Exam 7: Property Acquisitions and Cost Recovery Deductions

Exam 1: Taxes and Taxing Jurisdictions85 Questions

Exam 2: Policy Standards for a Good Tax85 Questions

Exam 3: Taxes As Transaction Costs82 Questions

Exam 4: Maxims of Income Tax Planning92 Questions

Exam 5: Tax Research75 Questions

Exam 6: Taxable Income From Business Operations116 Questions

Exam 7: Property Acquisitions and Cost Recovery Deductions106 Questions

Exam 8: Property Dispositions110 Questions

Exam 9: Nontaxable Exchanges97 Questions

Exam 10: Sole Proprietorships, Partnerships, Llcs, and S Corporations72 Questions

Exam 11: The Corporate Taxpayer97 Questions

Exam 12: The Choice of Business Entity97 Questions

Exam 13: Jurisdictional Issues in Business Taxation102 Questions

Exam 14: The Individual Tax Formula113 Questions

Exam 15: Compensation and Retirement Planning107 Questions

Exam 16: Investment and Personal Financial Planning109 Questions

Exam 17: Tax Consequences of Personal Activities93 Questions

Exam 18: The Tax Compliance Process a Present Value of $1 B Present Value of Annuity of $1 C 2013 Income Tax Rates86 Questions

Select questions type

Cobly Company, a calendar year taxpayer, made only one asset purchase this year: machinery costing $1,932,500. The machinery is 7-year recovery property, and Cobly placed it in service on October 12. How many months of MACRS depreciation on the machinery is Cobly allowed?

(Multiple Choice)

4.8/5  (35)

(35)

Repair costs incurred to keep a tangible asset in good working order must be capitalized to the cost of the asset.

(True/False)

4.7/5  (30)

(30)

Which of the following statements about tax basis is false?

(Multiple Choice)

4.7/5  (36)

(36)

Puloso Company, a calendar year taxpayer, incurred the following start-up expenditures before the opening of its new health and fitness center.  The Puloso Center opened its doors for business on March 21, 2013. How much of the start-up expenditures can Puloso deduct in 2013?

The Puloso Center opened its doors for business on March 21, 2013. How much of the start-up expenditures can Puloso deduct in 2013?

(Multiple Choice)

4.8/5  (36)

(36)

Mann Inc., a calendar year taxpayer, incurred $49,640 start-up expenditures during the preoperating phase of a new business venture. The business started operations in November. Mann expensed the $49,640 on its current-year financial statements. Which of the following statements is true?

(Multiple Choice)

4.7/5  (35)

(35)

MACRS depreciation for buildings is based on the straight-line method.

(True/False)

4.8/5  (31)

(31)

Research and experimental expenditures are not deductible if they result in the development of a patented formula or process.

(True/False)

4.8/5  (45)

(45)

Marz Inc. made a $75,000 cash expenditure this year (year 0). Compute the after-tax cost if Marz must capitalize the expenditure and amortize it ratably over three years, beginning in year 0. Marz has a 30% marginal tax rate and uses a 7% discount rate.

(Multiple Choice)

4.9/5  (38)

(38)

Mann Inc. paid $7,250 to a leasing agent to negotiate Mann's 36-month lease for 18,000 square feet of space in a new commercial building. For tax purposes, Mann must:

(Multiple Choice)

4.9/5  (35)

(35)

Kigin Company spent $240,000 to clean up hazardous waste that had contaminated land used in Kigin's business. Which of the following statements is true?

(Multiple Choice)

4.8/5  (32)

(32)

BriarHill Inc. purchased four items of tangible personalty in 2013 at a total cost of $2,798,000. BriarHill cannot elect to expense any of the cost of the property under Section 179.

(True/False)

4.7/5  (27)

(27)

A basic premise of federal income tax law is that an expense is deductible unless the Internal Revenue Code specifically prohibits the deduction.

(True/False)

4.9/5  (41)

(41)

A book/tax difference resulting from application of the unicap rules to manufactured inventory reverses in the year in which the inventory is sold.

(True/False)

4.9/5  (38)

(38)

W&F Company, a calendar year taxpayer, purchased a total of $2,104,700 tangible personalty in 2013. How much of this cost can W&F elect to expense under Section 179?

(Multiple Choice)

4.7/5  (33)

(33)

Gowda Inc., a calendar year taxpayer, purchased $1,496,000 of equipment on March 23. This was Gowda's only purchase of depreciable property for the year. If the equipment has a 7-year recovery period, refer to Table 7.2 and compute Gowda's first and second-year MACRS depreciation. (Disregard the Section 179 deduction and bonus depreciation in making your calculation.)

(Multiple Choice)

4.8/5  (38)

(38)

Hoopin Oil Inc. was allowed to deduct $5.3 million of intangible drilling and development costs on this year's tax return. Which of the following statements is false?

(Multiple Choice)

4.9/5  (40)

(40)

Dorian, a calendar year corporation, purchased $1,568,000 of equipment on May 3. This was Dorian's only purchase of depreciable property for the year. If the equipment has a 10-year recovery period, refer to Table 7.2 and compute Dorian's first and second-year MACRS depreciation. (Disregard the Section 179 deduction and bonus depreciation in making your calculation.)

(Multiple Choice)

4.8/5  (48)

(48)

Elcox Inc. spent $2.3 million on a new advertising campaign this year. Which of the following statements is true?

(Multiple Choice)

4.9/5  (36)

(36)

Which of the following capitalized cost is not amortizable for tax purposes?

(Multiple Choice)

4.8/5  (29)

(29)

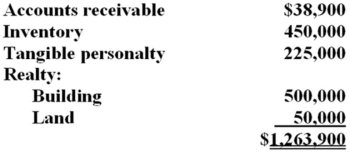

On May 1, Sessi Inc., a calendar year corporation, purchased a business for a $2 million lump-sum price. The business' balance sheet assets had the following appraised FMV.  a. Compute the cost basis of the goodwill acquired by Sessi Inc. on the purchase of this business.

b. Compute Sessi's goodwill amortization deduction for the year of purchase.

c. Use a 35 percent tax rate to compute Sessi's deferred tax liability resulting from the amortization deduction.

a. Compute the cost basis of the goodwill acquired by Sessi Inc. on the purchase of this business.

b. Compute Sessi's goodwill amortization deduction for the year of purchase.

c. Use a 35 percent tax rate to compute Sessi's deferred tax liability resulting from the amortization deduction.

(Essay)

4.9/5  (44)

(44)

Showing 81 - 100 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)