Exam 9: Intangible Assets, Goodwill, Mineral Resources, and Government Grants

Exam 1: Fundamentals of Financial Accounting Theory33 Questions

Exam 2: Conceptual Frameworks for Financial Reporting60 Questions

Exam 3: Accrual Accounting159 Questions

Exam 4: Revenue Recognition110 Questions

Exam 5: Cash and Receivables120 Questions

Exam 6: Inventories156 Questions

Exam 7: Financial Assets141 Questions

Exam 8: Property, Plant, and Equipment127 Questions

Exam 9: Intangible Assets, Goodwill, Mineral Resources, and Government Grants81 Questions

Exam 10: Applications of Fair Value to Non-Current Assets120 Questions

Select questions type

What is the appropriate treatment for re-payment of government grants under IFRS?

(Multiple Choice)

4.7/5  (35)

(35)

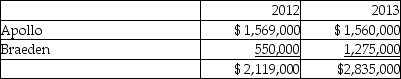

Kryan Corp. mines and produces aluminum. During 2012, the company explored two new sites and evaluated them for aluminum ore potential. By the December 31, 2012 year-end, both sites remained in the evaluation stage. During 2013, evaluation of site Apollo was completed and the site was deemed to have sufficient quantities of ore; consequently, development of the site began. However, site Braeden was determined to have ore concentrations too low to be commercially viable. The following is the cost of exploration and evaluation incurred on the two sites:

Required:

Record the journal entries in 2012 and 2013 relating to the exploration and evaluation costs using the successful efforts method. Assume that Kryan has a policy of capitalizing the costs of exploration and evaluation.

Required:

Record the journal entries in 2012 and 2013 relating to the exploration and evaluation costs using the successful efforts method. Assume that Kryan has a policy of capitalizing the costs of exploration and evaluation.

(Essay)

4.8/5  (32)

(32)

How does IFRS require that government grants for property, plant and equipment (PPE)be recorded?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following is a difference between intangible assets and property, plant and equipment (PPE)?

(Multiple Choice)

4.9/5  (36)

(36)

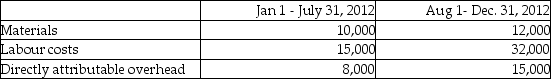

Research Corp., a publicly accountable entity, incurred the following costs in its research and development division:  At July 31, 2012, Research Corp. determined that the project was technically feasible and commercially viable. Research Corp. had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product. How much, if any, of the costs can be capitalized for fiscal 2012?

At July 31, 2012, Research Corp. determined that the project was technically feasible and commercially viable. Research Corp. had sufficient resources and intentions to complete the project and was confident that there was demand in the marketplace for the product. How much, if any, of the costs can be capitalized for fiscal 2012?

(Multiple Choice)

4.9/5  (35)

(35)

Explain how earnings can be manipulated through choices made in the estimated useful lives for intangible assets.

(Essay)

4.8/5  (45)

(45)

Xavier Corp capitalized exploration and evaluation costs of $470,000. A further $1,357,000 was spent on tangible property, plant, and equipment to develop an oil well. Reserves at the beginning of the year were 480,000 barrels. During the year, the Corp produced 57,600 barrels of oil.

Calculate the amounts for depletion and depreciation.

(Essay)

4.8/5  (47)

(47)

Which of the following is not a characteristic of an intangible asset?

(Multiple Choice)

4.8/5  (35)

(35)

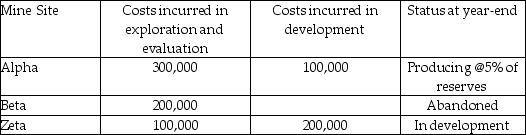

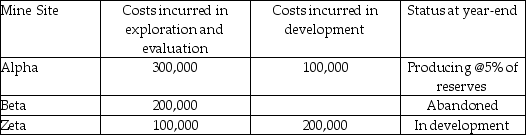

Soorya Resources incurred the following costs:  How much would be recorded as depletion expense under the successful efforts method?

How much would be recorded as depletion expense under the successful efforts method?

(Multiple Choice)

4.8/5  (38)

(38)

Soorya Resources incurred the following costs:  How much would be capitalized as "intangible assets" under the full cost method?

How much would be capitalized as "intangible assets" under the full cost method?

(Multiple Choice)

4.9/5  (37)

(37)

Why is it important to understand the difference between research costs and development costs?

(Essay)

4.7/5  (48)

(48)

Explain the accounting for assets in the mineral resource exploration industry.

(Essay)

4.8/5  (45)

(45)

Showing 61 - 80 of 81

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)