Exam 10: Applications of Fair Value to Non-Current Assets

Exam 1: Fundamentals of Financial Accounting Theory33 Questions

Exam 2: Conceptual Frameworks for Financial Reporting60 Questions

Exam 3: Accrual Accounting160 Questions

Exam 4: Revenue and Recognition108 Questions

Exam 5: Cash and Receivables119 Questions

Exam 6: Inventories156 Questions

Exam 7: Financial Assets137 Questions

Exam 8: Property, plant and Equipment128 Questions

Exam 9: Intangible Assets, goodwill, mineral Resources, and Government Grants81 Questions

Exam 10: Applications of Fair Value to Non-Current Assets121 Questions

Select questions type

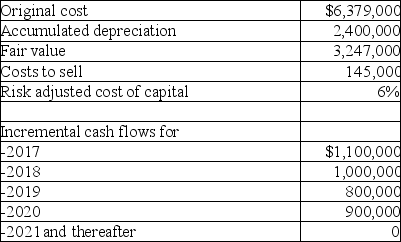

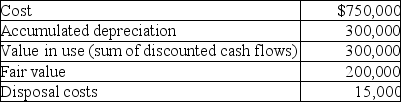

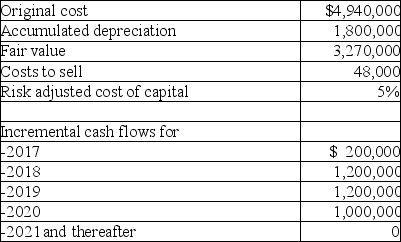

Due to increased competition from low-cost foreign manufacturers,Genevive's Toy Company is experiencing significant declines in sales.The company produces its toys from an assembly line.The equipment in this assembly line has not been previously revalued or impaired.For the year ending December 31,2016,the controller gathered the following information relating to the assembly line equipment,which is considered to be a cash generating unit:

Required:

Determine whether the assembly line is impaired,and if so,the amount of the impairment.

Required:

Determine whether the assembly line is impaired,and if so,the amount of the impairment.

(Essay)

4.8/5  (42)

(42)

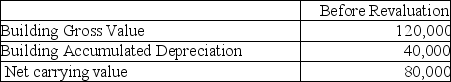

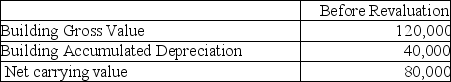

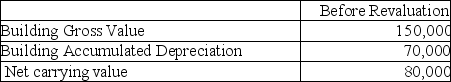

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $140,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $140,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

(Multiple Choice)

4.8/5  (38)

(38)

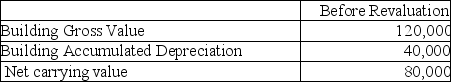

Wallace Inc wishes to use the revaluation model for this property:

The fair value for the property is $60,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $60,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

(Multiple Choice)

4.9/5  (37)

(37)

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $140,000.Assuming this is the first year of using the revaluation model,which of the following amounts will be booked?

The fair value for the property is $140,000.Assuming this is the first year of using the revaluation model,which of the following amounts will be booked?

(Multiple Choice)

4.9/5  (37)

(37)

Explain the accounting for assets related to the agricultural industry.

(Essay)

4.9/5  (38)

(38)

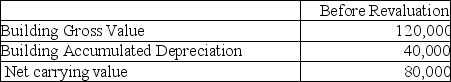

Smith Inc wishes to use the revaluation model for this property:

The fair value for the property is $150,000.Assuming this is the first year of using the revaluation model,what amount would be booked to the "other comprehensive income" account if Smith chooses to use the proportional method to record the revaluation?

The fair value for the property is $150,000.Assuming this is the first year of using the revaluation model,what amount would be booked to the "other comprehensive income" account if Smith chooses to use the proportional method to record the revaluation?

(Multiple Choice)

4.8/5  (36)

(36)

Based on the following information,what is the impairment booked at December 31,2018?

(Multiple Choice)

4.8/5  (43)

(43)

Which is not a source of information that would be used as an indicator of impairment?

(Multiple Choice)

4.9/5  (28)

(28)

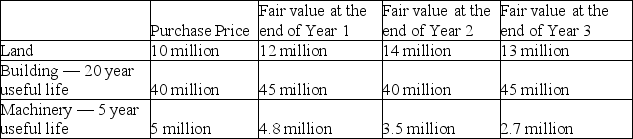

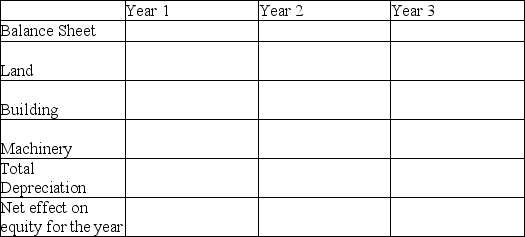

Information about the PPE for Jeffery Inc.is provided below.Determine the balance sheet presentation under the cost and fair value model for each year.Ignore the impact of income taxes and assume that a full year depreciation is taken each year using the straight-line method.

(Essay)

4.7/5  (45)

(45)

Wallace Inc wishes to use the revaluation model for this property:

The fair value for the property is $60,000.Assuming this is the first year of using the revaluation model,what amount would be booked to profit and loss if Wallace chooses to use the elimination method to record the revaluation?

The fair value for the property is $60,000.Assuming this is the first year of using the revaluation model,what amount would be booked to profit and loss if Wallace chooses to use the elimination method to record the revaluation?

(Multiple Choice)

4.7/5  (34)

(34)

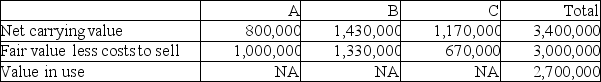

Stay Dry Raincoats uses three different machines (A,B,and C)to manufacture raincoats.These machines are considered to be a cash generating unit (CGU).Due to climate change and changes in consumer preferences,demand for raincoats has declined in recent years.The following information is relevant to the evaluation of impairment.

Required:

Determine the amount of impairment loss that should be recorded for the cash generating unit and for each of the three machines.

Required:

Determine the amount of impairment loss that should be recorded for the cash generating unit and for each of the three machines.

(Essay)

4.8/5  (25)

(25)

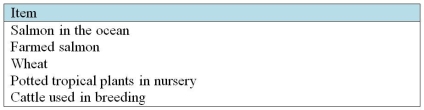

Explain the meaning of biological assets and agricultural produce.Classify each of the following items as: biological asset,agricultural produce,or neither.

(Essay)

4.9/5  (42)

(42)

A company owns an office building that it rents out to other businesses.Due to a downturn in the economy,rental rates have dropped while vacancy rates have increased.Due to these circumstances,the company evaluated the building for impairment.The building has a cost of $70 million,accumulated depreciation of $47.05 million,and a value in use of $20 million.In addition,the company has recently received an offer to purchase the building for $22 million.Legal and other costs necessary to complete a sale of this type would amount to $200,000.

Required:

Determine the amount of impairment,if any.

(Essay)

4.8/5  (33)

(33)

Reid Resch is a maker of instruments for measuring weight,temperature,pressure,and so on.Due to the increasing use of digital instruments,one of the company production lines based on analogue technology is potentially impaired.Management has produced the following information relating to this production line,which is considered to be a cash generating unit:

Required:

Determine whether the production line is impaired,and if so,the amount of the impairment.

Required:

Determine whether the production line is impaired,and if so,the amount of the impairment.

(Essay)

4.8/5  (38)

(38)

Showing 61 - 80 of 121

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)