Exam 10: Applications of Fair Value to Non-Current Assets

Exam 1: Fundamentals of Financial Accounting Theory33 Questions

Exam 2: Conceptual Frameworks for Financial Reporting60 Questions

Exam 3: Accrual Accounting159 Questions

Exam 4: Revenue Recognition110 Questions

Exam 5: Cash and Receivables120 Questions

Exam 6: Inventories156 Questions

Exam 7: Financial Assets141 Questions

Exam 8: Property, Plant, and Equipment127 Questions

Exam 9: Intangible Assets, Goodwill, Mineral Resources, and Government Grants81 Questions

Exam 10: Applications of Fair Value to Non-Current Assets120 Questions

Select questions type

Based on the following information, what is the net book value of the asset on the December 31, 2012 balance sheet?

Free

(Multiple Choice)

4.9/5  (37)

(37)

Correct Answer:

C

Which of the following is correct with respect to the accounting for "investment properties"?

Free

(Multiple Choice)

4.8/5  (43)

(43)

Correct Answer:

B

Explain how non-current assets that are part of a discontinued operation should be accounted for.

(Essay)

4.9/5  (44)

(44)

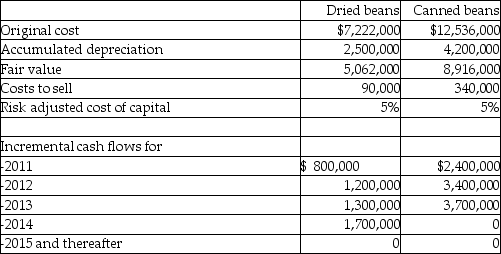

Bean World Company produces two distinct product lines: dried beans and canned beans. Due to changing consumer tastes, the company is evaluating these two cash generating units for impairment for the year ending December 31, 2010. Relevant information is as follows:

Required:

Determine whether either product line is impaired, and if so, the amount of the impairment.

Required:

Determine whether either product line is impaired, and if so, the amount of the impairment.

(Essay)

5.0/5  (42)

(42)

How is an impairment loss allocated to the non-current asset(s)?

(Multiple Choice)

4.9/5  (35)

(35)

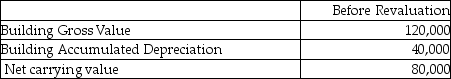

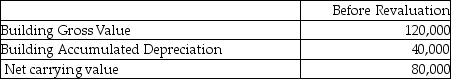

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much depreciation expense would be recorded in the year subsequent to the revaluation?

(Multiple Choice)

4.8/5  (39)

(39)

When should an entity select the exception to using "fair value less point of sale costs" approach for biological assets?

(Multiple Choice)

4.7/5  (40)

(40)

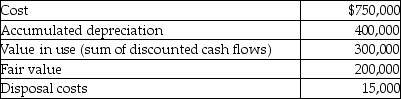

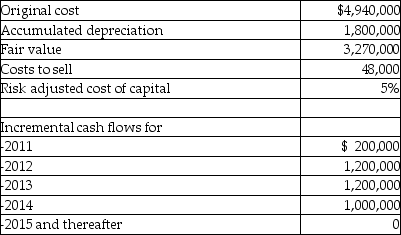

Reid Resch is a maker of instruments for measuring weight, temperature, pressure, and so on. Due to the increasing use of digital instruments, one of the company production lines based on analogue technology is potentially impaired. Management has produced the following information relating to this production line, which is considered to be a cash generating unit:

Required:

Determine whether the production line is impaired, and if so, the amount of the impairment.

Required:

Determine whether the production line is impaired, and if so, the amount of the impairment.

(Essay)

4.8/5  (41)

(41)

Company Nine purchased land for $600,000 some years ago. Fair value was $800,000 at the beginning of this year and $350,000 at the end of this year.

Prepare the journal entry to record this year's revaluation adjustment.

(Essay)

4.8/5  (36)

(36)

Wilson Inc wishes to use the revaluation model for this property:  The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

The fair value for the property is $140,000. Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years, how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

(Multiple Choice)

4.8/5  (39)

(39)

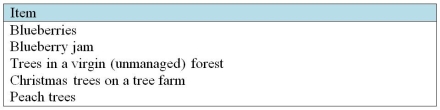

Explain the meaning of biological assets and agricultural produce. Classify each of the following items as: biological asset, agricultural produce, or neither.

(Essay)

4.7/5  (28)

(28)

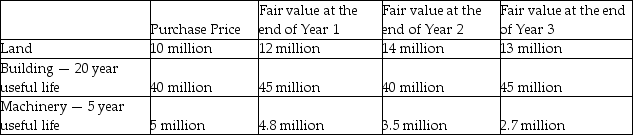

Information about the PPE for Jeremy Inc. is provided below. The company held the land and building to earn rental income and appropriately applied the fair value model for the land and building. Assume that the company takes a full of depreciation each year under the straight line method.

The company decided to use the building as its new head office at the beginning of year 3.

Prepare the journal entries required to record the change in use for Year 3.

(Essay)

4.7/5  (39)

(39)

Showing 1 - 20 of 120

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)