Exam 8: Foreign Currency Transactions and Hedges

Exam 1: Setting the Stage40 Questions

Exam 2: Intercorporate Equity Investments: an Introduction42 Questions

Exam 3: Business Combinations40 Questions

Exam 4: Wholly-Owned Subsidiaries: Reporting Subsequent to Acquisition37 Questions

Exam 5: Consolidation of Non-Wholly Owned Subsidiaries36 Questions

Exam 6: Subsequent-Year Consolidations: General Approach36 Questions

Exam 7: Segmented and Interim Reporting41 Questions

Exam 8: Foreign Currency Transactions and Hedges49 Questions

Exam 9: Reporting Foreign Operations43 Questions

Exam 10: Financial Reporting for Not-For-Profit Organizations46 Questions

Exam 11: Public Sector Financial Reporting41 Questions

Exam 12: Income Tax Allocation4 Questions

Exam 13: Income Tax Allocation Subsequent to Acquisition4 Questions

Exam 14: Good will Impairment Test6 Questions

Exam 15: Step Purchases6 Questions

Exam 16: Decreases in Ownership Interest4 Questions

Exam 18: Intercompany Bond Holdings6 Questions

Exam 19: Fund Accounting5 Questions

Select questions type

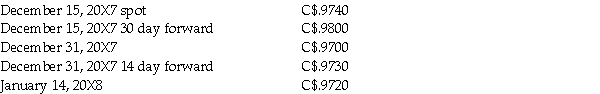

Helvetia Corp. ,a Swiss firm,bought merchandise from Bouchard Company of Quebec on December 15,20X7 for 20,000 CHF,payable on January 14,20X8.Bouchard and Helvetia both close their books on December 31.The 20,000 CHF was paid on January 14,20X8.The exchange rates for CHF1 were:  Required:

Provide the journal entries for Bouchard (the seller)at each of the above dates,as required.The account was hedged by Bouchard through a 30 day forward contract.Bouchard uses the gross method to record hedge transactions.Bouchard reports under IFRS.

Required:

Provide the journal entries for Bouchard (the seller)at each of the above dates,as required.The account was hedged by Bouchard through a 30 day forward contract.Bouchard uses the gross method to record hedge transactions.Bouchard reports under IFRS.

(Essay)

4.8/5  (37)

(37)

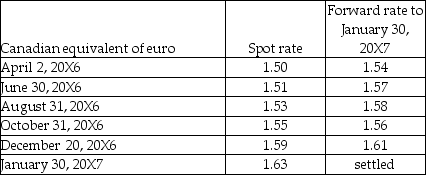

Beauty Care Limited (BCL)manufactures and distributes leather furniture to various companies in Europe.On April 2,20X6,BCL entered into a sales contract with a company in Germany to sell 1,000 sofas.The contract price is €2,000 per sofa.Five hundred sofas are to be delivered in May 15,20X6 and the remaining half is to be delivered on December 20,20X6.Payment is due in two instalments with half due on August 31,20X6 and the remaining half due January 30,20X7.However,the customer has the right to cancel the contract with 30 days' notice.

BCL entered into a forward contract to hedge against the Euro exchange rate for €1 million each coming due on January 31,20X7.BCL has an October 31 year end.

Delivery of the furniture occurred on the dates specified and the company collected the receivables due and settled the forward contract January 30,20X7.

The exchange rates were as followed:

Required:

Assume that the forward contract is designated as a cash flow hedge since the sale is highly probable.Prepare the journal entries to record the sales and the hedge.Use the net method to record the journal entries.BCL reports under IFRS.

Required:

Assume that the forward contract is designated as a cash flow hedge since the sale is highly probable.Prepare the journal entries to record the sales and the hedge.Use the net method to record the journal entries.BCL reports under IFRS.

(Essay)

4.9/5  (27)

(27)

On June 1,20X4,Chua (Canada)Co.entered into a 90-day forward contract to sell $500,000 Singapore dollars (SGD)to its bank on August 29,20X4.The following information has been provided:

June 1,90-day forward rate SGD$1 = $0.7750

July 1,60-day forward rate SGD$1 = $0.7630

August 29,spot rate SGD$1 = $0.748

Chua has a June 30 year-end.What is the net exchange gain (loss)on the contract?

(Multiple Choice)

4.9/5  (32)

(32)

Where is the ineffective portion of a cash-flow hedge recognized on the financial statements?

(Multiple Choice)

4.8/5  (41)

(41)

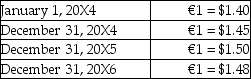

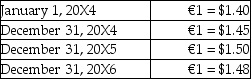

On January 1,20x4,HB Inc.issued 10,000,000 Euros (€)of bonds payable.The bonds are due on December 31,20X6.Over the life of the bonds,the exchange rates were as follows:

Assume that exchange gains and losses on long-term monetary are recognized in income immediately.What is the exchange gain (loss)recognized in income during 20X5?

Assume that exchange gains and losses on long-term monetary are recognized in income immediately.What is the exchange gain (loss)recognized in income during 20X5?

(Multiple Choice)

4.7/5  (32)

(32)

Under IFRS 8,at which exchange rate should monetary assets and liabilities be translated?

(Multiple Choice)

4.7/5  (43)

(43)

What exchange rate is usually used to report non-monetary assets on the statement of financial position?

(Multiple Choice)

4.9/5  (40)

(40)

What is the effect of fluctuations in exchange rates on accounts payable?

(Multiple Choice)

4.9/5  (34)

(34)

Fransen Co.does a lot of businesses in Denmark.It has numerous trade accounts receivables and accounts payables that are to be settled in Danish krones.What type of hedge does Fransen have?

(Multiple Choice)

4.7/5  (26)

(26)

Under the two transaction theory of treating a gain on exchange rate changes,how is the gain treated?

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following is not a major reason for fluctuating exchange rates?

(Multiple Choice)

4.8/5  (41)

(41)

On January 1,20x4,HB Inc.issued 10,000,000 Euros (€)of bonds payable.The bonds are due on December 31,20X6.Over the life of the bonds,the exchange rates were as follows:

Assume that exchange gains and losses on long-term monetary are recognized in income immediately.What is the exchange gain (loss)recognized in income during 20X6?

Assume that exchange gains and losses on long-term monetary are recognized in income immediately.What is the exchange gain (loss)recognized in income during 20X6?

(Multiple Choice)

4.9/5  (37)

(37)

On June 1,20X4,Chua (Canada)Co.entered into a 90-day forward contract to sell $500,000 Singapore dollars (SGD)to its bank on August 29,20X4.The following information has been provided:

June 1,90-day forward rate SGD$1 = $0.7750

July 1,60-day forward rate SGD$1 = $0.7630

August 29,spot rate SGD$1 = $0.748

Chua has a June 30 year-end.What is the exchange gain (loss)at June 30,20X4?

(Multiple Choice)

4.8/5  (45)

(45)

On December 1,20X5,Gillard Ltd.sold goods to International Traders Ltd. ,a company located in Switzerland for 500,000 Swiss francs (CHF).At the date of sale,the spot rate was CHF1 = $1.0329.On the same date,Gillard acquired a 90-day forward contract at a rate of CHF1 = $1.0315.On March 1,20X6,Gillard receives full payment from International Traders and delivered the Swiss francs in execution of the forward contract.The spot rate at March 1,20X6 was CHF1 = $1.0287.Assume that Gillard has a December 31 year-end and that the spot rate on that date was CHF1 = $1.0302.At December 31,the forward rate for a 60 day contract was CHF1 = 1.0394.At December 31,what is the balance of Gillard's accounts receivable?

(Multiple Choice)

4.8/5  (31)

(31)

Exchange gains and losses on accounts receivable/payable that are denominated in a foreign currency are ________.

(Multiple Choice)

4.9/5  (36)

(36)

HCB,a Canadian public company,entered into the following transactions late in 20X6:

• Transaction #1 - On October 15,HCB purchased inventory from a Mexican supplier for 800,000 pesos (Ps).On the same day,HCB entered into a forward contract for Ps 800,000 at the 60-day forward rate of Ps1 = $0.399.The company has designated this as a fair value hedge.The Mexican supplier was paid in full on December 15,20X6.

• Transaction #2 - On November 1,HCB contracted to sell inventory to a customer in Switzerland at a selling price of CHF 400,000.The contract called for the merchandise to be delivered to the customer on December 1,with payment to be received in Swiss francs by January 31,20X7.On November 1,HBC arranged a forward contract to deliver CHF 400,000 on January 31,20X7 at a rate of CHF1 = $1.20.The company has designated this as a fair value hedge on a firm commitment.

• On December 1,20X6,the forward rate on the Swiss francs to January 31,20X7 was CHF1 = $1.21

• The company has a December 31,20X6 year end.On this date the forward rates for the Swiss francs was CHF1 = $1.23.

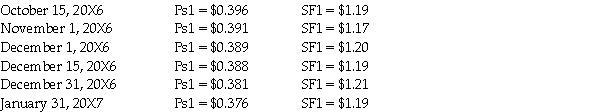

HBC has a year-end of December 31.Spot rates were as follows during this period of time:  Required:

The company uses the gross method to record hedging transactions.Prepare the journal entries that HCB should make to record the events described above.

Required:

The company uses the gross method to record hedging transactions.Prepare the journal entries that HCB should make to record the events described above.

(Essay)

4.8/5  (34)

(34)

Showing 21 - 40 of 49

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)