetermined overhead rate based on hours at capacity is closest to:

(Multiple Choice)

4.8/5  (40)

(40)

The management of Krach Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity.The company's controller has provided an example to illustrate how this new system would work.In this example,the allocation base is machine-hours and the estimated amount of the allocation base for the upcoming year is 10,000 machine-hours.Capacity is 12,000 machine-hours and the actual level of activity for the year is assumed to be 9,500 machine-hours.All of the manufacturing overhead is fixed and both the estimated amount at the beginning of the year and the actual amount at the end of the year are assumed to be $12,000 per year.For simplicity,it is assumed that this is the estimated manufacturing overhead for the year as well as the manufacturing overhead at capacity.It is further assumed that this is also the actual amount of manufacturing overhead for the year. If the company bases its predetermined overhead rate on capacity,what would be the cost of unused capacity reported on the income statement prepared for internal management purposes?

(Multiple Choice)

4.8/5  (35)

(35)

(Appendix 2B) Dunnings Woodworking Corporation produces fine cabinets. The company uses a job-order costing system in which its predetermined overhead rate is based on capacity. The capacity of the factory is determined by the capacity of its constraint, which is an automated router. Additional information is provided below for the most recent month:

-If the company bases its predetermined overhead rate on capacity,what would be the cost of unused capacity reported on the income statement prepared for internal management purposes?

-If the company bases its predetermined overhead rate on capacity,what would be the cost of unused capacity reported on the income statement prepared for internal management purposes?

(Multiple Choice)

4.8/5  (35)

(35)

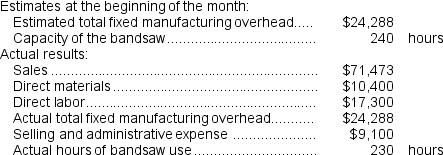

Knipple Woodworking Corporation produces fine cabinets.The company uses a job-order costing system in which its predetermined overhead rate is based on capacity.The capacity of the factory is determined by the capacity of its constraint,which is an automated bandsaw.Additional information is provided below for the most recent month:

Required:

Prepare an income statement following the Example in Appendix 2B in which any cost of unused capacity is directly recorded on the income statement as a period expense.

Required:

Prepare an income statement following the Example in Appendix 2B in which any cost of unused capacity is directly recorded on the income statement as a period expense.

(Essay)

4.8/5  (32)

(32)

(Appendix 2B) The management of Plitt Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity. The company's controller has provided an example to illustrate how this new system would work. In this example, the allocation base is machine-hours and the estimated amount of the allocation base for the upcoming year is 69,000 machine-hours. Capacity is 82,000 machine-hours and the actual level of activity for the year is assumed to be 72,400 machine-hours. All of the manufacturing overhead is fixed and both the estimated amount at the beginning of the year and the actual amount at the end of the year are assumed to be $4,130,340 per year. It is assumed that a number of jobs were worked on during the year, one of which was Job Q20L which required 470 machine-hours.

-If the company bases its predetermined overhead rate on capacity,then the amount of manufacturing overhead charged to Job Q20L is closest to:

(Multiple Choice)

4.7/5  (40)

(40)

If the predetermined overhead rate on is based on the estimated level of activity for the current period,then products will be charged only for the capacity that they use and will not be charged for the capacity they don't use.

(True/False)

4.7/5  (31)

(31)

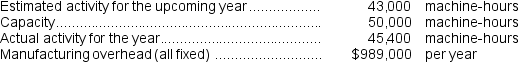

The management of Michaeli Corporation would like to investigate the possibility of basing its predetermined overhead rate on activity at capacity rather than on the estimated amount of activity for the year.The company's controller has provided an example to illustrate how this new system would work.

Required:

Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity.

Required:

Determine the cost of unused capacity for the year if the predetermined overhead rate is based on activity at capacity.

(Essay)

4.9/5  (29)

(29)

Showing 1 - 20 of 42

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)