Exam 29: Property Transactions: Sec1231 and Recapture

Exam 1: Tax Research114 Questions

Exam 2: Corporate Formations and Capital Structure123 Questions

Exam 3: the Corporate Income Tax127 Questions

Exam 4: Corporate Nonliquidating Distributions113 Questions

Exam 5: Other Corporate Tax Levies103 Questions

Exam 6: Corporate Liquidating Distributions107 Questions

Exam 7: Corporate Acquisitions and Reorganizations108 Questions

Exam 8: Consolidated Tax Returns104 Questions

Exam 9: Partnership Formation and Operation116 Questions

Exam 10: Special Partnership Issues107 Questions

Exam 11: S Corporations103 Questions

Exam 12: The Gift Tax105 Questions

Exam 13: The Estate Tax107 Questions

Exam 14: Income Taxation of Trusts and Estates105 Questions

Exam 15: Administrative Procedures104 Questions

Exam 16: Ustaxation of Foreign-Related Transactions97 Questions

Exam 17: An Introduction to Taxation109 Questions

Exam 18: Determination of Tax152 Questions

Exam 19: Gross Income: Inclusions144 Questions

Exam 20: Gross Income: Exclusions116 Questions

Exam 21: Property Transactions: Capital Gains and Losses147 Questions

Exam 22: Deductions and Losses146 Questions

Exam 23: Itemized Deductions130 Questions

Exam 24: Losses and Bad Debts125 Questions

Exam 25: Employee Expenses and Deferred Compensation151 Questions

Exam 26: Depreciation, cost Recovery, amortization, and Depletion106 Questions

Exam 27: Accounting Periods and Methods124 Questions

Exam 28: Property Transactions: Nontaxable Exchanges125 Questions

Exam 29: Property Transactions: Sec1231 and Recapture115 Questions

Exam 30: Special Tax Computation Methods, tax Credits, and Payment of Tax147 Questions

Exam 31: Tax Research133 Questions

Exam 32: Corporations149 Questions

Exam 33: Partnerships and S Corporations150 Questions

Exam 34: Taxes and Investment Planning84 Questions

Select questions type

Harry owns equipment ($50,000 basis and $38,000 FMV)and a building ($140,000 basis and $156,000 FMV),which are used in his business.Harry uses straight-line depreciation for both assets,which were acquired several years ago.Both the equipment and the building are destroyed in a fire,and Harry collects insurance proceeds equal to the assets' FMV.The tax result to Harry for this transaction is

(Multiple Choice)

4.9/5  (44)

(44)

Pete sells equipment for $15,000 to Marcel,his son.The equipment cost $20,000 and has accumulated depreciation of $12,000.Marcel will use the equipment in his business.

a.What is the amount and character of Pete's gain on the sale?

b.How does your answer change if the sales price is $22,000?

(Essay)

4.9/5  (32)

(32)

When corporate and noncorporate taxpayers sell real property placed in service after 1986,all depreciation taken will be taxed at a maximum rate of 25%.

(True/False)

4.9/5  (37)

(37)

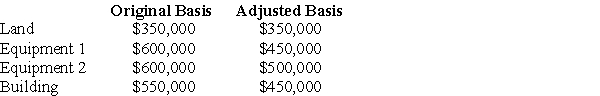

Describe the tax treatment for a noncorporate taxpayer in the 39.6% marginal tax bracket who sells each of the first two assets for $500,000 and each of the second two assets for $750,000.Each asset was purchased in 2013 and is used in a trade or business.There are no other gains and losses and no nonrecaptured Sec.1231 losses.

(Essay)

5.0/5  (36)

(36)

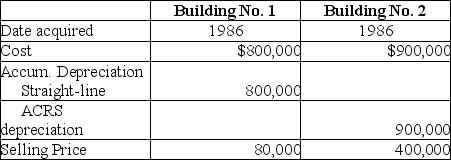

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for the first building and the accelerated method (ACRS)was used for the second building.Information about those buildings is presented below.  How much gain from these sales should be reported as Sec.1231 gain and ordinary income due to depreciation recapture by the owner of the business?

How much gain from these sales should be reported as Sec.1231 gain and ordinary income due to depreciation recapture by the owner of the business?

(Multiple Choice)

4.8/5  (33)

(33)

Four years ago Otto purchased farmland for $600,000 and spent an additional $40,000 on soil and water conservation which was deducted in the year of purchase.Otto has just sold the land for $900,000.How much of the $300,000 gain will be treated as ordinary income?

(Multiple Choice)

5.0/5  (36)

(36)

WAM Corporation sold a warehouse during the current year for $830,000.The building had been acquired in 1992 at a cost of $730,000 and had total straight-line depreciation of $510,000.

What is the amount and nature of the gain or loss on the sale of the warehouse?

(Essay)

4.8/5  (49)

(49)

During the current year,a corporation sells equipment for $300,000.The equipment cost $270,000 when purchased and placed in service two years ago and $60,000 of depreciation deductions were allowed.The results of the sale are

(Multiple Choice)

4.7/5  (34)

(34)

Hilton,a single taxpayer in the 28% marginal tax bracket,has $16,000 of nonrecaptured net Sec.1231 losses,at the beginning of a year in which he had the following transactions:

-Sale of Asset A at a $10,000 1231 gain,all of which is unrecaptured Sec.1250 gain

-Sale of Asset B at a $13,000 1231 gain

How are the items reported this year and at which rate(s)are the amounts taxed?

(Essay)

5.0/5  (52)

(52)

Gain due to depreciation recapture is included in the netting of Sec.1231 gains and losses.

(True/False)

4.9/5  (43)

(43)

Jacqueline dies while owning a building with a $1,000,000 FMV.The building is classified as Sec.1245 property acquired in 1985 for $850,000.Cost-recovery deductions of $850,000 have been claimed.Pam inherits the property.

a.What is the amount of Pam's basis in the property?

b.What is the amount of cost-recovery deductions that Pam must recover if she immediately sells the building?

(Essay)

4.9/5  (37)

(37)

Costs of tangible personal business property which are expensed under Sec.179 are subject to recapture if the property is converted to nonbusiness use before the end of the MACRS recovery period.

(True/False)

4.9/5  (38)

(38)

The purpose of Sec.1245 is to eliminate the advantage taxpayers would have if they were able to reduce ordinary income by depreciation deductions and also receive favorable Sec.1231 treatment when the asset was sold.

(True/False)

4.8/5  (33)

(33)

Jillian,whose tax rate is 39.6%,had the following sales of Sec.1231 property this year:

Sale of land A at a gain of $15,000

Sale of land B at a gain of $12,000

Sale of land C at a loss of $8,000

a.What is the amount of her resulting tax liability?

b.Assume instead that Jillian has a 15% marginal tax rate.What is the amount of her resulting tax liability?

c.Assume instead that Jillian has a 28% marginal tax rate.What is the amount of her resulting tax liability?

(Essay)

4.8/5  (30)

(30)

A building used in a business for more than a year is sold.Sec.1250 will not cause depreciation recapture if

(Multiple Choice)

4.7/5  (33)

(33)

Showing 101 - 115 of 115

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)