Exam 13: Dividend Policy and Internal Financing

Exam 1: An Introduction to the Foundations of Financial Management127 Questions

Exam 2: The Financial Markets and Interest Rates148 Questions

Exam 3: Understanding Financial Statements and Cash Flows110 Questions

Exam 4: Evaluating a Firms Financial Performance148 Questions

Exam 5: The Time Value of Money162 Questions

Exam 6: The Meaning and Measurement of Risk and Return147 Questions

Exam 7: The Valuation and Characteristics of Bonds145 Questions

Exam 8: The Valuation and Characteristics of Stock128 Questions

Exam 9: The Cost of Capital135 Questions

Exam 10: Capital-Budgeting Techniques and Practice155 Questions

Exam 11: Cash Flows and Other Topics in Capital Budgeting155 Questions

Exam 12: Determining the Financing Mix151 Questions

Exam 13: Dividend Policy and Internal Financing164 Questions

Exam 14: Short-Term Financial Planning141 Questions

Exam 15: Working-Capital Management165 Questions

Exam 16: Current Asset Management181 Questions

Exam 17: International Business Finance134 Questions

Select questions type

Security markets are considered to be perfect when firms can issue securities at no cost and the investor incurs no brokerage commissions.

(True/False)

4.7/5  (28)

(28)

Shareholders may prefer a share repurchase program to dividends because dividends are subject to taxation and increasing value per share due to repurchase programs is tax deferred.

(True/False)

4.8/5  (28)

(28)

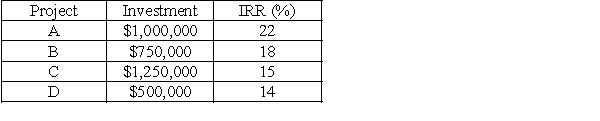

The Clydesdale Corporation has an optimal capital structure consisting of 70 percent debt and 30 percent equity.The marginal cost of capital is calculated to be 14.75 percent.Total earnings available to common stockholders for the coming year total $1,200,000.Investment opportunities are:

a.According to the residual dividend theory,what should the firm's total dividend payment be?

b.If the firm paid a total dividend of $675,000,and restricted equity financing to internally generated funds,which projects should be selected?

Assume the marginal cost of capital is constant.

a.According to the residual dividend theory,what should the firm's total dividend payment be?

b.If the firm paid a total dividend of $675,000,and restricted equity financing to internally generated funds,which projects should be selected?

Assume the marginal cost of capital is constant.

(Essay)

4.9/5  (41)

(41)

Expected dividends and share repurchases are the cash flow that underlies stock valuation.

(True/False)

4.9/5  (46)

(46)

From the shareholders' perspective,a stock repurchase has a potential tax advantage over the payment of a cash dividend.

(True/False)

4.8/5  (42)

(42)

Statutory restrictions on dividend payments include all of the following except:

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following strategies may be used to alter a firm's capital structure toward a higher percentage of debt compared to equity?

(Multiple Choice)

4.7/5  (40)

(40)

Describe the types of dividend policies that corporations frequently use.Which is most common?

Why?

(Essay)

4.9/5  (29)

(29)

Cyberco Corporation has 5 million shares of stock outstanding.Cyberco's after-tax profits are $15 million and the corporation's stock is selling at a price-earnings multiple of 10,for a stock price of $30 per share.Cyberco management issues a 25% stock dividend.

a.Calculate Cyberco's earnings per share before and after the stock dividend.

b.Suppose an investor owns 100 shares of Cyberco before the stock dividend.Use the price earnings multiple to estimate the value of the investor's holdings both before and after the dividend.

c.Comment on the results of the stock dividend for current shareholders.

(Essay)

4.8/5  (43)

(43)

Willows Corporation is experiencing high demand for its products and high growth rates.The company just reported earnings per share of $5 for the most recent year and has many positive NPV projects to fund.One vice president wants to pay a dividend of $5 per share,arguing that this will maximize shareholder value.You argue that a much smaller dividend will maximize value.Your argument may be based on

(Multiple Choice)

4.8/5  (29)

(29)

Conceptually,stock dividends and stock splits may be expected to increase the shareholder's value.

(True/False)

4.8/5  (42)

(42)

JB Corporation has a retained earnings balance of $2,000,000.The company reported net income of $600,000,sales of $4,000,000,and has 200,000 shares of common stock outstanding.The company announced a dividend of $2.00 per share.Therefore,the company's dividend payout ratio is

(Multiple Choice)

4.8/5  (43)

(43)

All of the following may influence a firm's dividend payment except:

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following statements would be consistent with the residual dividend theory?

(Multiple Choice)

4.8/5  (41)

(41)

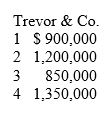

Trevor Co.'s future earnings for the next four years are predicted below.Assuming there are 500,000 shares outstanding,what will the yearly dividend per share be if the dividend policy is:

a.a constant payout ratio of 40%

b.stable dollar dividend targeted at 40% of the average earnings over the four-year period

c.small,regular dividend of $0.75 plus a year-end extra of 40% of profits exceeding $1,000,000

a.a constant payout ratio of 40%

b.stable dollar dividend targeted at 40% of the average earnings over the four-year period

c.small,regular dividend of $0.75 plus a year-end extra of 40% of profits exceeding $1,000,000

(Essay)

4.7/5  (35)

(35)

According to the clientele effect,dividend policy matters even if capital markets are perfect because investors self-select into dividend preference groups.

(True/False)

5.0/5  (43)

(43)

LAW,Inc.settled a large lawsuit that caused earnings to be negative for the quarter.This quarterly loss was the first in 22 years.In addition,the company has a record of 48 consecutive quarters of dividend payments.Which of the following is correct?

(Multiple Choice)

5.0/5  (44)

(44)

Showing 141 - 160 of 164

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)