Exam 11: Diversification and Risky Asset Allocation

Exam 1: A Brief History of Risk and Return100 Questions

Exam 2: The Investment Process100 Questions

Exam 3: Overview of Security Types94 Questions

Exam 4: Mutual Funds101 Questions

Exam 5: The Stock Market106 Questions

Exam 6: Common Stock Valuation104 Questions

Exam 7: Stock Price Behavior and Market Efficiency82 Questions

Exam 8: Behavioral Finance and the Psychology of Investing84 Questions

Exam 9: Interest Rates100 Questions

Exam 10: Bond Prices and Yields95 Questions

Exam 11: Diversification and Risky Asset Allocation84 Questions

Exam 12: Return, Risk, and the Security Market Line84 Questions

Exam 13: Performance Evaluation and Risk Management91 Questions

Exam 14: Futures Contracts97 Questions

Exam 15: Stock Options100 Questions

Exam 16: Option Valuation72 Questions

Exam 17: Projecting Cash Flow and Earnings100 Questions

Exam 18: Corporate Bonds85 Questions

Exam 19: Government Bonds84 Questions

Exam 20: Mortgage-Backed Securities92 Questions

Select questions type

Tall Stand Timber stock has an expected return of 17.3 percent. What is the risk-free rate if the risk premium on the stock is 12.4 percent?

(Multiple Choice)

4.8/5  (39)

(39)

You are graphing the investment opportunity set for a portfolio of two securities with the expected return on the vertical axis and the standard deviation on the horizontal axis. If the correlation coefficient of the two securities is +1, the opportunity set will appear as which one of the following shapes?

(Multiple Choice)

4.8/5  (34)

(34)

Explain the primary goal of portfolio diversification as it relates to asset allocation and correlation.

(Essay)

4.8/5  (45)

(45)

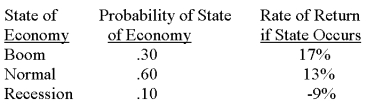

The risk-free rate is 4.35 percent. What is the expected risk premium on this security given the following information?

(Multiple Choice)

4.8/5  (33)

(33)

Showing 81 - 84 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)