Exam 11: Performance Measurement in Decentralized Organizations

Exam 1: Managerial Accounting and Cost Concepts299 Questions

Exam 2: Job-Order Costing: Calculating Unit Production Costs292 Questions

Exam 3: Job-Order Costing: Cost Flows and External Reporting255 Questions

Exam 4: Process Costing138 Questions

Exam 5: Cost-Volume-Profit Relationships260 Questions

Exam 6: Variable Costing and Segment Reporting: Tools for Management291 Questions

Exam 7: Super-Variable Costing49 Questions

Exam 8: Master Budgeting234 Questions

Exam 9: Flexible Budgets and Performance Analysis417 Questions

Exam 10: Standard Costs and Variances247 Questions

Exam 11: Performance Measurement in Decentralized Organizations180 Questions

Exam 12: Differential Analysis: The Key to Decision Making203 Questions

Exam 13: Capital Budgeting Decisions179 Questions

Exam 14: Statement of Cash Flows132 Questions

Exam 15: Financial Statement Analysis289 Questions

Exam 16: Cost of Quality66 Questions

Exam 17: Activity-Based Absorption Costing20 Questions

Exam 18: The Predetermined Overhead Rate and Capacity42 Questions

Exam 19: Job-Order Costing: a Microsoft Excel-Based Approach28 Questions

Exam 20: Fifo Method100 Questions

Exam 21: Service Department Allocations60 Questions

Exam 22: Analyzing Mixed Costs81 Questions

Exam 23: Time-Driven Activity-Based Costing: a Microsoft Excel-Based Approach123 Questions

Exam 24: Predetermined Overhead Rates and Overhead Analysis in a Standard Costing System177 Questions

Exam 25: Standard Cost Systems: a Financial Reporting Perspective Using Microsoft Excel138 Questions

Exam 26: Transfer Pricing102 Questions

Exam 27: Service Department Charges44 Questions

Exam 28: Pricing Decisions149 Questions

Exam 29: The Concept of Present Value16 Questions

Exam 30: Income Taxes and the Present Value Method150 Questions

Exam 31: the Direct Method of Determining the Net Cash Provided by Operating Activities56 Questions

Select questions type

The use of return on investment (ROI)as a performance measure may lead managers to reject a project that would be favorable for the company as a whole.

Free

(True/False)

4.9/5  (30)

(30)

Correct Answer:

True

ROI and residual income are tools used to evaluate managerial performance in investment centers.

Free

(True/False)

4.8/5  (27)

(27)

Correct Answer:

True

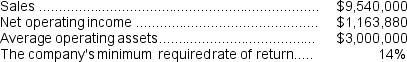

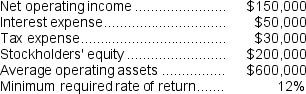

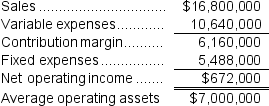

Fabbri Wares is a division of a major corporation.The following data are for the latest year of operations:

Required:

a.What is the division's return on investment (ROI)?

b.What is the division's residual income?

Required:

a.What is the division's return on investment (ROI)?

b.What is the division's residual income?

Free

(Essay)

4.9/5  (33)

(33)

Correct Answer:

a.ROI = Net operating income ÷ Average operating assets = $1,163,880 ÷ $3,000,000 = 38.8%

b.Residual income = Net operating income - Minimum required rate of return × Average operating assets = $1,163,880 - (14% × $3,000,000)= $743,880

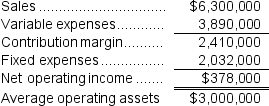

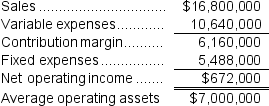

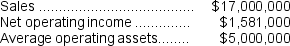

Verbeke Inc.reported the following results from last year's operations:

Last year's turnover was closest to:

Last year's turnover was closest to:

(Multiple Choice)

4.7/5  (35)

(35)

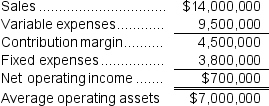

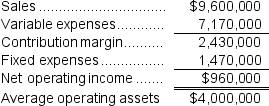

Parsa Inc. reported the following results from last year's operations:

At the beginning of this year, the company has a $1,100,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $1,100,000 investment opportunity with the following characteristics:

-Last year's return on investment (ROI)was closest to:

-Last year's return on investment (ROI)was closest to:

(Multiple Choice)

4.9/5  (32)

(32)

Gabbe Industries is a division of a major corporation.Last year the division had total sales of $8,910,000,net operating income of $962,280,and average operating assets of $3,000,000.The company's minimum required rate of return is 10%.

Required:

a.What is the division's margin?

b.What is the division's turnover?

c.What is the division's return on investment (ROI)?

(Essay)

4.8/5  (21)

(21)

The Hum Division of the Ho Company reported the following data for last year:

-What was the West Division's minimum required return in August?

-What was the West Division's minimum required return in August?

(Multiple Choice)

4.8/5  (38)

(38)

Serie Inc. reported the following results from last year's operations:

At the beginning of this year, the company has a $2,100,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $2,100,000 investment opportunity with the following characteristics:

-If the company pursues the investment opportunity and otherwise performs the same as last year,the combined margin for the entire company will be closest to:

-If the company pursues the investment opportunity and otherwise performs the same as last year,the combined margin for the entire company will be closest to:

(Multiple Choice)

4.8/5  (38)

(38)

Residual income can be used most effectively in comparing the performance of divisions of different size.

(True/False)

4.9/5  (34)

(34)

A profit center is responsible for generating revenue,but it is not responsible for controlling costs.

(True/False)

4.8/5  (31)

(31)

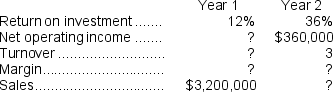

The Millard Division's operating data for the past two years are provided below:

Millard Division's margin in Year 2 was 150% of the margin in Year 1.

-The sales for Year 2 were:

Millard Division's margin in Year 2 was 150% of the margin in Year 1.

-The sales for Year 2 were:

(Multiple Choice)

4.8/5  (41)

(41)

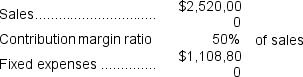

Boespflug Inc.has a $1,000,000 investment opportunity that involves sales of $900,000,fixed expenses of $225,000,and a contribution margin ratio of 30% of sales.The margin for this investment opportunity is closest to:

(Multiple Choice)

4.8/5  (29)

(29)

During the most recent month at Schwab Corporation,queue time was 7.8 days,inspection time was 0.3 day,process time was 1.3 days,wait time was 9.7 days,and move time was 0.7 day.

Required:

a.Compute the throughput time.

b.Compute the manufacturing cycle efficiency (MCE).

c.What percentage of the production time is spent in non-value-added activities?

d.Compute the delivery cycle time.

(Essay)

4.8/5  (46)

(46)

Agustin Industries is a division of a major corporation. Data concerning the most recent year appears below:

-The division's margin is closest to:

-The division's margin is closest to:

(Multiple Choice)

4.9/5  (37)

(37)

Canedo Inc.reported the following results from last year's operations:

At the beginning of this year,the company has a $700,000 investment opportunity with the following characteristics:

At the beginning of this year,the company has a $700,000 investment opportunity with the following characteristics:

If the company pursues the investment opportunity and otherwise performs the same as last year,the combined turnover for the entire company will be closest to:

If the company pursues the investment opportunity and otherwise performs the same as last year,the combined turnover for the entire company will be closest to:

(Multiple Choice)

4.7/5  (39)

(39)

Schurz Corporation's management reports that its average delivery cycle time is 26.7 days,its average throughput time is 10.0 days,its manufacturing cycle efficiency (MCE)is 0.22,its average move time is 0.6 day,and its average queue time is 6.7 days.

Required:

a.What is the wait time?

b.What is the process time?

c.What is the inspection time?

(Essay)

4.9/5  (38)

(38)

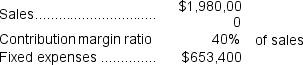

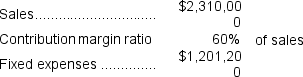

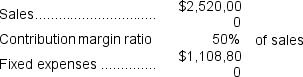

Bonilla Inc. has a $700,000 investment opportunity with the following characteristics:

-The ROI for the investment opportunity is closest to:

-The ROI for the investment opportunity is closest to:

(Multiple Choice)

4.7/5  (35)

(35)

Serie Inc. reported the following results from last year's operations:

At the beginning of this year, the company has a $2,100,000 investment opportunity with the following characteristics:

At the beginning of this year, the company has a $2,100,000 investment opportunity with the following characteristics:

-Last year's margin was closest to:

-Last year's margin was closest to:

(Multiple Choice)

4.9/5  (39)

(39)

The Clipper Corporation had net operating income of $380,000 and average operating assets of $2,000,000.The corporation requires a return on investment of 18%.

Required:

a.Calculate the company's return on investment (ROI)and residual income (RI).

b.Clipper Corporation is considering an investment of $70,000 in a project that will generate annual net operating income of $12,950.Would it be in the best interests of the company to make this investment?

c.Clipper Corporation is considering an investment of $70,000 in a project that will generate annual net operating income of $12,950.If the division planning to make the investment currently has a return on investment of 20% and its manager is evaluated based on the division's ROI,will the division manager be inclined to request funds to make this investment?

d.Clipper Corporation is considering an investment of $70,000 in a project that will generate annual net operating income of $12,950.If the division planning to make the investment currently has a residual income of $50,000 and its manager is evaluated based on the division's residual income,will the division manager be inclined to request funds to make this investment?

(Essay)

4.7/5  (41)

(41)

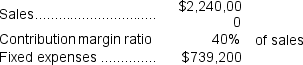

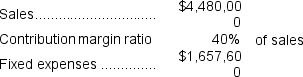

Tennill Inc.has a $1,400,000 investment opportunity with the following characteristics:

The ROI for this year's investment opportunity considered alone is closest to:

The ROI for this year's investment opportunity considered alone is closest to:

(Multiple Choice)

4.9/5  (38)

(38)

Showing 1 - 20 of 180

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)