Exam 7: Property Acquisitions and Cost Recovery Deductions

Exam 1: Taxes and Taxing Jurisdictions85 Questions

Exam 2: Policy Standards for a Good Tax85 Questions

Exam 3: Taxes As Transaction Costs82 Questions

Exam 4: Maxims of Income Tax Planning92 Questions

Exam 5: Tax Research75 Questions

Exam 6: Taxable Income From Business Operations116 Questions

Exam 7: Property Acquisitions and Cost Recovery Deductions106 Questions

Exam 8: Property Dispositions110 Questions

Exam 9: Nontaxable Exchanges97 Questions

Exam 10: Sole Proprietorships, Partnerships, Llcs, and S Corporations72 Questions

Exam 11: The Corporate Taxpayer97 Questions

Exam 12: The Choice of Business Entity97 Questions

Exam 13: Jurisdictional Issues in Business Taxation102 Questions

Exam 14: The Individual Tax Formula113 Questions

Exam 15: Compensation and Retirement Planning107 Questions

Exam 16: Investment and Personal Financial Planning109 Questions

Exam 17: Tax Consequences of Personal Activities93 Questions

Exam 18: The Tax Compliance Process a Present Value of $1 B Present Value of Annuity of $1 C 2013 Income Tax Rates86 Questions

Select questions type

Cosmo Inc. paid $15,000 plus $825 sales tax plus a $200 delivery charge for a new business asset. Cosmo's tax basis in the asset is $15,200, and it can deduct the sales tax.

(True/False)

4.9/5  (34)

(34)

Which of the following statements about the uniform capitalization (unicap) rules is false?

(Multiple Choice)

5.0/5  (36)

(36)

Burton Company acquired new machinery by performing professional services worth $8,250 for the seller of the machinery. Burton's tax basis in the machinery is $8,250.

(True/False)

4.8/5  (29)

(29)

Mallow Inc., which has a 35% tax rate, purchased a new business asset. First-year book depreciation was $37,225, and first-year MACRS depreciation was $55,025. As a result of this book/tax difference, Mallow recorded a $6,230 deferred tax asset.

(True/False)

4.7/5  (38)

(38)

Deitle Inc. manufactures small appliances. This year, Deitle capitalized $3,679,000 indirect costs to inventory for book purposes and $3,865,000 indirect costs to inventory for tax purposes. The consequence of the different accounting methods is a $186,000:

(Multiple Choice)

5.0/5  (39)

(39)

Jaboy Inc. was incorporated three years ago. In its first year, Jaboy capitalized $72,000 organizational and start-up costs for tax purposes. However, it expensed these costs for financial statement purposes. Which of the following statements is true?

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following statements concerning business goodwill is false?

(Multiple Choice)

4.9/5  (40)

(40)

Environmental clean-up costs are generally deductible in the year incurred.

(True/False)

4.8/5  (41)

(41)

Belsap Inc., a calendar year taxpayer, purchased a total of $519,000 depreciable personalty during May 2013. Which of the following statements is true?

(Multiple Choice)

4.8/5  (35)

(35)

Firms engaged in the extraction of natural resources such as oil, gas, or minerals can deduct the lesser of cost depletion or percentage depletion on their productive wells or mines.

(True/False)

4.8/5  (35)

(35)

Pyle Inc., a calendar year taxpayer, generated over $10 million taxable income in 2013. Pyle made one asset purchase: new transportation equipment costing $322,000. The equipment has a 5-year recovery period and was placed in service on February 9. Assuming that Pyle made the Section 179 election with respect to the equipment, compute Pyle's 2013 cost recovery deduction.

(Multiple Choice)

4.7/5  (46)

(46)

Hextone Inc., which has a 35% tax rate, purchased a new business asset. First-year book depreciation was $14,890, and first-year MACRS depreciation was $27,090. As a result of this book/tax difference, Hextone recorded a $4,270 deferred tax liability.

(True/False)

4.8/5  (34)

(34)

Lovely Cosmetics Inc. incurred $785,000 research costs on the development of its formula for a new line of face creams. Lovely obtained a 17-year patent on the formula from the U.S. government. Which of the following statements is true?

(Multiple Choice)

4.8/5  (44)

(44)

NRW Company, a calendar year taxpayer, purchased a residential apartment complex for $5.8 million and allocated $1 million cost to the land and $4.8 million cost to the building. NRW placed the realty in service on August 2, 2012.

a. Compute NRW's MACRS depreciation with respect to the realty for 2012 and 2013.

b. Compute NRW's adjusted basis in the land and building on December 31, 2013.

c. How would your answer to a. change if the building was a manufacturing plant instead of an apartment complex?

(Essay)

4.8/5  (35)

(35)

NLT Inc. purchased only one item of tangible personalty in 2013. The cost of the item was $124,000. NLT's taxable income before any Section 179 deduction was $77,100. NLT can elect Section 179 for only $77,100 of the cost of the property.

(True/False)

4.9/5  (34)

(34)

The expense of adapting an existing asset to a new or different use must be capitalized to the cost of the asset for tax purposes.

(True/False)

4.9/5  (36)

(36)

Colby Company performed professional services for M&E Inc. In exchange for the services, M&E gave Colby a 12-month lease on commercial office space. M&E could have charged $4,350 monthly rent for the space on the open market. Compute Colby's tax basis in the lease.

(Multiple Choice)

4.8/5  (36)

(36)

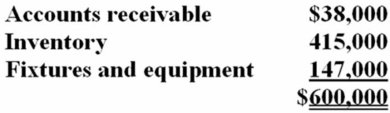

Mr. and Mrs. Schulte paid a $750,000 lump-sum price to purchase a business. At date of purchase, the appraised FMVs of the balance sheet assets were:  Which of the following statements is true?

Which of the following statements is true?

(Multiple Choice)

4.9/5  (37)

(37)

Broadus., a calendar year taxpayer, purchased a total of $128,300 tangible personalty in 2013. Broadus' taxable income without regard to a Section 179 deduction was $92,600. Which of the following statements is true?

(Multiple Choice)

4.7/5  (45)

(45)

Showing 61 - 80 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)