Exam 10: Applications of Fair Value to Non-Current Assets

Exam 1: Fundamentals of Financial Accounting Theory33 Questions

Exam 2: Conceptual Frameworks for Financial Reporting60 Questions

Exam 3: Accrual Accounting160 Questions

Exam 4: Revenue and Recognition108 Questions

Exam 5: Cash and Receivables119 Questions

Exam 6: Inventories156 Questions

Exam 7: Financial Assets137 Questions

Exam 8: Property, plant and Equipment128 Questions

Exam 9: Intangible Assets, goodwill, mineral Resources, and Government Grants81 Questions

Exam 10: Applications of Fair Value to Non-Current Assets121 Questions

Select questions type

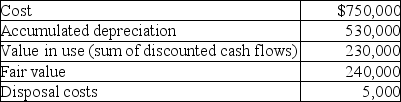

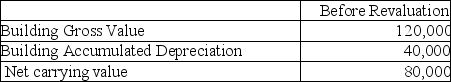

Based on the following information,what is the impairment amount to be recorded?

(Multiple Choice)

4.8/5  (34)

(34)

Where are gains and losses on agricultural activity reported in the financial statements?

(Multiple Choice)

4.9/5  (44)

(44)

Which of the following is correct with respect to the "impairment loss under the revaluation model"?

(Multiple Choice)

4.8/5  (41)

(41)

Explain how non-current assets that are part of a discontinued operation should be accounted for.

(Essay)

4.7/5  (31)

(31)

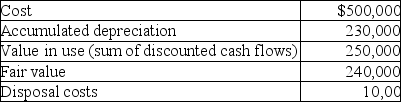

Based on the following information,what is the net amount that this equipment should be reported at in the balance sheet at December 31,2018?

(Multiple Choice)

4.8/5  (41)

(41)

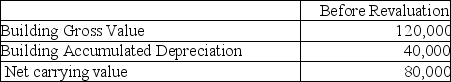

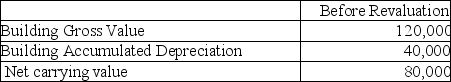

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $40,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $40,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

(Multiple Choice)

4.9/5  (37)

(37)

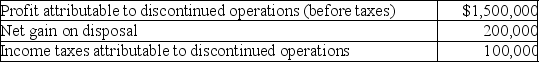

The following information is available about George Inc's discontinued operations:

What single amount will be presented on George's statement of comprehensive income?

What single amount will be presented on George's statement of comprehensive income?

(Multiple Choice)

4.9/5  (40)

(40)

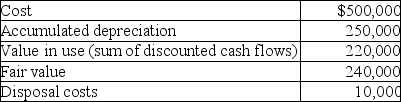

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $20,000.Assuming this is the first year of using the revaluation model,what amount would be booked to the "other comprehensive income" account if Wilson chooses to use the proportional method to record the revaluation?

The fair value for the property is $20,000.Assuming this is the first year of using the revaluation model,what amount would be booked to the "other comprehensive income" account if Wilson chooses to use the proportional method to record the revaluation?

(Multiple Choice)

4.8/5  (37)

(37)

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $40,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $40,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much depreciation expense would be recorded in the year subsequent to the revaluation?

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following is correct with respect to the accounting for "investment properties"?

(Multiple Choice)

4.8/5  (39)

(39)

On December 31,2018,CA Inc.had a machine with an original cost of $20,000 and accumulated depreciation of $5,000.An impairment test on that date indicated that the machine had a value in use of $12,000 and a fair value of $10,000 (no disposal costs).What impairment loss is recorded for fiscal 2018?

(Multiple Choice)

4.7/5  (38)

(38)

Based on the following information,what is the net amount that this equipment should be reported at on FlexiHose's balance sheet at December 31,2018?

(Multiple Choice)

4.8/5  (34)

(34)

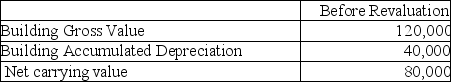

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $140,000.What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the elimination method to record the revaluation?

The fair value for the property is $140,000.What amount would be booked to the "accumulated depreciation" account if Wilson chooses to use the elimination method to record the revaluation?

(Multiple Choice)

4.9/5  (41)

(41)

Showing 101 - 120 of 121

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)