Exam 2: Policy Standards for a Good Tax

Exam 1: Taxes and Taxing Jurisdictions85 Questions

Exam 2: Policy Standards for a Good Tax85 Questions

Exam 3: Taxes As Transaction Costs82 Questions

Exam 4: Maxims of Income Tax Planning92 Questions

Exam 5: Tax Research75 Questions

Exam 6: Taxable Income From Business Operations116 Questions

Exam 7: Property Acquisitions and Cost Recovery Deductions106 Questions

Exam 8: Property Dispositions110 Questions

Exam 9: Nontaxable Exchanges97 Questions

Exam 10: Sole Proprietorships, Partnerships, Llcs, and S Corporations87 Questions

Exam 11: The Corporate Taxpayer97 Questions

Exam 12: The Choice of Business Entity97 Questions

Exam 13: Jurisdictional Issues in Business Taxation102 Questions

Exam 14: The Individual Tax Formula111 Questions

Exam 15: Compensation and Retirement Planning107 Questions

Exam 16: Investment and Personal Financial Planning104 Questions

Exam 17: Tax Consequences of Personal Activities93 Questions

Exam 18: The Tax Compliance Process86 Questions

Select questions type

Congress recently amended the tax law to make it easier for individuals to file their income tax returns electronically (online). Which of the following statements is true?

(Multiple Choice)

4.9/5  (40)

(40)

If State H increases its sales tax rate by 1 percent, its sales tax revenue must also increase by 1 percent.

(True/False)

4.7/5  (44)

(44)

Congress plans to amend the federal income tax to provide a deduction for the first $2,400 of residential rent paid by families with incomes below the federal poverty level. Which of the following statements is true?

(Multiple Choice)

4.8/5  (30)

(30)

The federal Social Security tax burden on employees has not increased since 1990 because the tax rate has not increased since that year.

(True/False)

4.8/5  (32)

(32)

Which of the following statements about a proportionate income tax rate structure is false?

(Multiple Choice)

4.7/5  (32)

(32)

According to the Keynesian concept of efficiency, an efficient tax should be neutral in its effect on free market allocations of economic resources.

(True/False)

4.9/5  (42)

(42)

Which of the following statements about the substitution effect of an income tax rate increase is false?

(Multiple Choice)

4.9/5  (33)

(33)

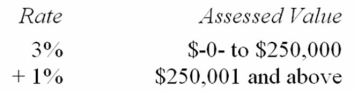

Vervet County levies a real property tax based on the following schedule.  Bilex Inc. owns real property valued at $629,800. Compute Bilex's tax on this property.

Bilex Inc. owns real property valued at $629,800. Compute Bilex's tax on this property.

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following statements concerning the standard of fairness is false?

(Multiple Choice)

4.9/5  (30)

(30)

Which of the following statements about a regressive tax rate structure is false?

(Multiple Choice)

4.8/5  (36)

(36)

The city of Hartwell spends about $3 million annually on snow removal. The city is considering amending its real property tax law to allow homeowners to offset the cost of private snow removal against their annual property tax liability. This amendment would affect the:

(Multiple Choice)

4.8/5  (45)

(45)

Congress plans to amend the federal individual income tax to eliminate the deductions for medical care, educational savings, charitable contributions, and home mortgage interest. Which of the following statements is true?

(Multiple Choice)

4.8/5  (33)

(33)

The city of Belleview operated at an $865,000 surplus this year. The surplus suggests that the municipal tax system is:

(Multiple Choice)

4.8/5  (28)

(28)

Which of the following statements does not describe the classical standard of tax efficiency?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following statements about the income effect of an income tax rate increase is true?

(Multiple Choice)

5.0/5  (39)

(39)

According to supply-side economic theory, a decrease in tax rates for high-income individuals could actually cause an increase in tax revenue.

(True/False)

4.7/5  (40)

(40)

Congress plans to amend the federal income tax to provide a deduction for the cost of energy-efficient fluorescent light bulbs. Which of the following statements is true?

(Multiple Choice)

4.8/5  (29)

(29)

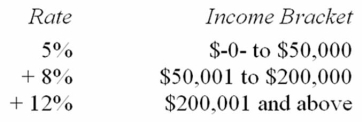

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is false?

Which of the following statements is false?

(Multiple Choice)

4.8/5  (33)

(33)

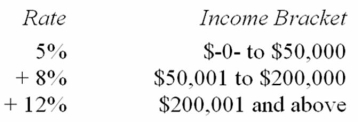

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is true?

Which of the following statements is true?

(Multiple Choice)

4.8/5  (35)

(35)

The federal income tax law allows individuals whose property is destroyed by a natural disaster such as a fire or hurricane to reduce their taxable income by the amount of their financial loss. This rule is intended to improve the:

(Multiple Choice)

4.8/5  (35)

(35)

Showing 21 - 40 of 85

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)