Exam 18: Determination of Tax

Exam 1: Tax Research114 Questions

Exam 2: Corporate Formations and Capital Structure123 Questions

Exam 3: the Corporate Income Tax127 Questions

Exam 4: Corporate Nonliquidating Distributions113 Questions

Exam 5: Other Corporate Tax Levies103 Questions

Exam 6: Corporate Liquidating Distributions107 Questions

Exam 7: Corporate Acquisitions and Reorganizations108 Questions

Exam 8: Consolidated Tax Returns104 Questions

Exam 9: Partnership Formation and Operation116 Questions

Exam 10: Special Partnership Issues107 Questions

Exam 11: S Corporations103 Questions

Exam 12: The Gift Tax105 Questions

Exam 13: The Estate Tax107 Questions

Exam 14: Income Taxation of Trusts and Estates105 Questions

Exam 15: Administrative Procedures104 Questions

Exam 16: Ustaxation of Foreign-Related Transactions97 Questions

Exam 17: An Introduction to Taxation109 Questions

Exam 18: Determination of Tax152 Questions

Exam 19: Gross Income: Inclusions144 Questions

Exam 20: Gross Income: Exclusions116 Questions

Exam 21: Property Transactions: Capital Gains and Losses147 Questions

Exam 22: Deductions and Losses146 Questions

Exam 23: Itemized Deductions130 Questions

Exam 24: Losses and Bad Debts125 Questions

Exam 25: Employee Expenses and Deferred Compensation151 Questions

Exam 26: Depreciation, cost Recovery, amortization, and Depletion106 Questions

Exam 27: Accounting Periods and Methods124 Questions

Exam 28: Property Transactions: Nontaxable Exchanges125 Questions

Exam 29: Property Transactions: Sec1231 and Recapture115 Questions

Exam 30: Special Tax Computation Methods, tax Credits, and Payment of Tax147 Questions

Exam 31: Tax Research133 Questions

Exam 32: Corporations149 Questions

Exam 33: Partnerships and S Corporations150 Questions

Exam 34: Taxes and Investment Planning84 Questions

Select questions type

If an individual with a marginal tax rate of 15% has a long-term capital gain,it is taxed at

(Multiple Choice)

4.7/5  (48)

(48)

Charlie is claimed as a dependent on his parents' tax return in 2017.He received $8,000 during the year from a part-time acting job,which was his only income.What is his standard deduction?

(Multiple Choice)

4.8/5  (35)

(35)

Generally,in the case of a divorced couple,the parent who has physical custody of a child for the greater part of the year is entitled to the dependency exemption.

(True/False)

4.9/5  (36)

(36)

A taxpayer is able to change his filing status from married filing jointly to married filing separately by filing an amended return.

(True/False)

4.8/5  (38)

(38)

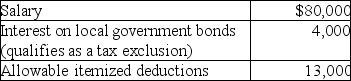

A single taxpayer provided the following information for 2017:  What is taxable income?

What is taxable income?

(Multiple Choice)

4.8/5  (34)

(34)

In order to qualify to file as surviving spouse,all of the following criteria must be met by the widow or widower except

(Multiple Choice)

4.8/5  (31)

(31)

The oldest age at which the "Kiddie Tax" could apply to a dependent child is

(Multiple Choice)

4.9/5  (31)

(31)

An individual may not qualify for the dependency exemption as a qualifying child but may still qualify as a dependent.

(True/False)

4.8/5  (32)

(32)

Juanita's mother lives with her.Juanita purchased clothing for her mother costing $1,000 and provided her with a room that Juanita estimates she could have rented for $4,000.Juanita spent $5,000 on groceries she shared with her mother.Juanita also paid $700 for her mother's health insurance coverage.How much of these costs is considered support?

(Multiple Choice)

4.7/5  (35)

(35)

Taquin,age 67 and single,paid home mortgage interest of $4,000,charitable contributions of $2,000 and property taxes of $3,000 in 2017.He has no dependents.In addition to the personal exemption,Taquin will claim a deduction from AGI of

(Multiple Choice)

4.8/5  (24)

(24)

Steven and Susie Tyler have three dependent children ages 13,15,and 17.Their modified AGI is $108,000.What is the amount of the child credit to which they are entitled?

(Multiple Choice)

4.8/5  (32)

(32)

A qualifying child of the taxpayer must meet the gross income test.

(True/False)

4.9/5  (28)

(28)

Sally divorced her husband three years ago and has not remarried.Since the divorce she has maintained her home in which she and her now sixteen-year-old daughter reside.The daughter is a qualified child.Sally signed the dependency exemption over to her ex-spouse by filing the appropriate IRS form.What is Sally's filing status for the current year and how many exemptions may she claim?

(Multiple Choice)

4.7/5  (42)

(42)

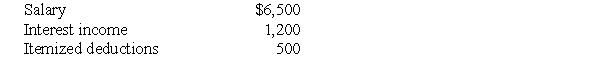

The following information for 2017 relates to Emma Grace,a single taxpayer,age 18:

a.Compute Emma Grace's taxable income assuming she is self-supporting.

b.Compute Emma Grace's taxable income assuming she is a dependent of her parents.

a.Compute Emma Grace's taxable income assuming she is self-supporting.

b.Compute Emma Grace's taxable income assuming she is a dependent of her parents.

(Essay)

4.8/5  (40)

(40)

Discuss why Congress passed the innocent spouse provision and detail the requirements to be met in order to qualify as an innocent spouse and be relieved of liability for tax on unreported income.

(Essay)

4.8/5  (36)

(36)

Generally,itemized deductions are personal expenses specifically allowed by the tax law.

(True/False)

4.9/5  (27)

(27)

Frank,age 17,received $4,000 of dividends and $1,500 from a part-time job.Frank is a dependent of his parents who are in the 28% percent bracket.Frank's 2017 taxable income is

(Multiple Choice)

4.9/5  (46)

(46)

A married person who files a separate return can claim a personal exemption for his spouse if the spouse is not the dependent of another and has

(Multiple Choice)

4.8/5  (39)

(39)

Showing 21 - 40 of 152

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)