Exam 2: Policy Standards for a Good Tax

Exam 1: Taxes and Taxing Jurisdictions85 Questions

Exam 2: Policy Standards for a Good Tax85 Questions

Exam 3: Taxes As Transaction Costs82 Questions

Exam 4: Maxims of Income Tax Planning92 Questions

Exam 5: Tax Research75 Questions

Exam 6: Taxable Income From Business Operations116 Questions

Exam 7: Property Acquisitions and Cost Recovery Deductions106 Questions

Exam 8: Property Dispositions110 Questions

Exam 9: Nontaxable Exchanges97 Questions

Exam 10: Sole Proprietorships, Partnerships, Llcs, and S Corporations72 Questions

Exam 11: The Corporate Taxpayer97 Questions

Exam 12: The Choice of Business Entity97 Questions

Exam 13: Jurisdictional Issues in Business Taxation102 Questions

Exam 14: The Individual Tax Formula113 Questions

Exam 15: Compensation and Retirement Planning107 Questions

Exam 16: Investment and Personal Financial Planning109 Questions

Exam 17: Tax Consequences of Personal Activities93 Questions

Exam 18: The Tax Compliance Process a Present Value of $1 B Present Value of Annuity of $1 C 2013 Income Tax Rates86 Questions

Select questions type

A good tax should result in either horizontal or vertical equity across taxpayers.

(True/False)

4.9/5  (36)

(36)

A tax meets the standard of sufficiency if it is easy for people to pay the tax.

(True/False)

4.9/5  (37)

(37)

Which of the following statements concerning income tax rate structures is false?

(Multiple Choice)

4.9/5  (41)

(41)

Mr. and Mrs. Boln earn $63,000 annual income and pay 20% in state and federal income tax. If tax rates increase so that the couple's annual rate increases to 25%, how much additional income must they earn to maintain their after-tax standard of living?

(Essay)

4.9/5  (43)

(43)

A dynamic forecast of the incremental revenue from a tax rate increase presumes that:

(Multiple Choice)

4.8/5  (31)

(31)

Government J decides that it must increase its tax revenue. Which of the strategies should result in more revenue?

(Multiple Choice)

4.9/5  (40)

(40)

Individuals who believe that a tax system is fair are less likely to cheat on their taxes than individuals who believe that the system is unfair.

(True/False)

4.9/5  (32)

(32)

Many taxpayers believe the income tax system is unfair because it is so complicated.

(True/False)

4.7/5  (36)

(36)

The city of Belleview operated at an $865,000 surplus this year. The surplus suggests that the municipal tax system is:

(Multiple Choice)

4.8/5  (34)

(34)

Which of the following statements about the income effect of an income tax rate increase is true?

(Multiple Choice)

4.7/5  (36)

(36)

The state of California plans to amend its personal income tax laws to allow parents to reduce their tax by the cost of infant car seats. Which of the following statements is true?

(Multiple Choice)

4.8/5  (35)

(35)

The federal government is not required to pay interest on the national debt.

(True/False)

4.9/5  (32)

(32)

Government officials of Country Z estimate that next year's public programs will cost $19 million but that tax revenues will be only $15 million. Which of the following statements is false?

(Multiple Choice)

4.8/5  (40)

(40)

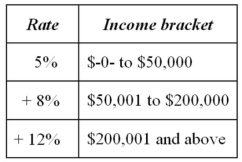

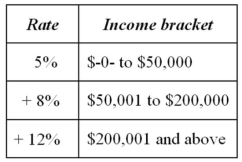

Jurisdiction M imposes an individual income tax based on the following schedule.  Which of the following statements is true?

Which of the following statements is true?

(Multiple Choice)

4.9/5  (27)

(27)

The government of Nation C operated at a $32 billion deficit this year. The deficit suggests that Nation C's tax system is:

(Multiple Choice)

4.7/5  (29)

(29)

Which of the following statements about the substitution effect of an income tax rate increase is false?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following statements concerning a regressive tax rate structure is true?

(Multiple Choice)

4.8/5  (32)

(32)

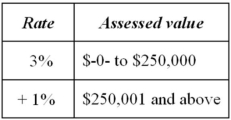

Vervet County levies a real property tax based on the following schedule.  Which of the following statements is false?

Which of the following statements is false?

(Multiple Choice)

4.8/5  (42)

(42)

Jurisdiction M imposes an individual income tax based on the following schedule.  Which type of rate structure does this tax use?

Which type of rate structure does this tax use?

(Multiple Choice)

4.9/5  (43)

(43)

According to supply-side economic theory, a decrease in tax rates for high-income individuals could actually cause an increase in tax revenue.

(True/False)

4.8/5  (38)

(38)

Showing 21 - 40 of 85

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)