Exam 11: Optimal Portfolio Choice and the Capital Asset Pricing Model

Exam 1: The Corporation37 Questions

Exam 2: Introduction to Financial Statement Analysis93 Questions

Exam 3: Financial Decision Making and the Law of One Price89 Questions

Exam 4: The Time Value of Money89 Questions

Exam 5: Interest Rates68 Questions

Exam 6: Valuing Bonds110 Questions

Exam 7: Investment Decision Rules86 Questions

Exam 8: Fundamentals of Capital Budgeting93 Questions

Exam 9: Valuing Stocks96 Questions

Exam 10: Capital Markets and the Pricing of Risk101 Questions

Exam 11: Optimal Portfolio Choice and the Capital Asset Pricing Model133 Questions

Exam 12: Estimating the Cost of Capital104 Questions

Exam 13: Investor Behavior and Capital Market Efficiency75 Questions

Exam 14: Capital Structure in a Perfect Market98 Questions

Exam 15: Debt and Taxes95 Questions

Exam 16: Financial Distress, managerial Incentives, and Information111 Questions

Exam 17: Payout Policy96 Questions

Exam 18: Capital Budgeting and Valuation With Leverage96 Questions

Exam 19: Valuation and Financial Modeling: a Case Study49 Questions

Select questions type

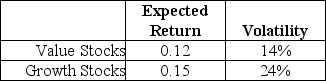

Use the following information to answer the question(s) below.

Suppose that all stocks can be grouped into two mutually exclusive portfolios (with each stock appearing in only one portfolio): growth stocks and value stocks. Assume that these two portfolios are equal in size (market value), the correlation of their returns is equal to 0.6, and the portfolios have the following characteristics:

The risk free rate is 3.5%.

-The Sharpe ratio for the market (which is a 50-50 combination of the value and growth portfolios)portfolio is closest to:

The risk free rate is 3.5%.

-The Sharpe ratio for the market (which is a 50-50 combination of the value and growth portfolios)portfolio is closest to:

(Multiple Choice)

4.9/5  (40)

(40)

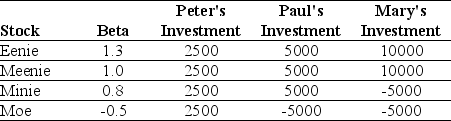

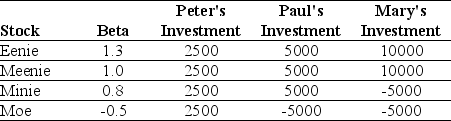

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-The beta on Paul's Portfolio is closest to:

-The beta on Paul's Portfolio is closest to:

(Multiple Choice)

4.8/5  (41)

(41)

The beta for the portfolio of the three stocks is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

Use the table for the question(s) below.

Consider the following three individuals portfolios consisting of investments in four stocks:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's portfolio is closest to:

-Assuming that the risk-free rate is 4% and the expected return on the market is 12%,then required return on Peter's portfolio is closest to:

(Multiple Choice)

4.8/5  (31)

(31)

Suppose over the next year Ball has a return of 12.5%,Lowes has a return of 20%,and Abbott Labs has a return of -10%.The return on your portfolio over the year is:

(Multiple Choice)

4.8/5  (40)

(40)

Suppose that you want to maximize your expected return without increasing your risk.How can you achieve this goal? Without increasing your risk,what is the maximum expected return you can expect?

(Essay)

4.9/5  (34)

(34)

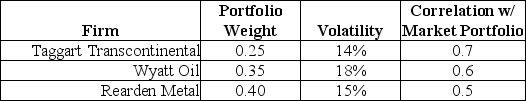

Use the following information to answer the question(s) below.

The volatility of the market portfolio is 10%, the expected return on the market is 12%, and the risk-free rate of interest is 4%.

-The beta for Wyatt Oil is closest to:

The volatility of the market portfolio is 10%, the expected return on the market is 12%, and the risk-free rate of interest is 4%.

-The beta for Wyatt Oil is closest to:

(Multiple Choice)

4.9/5  (35)

(35)

Use the information for the question(s) below.

Suppose you have $10,000 in cash and you decide to borrow another $10,000 at a 6% interest rate to invest in the stock market. You invest the entire $20,000 in an exchange traded fund (ETF) with a 12% expected return and a 20% volatility.

-The volatility of your of your investment is closest to:

(Multiple Choice)

4.7/5  (37)

(37)

Use the information for the question(s) below.

Suppose you have $10,000 in cash and you decide to borrow another $10,000 at a 6% interest rate to invest in the stock market. You invest the entire $20,000 in an exchange traded fund (ETF) with a 12% expected return and a 20% volatility.

-Assume that the EFT you invested in returns -10%,then the realized return on your investment is closest to:

(Multiple Choice)

4.9/5  (30)

(30)

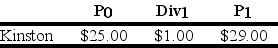

Suppose you have $10,000 in cash to invest.You decide to sell short $5,000 worth of Kinston stock and invest the proceeds from your short sale,plus your $10,000 into one-year U.S.treasury bills earning 5%.At the end of the year,you decide to liquidate your portfolio.Kinston Industries has the following realized returns:  The return on your portfolio is closest to:

The return on your portfolio is closest to:

(Multiple Choice)

4.7/5  (28)

(28)

Use the information for the question(s) below.

You are presently invested in the Luther Fund, a broad based mutual fund that invest in stocks and other securities. The Luther Fund has an expected return of 14% and a volatility of 20%. Risk-free Treasury bills are currently offering returns of 4%. You are considering adding a precious metals fund to your current portfolio. The metals fund has an expected return of 10%, a volatility of 30%, and a correlation of -.20 with the Luther Fund.

-Will adding the precious metals fund improve your portfolio?

(Essay)

4.8/5  (36)

(36)

Suppose you invest $15,000 in Merck stock and $25,000 in Home Depot stock.You expect a return of 16% for Merck and 12% for Home Depot.What is the expected return on your portfolio?

(Multiple Choice)

4.9/5  (38)

(38)

The expected return on the portfolio of the three stocks is closest to:

(Multiple Choice)

4.7/5  (40)

(40)

Showing 61 - 80 of 133

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)