Exam 10: Applications of Fair Value to Non-Current Assets

Exam 1: Fundamentals of Financial Accounting Theory33 Questions

Exam 2: Conceptual Frameworks for Financial Reporting60 Questions

Exam 3: Accrual Accounting160 Questions

Exam 4: Revenue and Recognition108 Questions

Exam 5: Cash and Receivables119 Questions

Exam 6: Inventories156 Questions

Exam 7: Financial Assets137 Questions

Exam 8: Property, plant and Equipment128 Questions

Exam 9: Intangible Assets, goodwill, mineral Resources, and Government Grants81 Questions

Exam 10: Applications of Fair Value to Non-Current Assets121 Questions

Select questions type

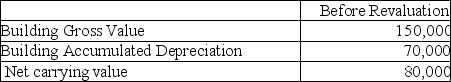

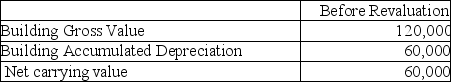

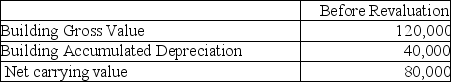

Wallace Inc wishes to use the revaluation model for this property:

The fair value for the property is $60,000.What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the elimination method to record the revaluation?

The fair value for the property is $60,000.What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the elimination method to record the revaluation?

(Multiple Choice)

4.9/5  (35)

(35)

Company Ten purchased land for $400,000 during the year.Fair value at the end of the year was $500,000.

Prepare the journal entry to record the revaluation adjustment.

(Essay)

5.0/5  (36)

(36)

Compare the proportional method and the elimination method for recording the revaluation entry.Contrast the benefits and drawbacks of each method.

(Essay)

4.8/5  (43)

(43)

Which of the following is correct with respect to when the impairment test must be performed?

(Multiple Choice)

4.9/5  (40)

(40)

Which is correct with respect to the accounting treatment under the cost or revaluation model?

(Multiple Choice)

4.9/5  (36)

(36)

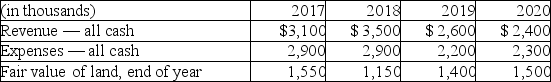

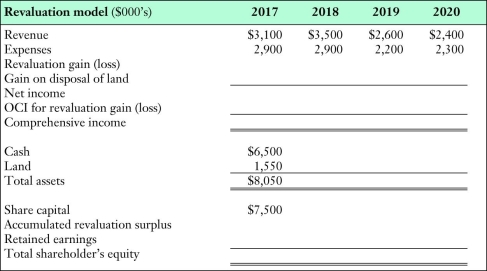

Wright Now Limited (WNL)was incorporated on January 1,2017 when the sole shareholder invested $7,500,000.This is the only financing the firm needed.WNL used $1,200,000 of the funds to purchase land.The company has a single project that it developed over four years.Below are details of the four years of operations.At the end of 2020 the land was sold for its fair value.

Required:

Complete the following table,assuming that WNL uses the revaluation model of measurement.OCI refers to other comprehensive income.

Required:

Complete the following table,assuming that WNL uses the revaluation model of measurement.OCI refers to other comprehensive income.

(Essay)

4.8/5  (38)

(38)

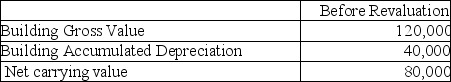

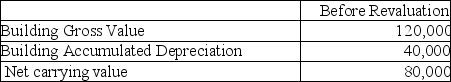

Grover Inc wishes to use the revaluation model for this property:

The fair value for the property is $100,000.Assuming this is the first year of using the revaluation model,what amount would be booked to the "other comprehensive income" account if Grover chooses to use the proportional method to record the revaluation?

The fair value for the property is $100,000.Assuming this is the first year of using the revaluation model,what amount would be booked to the "other comprehensive income" account if Grover chooses to use the proportional method to record the revaluation?

(Multiple Choice)

4.7/5  (44)

(44)

Which of the following is correct with respect to when the impairment test must be performed?

(Multiple Choice)

4.8/5  (25)

(25)

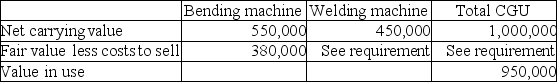

Adam's Bikes produces specialized bicycle frames.The production process uses two machines,which together form a cash generating unit (CGU).The following information is relevant to the evaluation of impairment for these machines.

Required:

a.Assume that the welding machine has a fair value less costs to sell of $420,000.Determine the amount of impairment that should be recorded for the cash generating unit and for each of the two machines.

b.Assume that the welding machine has a fair value less costs to sell of $455,000.Determine the amount of impairment that should be recorded for the cash generating unit and for each of the two machines.

Required:

a.Assume that the welding machine has a fair value less costs to sell of $420,000.Determine the amount of impairment that should be recorded for the cash generating unit and for each of the two machines.

b.Assume that the welding machine has a fair value less costs to sell of $455,000.Determine the amount of impairment that should be recorded for the cash generating unit and for each of the two machines.

(Essay)

4.9/5  (41)

(41)

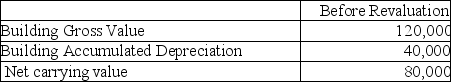

Wallace Inc wishes to use the revaluation model for this property:

The fair value for the property is $60,000.What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the proportional method to record the revaluation?

The fair value for the property is $60,000.What amount would be booked to the "accumulated depreciation" account if Wallace chooses to use the proportional method to record the revaluation?

(Multiple Choice)

4.8/5  (34)

(34)

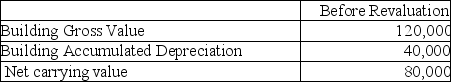

Smith Inc wishes to use the revaluation model for this property:

The fair value for the property is $150,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $150,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much depreciation expense would be recorded in the year subsequent to the revaluation?

(Multiple Choice)

4.8/5  (40)

(40)

Grover Inc wishes to use the revaluation model for this property:

The fair value for the property is $100,000.What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the proportional method to record the revaluation?

The fair value for the property is $100,000.What amount would be booked to the "accumulated depreciation" account if Grover chooses to use the proportional method to record the revaluation?

(Multiple Choice)

4.9/5  (34)

(34)

Wallace Inc wishes to use the revaluation model for this property:

The fair value for the property is $60,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $60,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much depreciation expense would be recorded in the year subsequent to the revaluation?

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following is correct with respect to the "fair value model"?

(Multiple Choice)

4.9/5  (37)

(37)

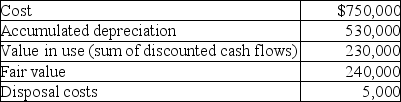

Based on the following information,what is the recoverable amount for the impairment test?

(Multiple Choice)

4.8/5  (28)

(28)

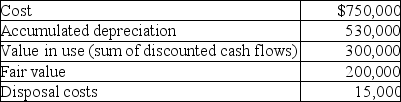

Based on the following information,what is the recoverable amount?

(Multiple Choice)

4.9/5  (32)

(32)

Smith Inc wishes to use the revaluation model for this property:

The fair value for the property is $150,000.What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the proportional method to record the revaluation?

The fair value for the property is $150,000.What amount would be booked to the "accumulated depreciation" account if Smith chooses to use the proportional method to record the revaluation?

(Multiple Choice)

5.0/5  (35)

(35)

Showing 41 - 60 of 121

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)