Exam 5: Consolidation of Non-Wholly Owned Subsidiaries

Exam 1: Setting the Stage40 Questions

Exam 2: Intercorporate Equity Investments: an Introduction42 Questions

Exam 3: Business Combinations40 Questions

Exam 4: Wholly-Owned Subsidiaries: Reporting Subsequent to Acquisition37 Questions

Exam 5: Consolidation of Non-Wholly Owned Subsidiaries36 Questions

Exam 6: Subsequent-Year Consolidations: General Approach36 Questions

Exam 7: Segmented and Interim Reporting41 Questions

Exam 8: Foreign Currency Transactions and Hedges49 Questions

Exam 9: Reporting Foreign Operations43 Questions

Exam 10: Financial Reporting for Not-For-Profit Organizations46 Questions

Exam 11: Public Sector Financial Reporting41 Questions

Exam 12: Income Tax Allocation4 Questions

Exam 13: Income Tax Allocation Subsequent to Acquisition4 Questions

Exam 14: Good will Impairment Test6 Questions

Exam 15: Step Purchases6 Questions

Exam 16: Decreases in Ownership Interest4 Questions

Exam 18: Intercompany Bond Holdings6 Questions

Exam 19: Fund Accounting5 Questions

Select questions type

Pooke Co.acquired 75% of Finch Ltd.3 years ago.In calculating the balance for the non-controlling interest,Pooke started with the net income from Finch's current year-end single-entity financial statements.Which of the following adjustments must be added to Finch's net income in calculating Finch's adjusted net income?

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

D

Which of the following statements about IFRS 3,Business Combinations is true?

Free

(Multiple Choice)

4.8/5  (35)

(35)

Correct Answer:

B

Under IAS 27,where does the non-controlling interest (NCI)appear on the statement of financial position?

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

B

Arnez Ltd.acquired 70% of Bedard Ltd.At the acquisition date,Bedard's net identifiable assets had a carrying value of $825,000 and a fair value of $1,000,000.Arnez paid $910,000 for the acquisition.Under the parent-company extension method,what amount should be reported for goodwill on Arnez's consolidated statement of financial position?

(Multiple Choice)

4.7/5  (45)

(45)

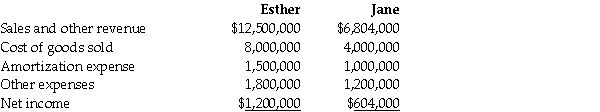

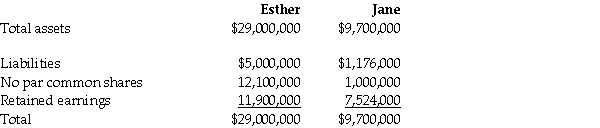

On December 31,20X2,the Esther Company purchased 80% of the outstanding common shares of the Jane Company for $7.5 million in cash.On that date,the shareholders' equity of Jane totalled $6 million and consisted of $1 million in no par common shares and $5 million in retained earnings.Both companies use the straight-line method to calculate depreciation and amortization.Goodwill,if any arises as a result of this business combination,is written down if there is a permanent impairment in its value.

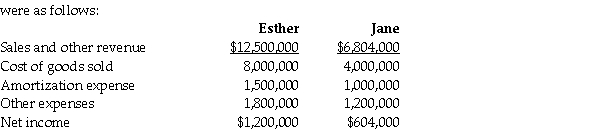

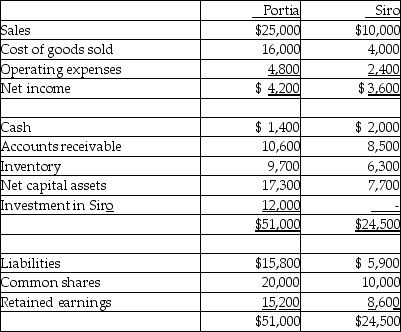

For the year ending December 31,20X4,the statements of comprehensive income for Esther and Jane  At December 31,20X4,the condensed statement of financial position for the two companies were as follows:

At December 31,20X4,the condensed statement of financial position for the two companies were as follows:  OTHER INFORMATION:

1.On December 31,20X2,Jane had a building with a fair value that was $450,000 greater than its carrying value.The building had an estimated remaining useful life of 15 years.

2.On December 31,20X2,Jane had inventory with a fair value that was $150,000 less than its carrying value.This inventory was sold in 20X3.

3.During 20X3,Jane sold merchandise to Esther for $100,000,a price that included a gross profit of $50,000.During 20X3,40% of this merchandise was resold by Esther and the other 60% remained in its December 31,20X3 inventories.On December 31,20X4,the inventories of Esther contained merchandise purchased from Jane on which Jane had recognized a gross profit in the amount of $20,000.Total sales from Jane to Esther were $150,000 during 20X4.

4.During 20X4,Esther declared and paid dividends of $300,000 while Jane declared and paid dividends of $100,000.

5.Esther accounts for its investment in Jane using the cost method.

Required:

Calculate goodwill on the consolidated balance sheet at December 31,20X4 under the entity method and the parent-company extension method.Explain the differences between the two balances.

OTHER INFORMATION:

1.On December 31,20X2,Jane had a building with a fair value that was $450,000 greater than its carrying value.The building had an estimated remaining useful life of 15 years.

2.On December 31,20X2,Jane had inventory with a fair value that was $150,000 less than its carrying value.This inventory was sold in 20X3.

3.During 20X3,Jane sold merchandise to Esther for $100,000,a price that included a gross profit of $50,000.During 20X3,40% of this merchandise was resold by Esther and the other 60% remained in its December 31,20X3 inventories.On December 31,20X4,the inventories of Esther contained merchandise purchased from Jane on which Jane had recognized a gross profit in the amount of $20,000.Total sales from Jane to Esther were $150,000 during 20X4.

4.During 20X4,Esther declared and paid dividends of $300,000 while Jane declared and paid dividends of $100,000.

5.Esther accounts for its investment in Jane using the cost method.

Required:

Calculate goodwill on the consolidated balance sheet at December 31,20X4 under the entity method and the parent-company extension method.Explain the differences between the two balances.

(Essay)

4.9/5  (29)

(29)

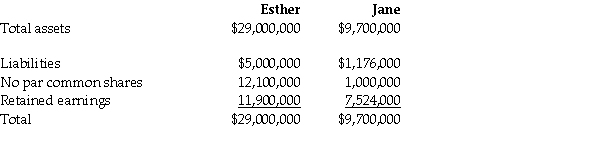

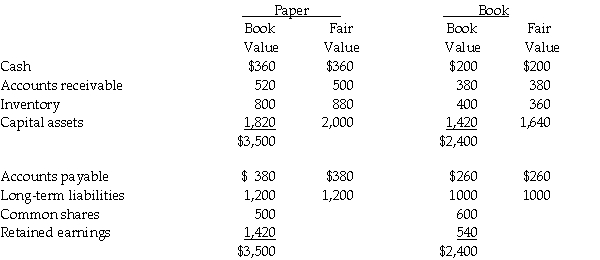

On December 31,20X5,Paper Co.purchased 60% of the outstanding common shares of Book Ltd.for $760,000 in shares and $200,000 in cash.The statements of financial position of Paper and Book immediately before the acquisition and issuance of the notes payable were as follows (in 000s):  The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

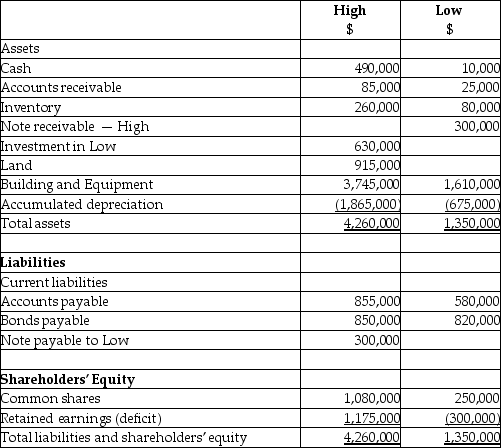

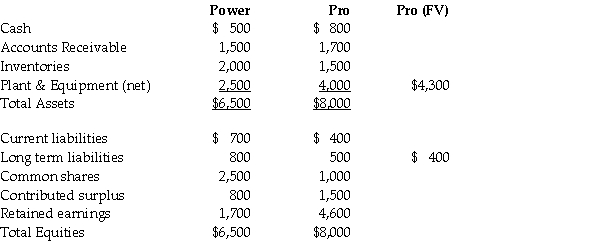

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

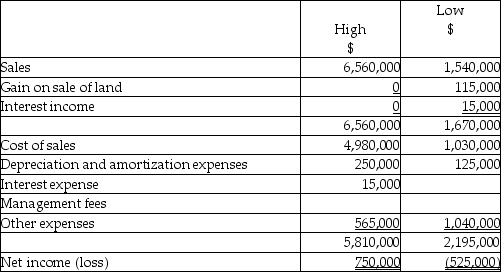

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

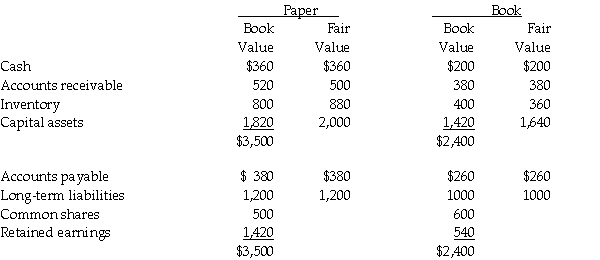

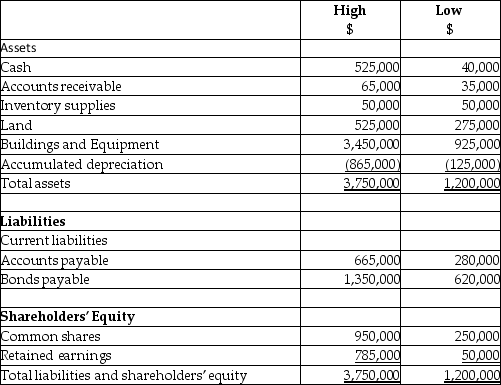

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-inline" loading="lazy" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-inline" loading="lazy" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-inline" loading="lazy" >

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-inline" loading="lazy" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-inline" loading="lazy" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-inline" loading="lazy" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-inline" loading="lazy" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-inline" loading="lazy" >

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-inline" loading="lazy" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Changes in Equity - Retained Earnings Section For the year ended December 31,20X7 (in thousands of

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Required: Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method. Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7. Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7." class="answers-bank-image d-inline" loading="lazy" >

The difference in the carrying value and the fair value of the capital assets for Book relates to its office building.This building has an estimated 20 years remaining of useful life.

During 20X6,the year following the acquisition,the following occurred:

1.Throughout the year,Book purchased merchandise of $800,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $250,000 on this merchandise.75% of this merchandise was resold by Book prior to December 31,20X6.

2.Throughout the year,Book sold merchandise to Paper totalling $500,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 60% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X6 and Paper paid dividends of $500,000.

During 20X7,the following occurred:

1.Throughout the year,Book purchased merchandise of $1,000,000 from Paper.Paper's gross margin is 30% of selling price.At December 31,20X6,Book still owed Paper $150,000 on this merchandise.85% of this merchandise was resold by Book prior to December 31,20X7.

2.Throughout the year,Book sold merchandise to Paper totalling $650,000.The gross margin in these products is 25%.At the end of 20X6,Paper had not yet resold 40% of this merchandise.

3.Management fees were paid to Paper from Book totalling $250,000.

4.Book paid dividends of $250,000 at the end of 20X7 and Paper paid dividends of $500,000.

5.Paper uses the cost method to report its investment in Book.

Statements of Financial Position

As at December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93af_8673_1967903a7390_TB1557_00

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.

Prepare the consolidated statement of retained earnings for Paper Co.as at December 31,20X7.s) Statements of Comprehensive Income For the year ended December 31,20X7 (in thousands of

Statements of Comprehensive Income

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b0_8673_5d1ae94fb227_TB1557_00

Statements of Changes in Equity - Retained Earnings Section

For the year ended December 31,20X7

(in thousands of $'s)

11ea7fc9_1098_93b1_8673_172e931e9b8b_TB1557_00

Required:

Prepare the consolidated statement of comprehensive income for Paper Co.for the year ended December 31,20X7 under the entity method.

Calculate the consolidated retained earnings for Paper Co.as at December 31,20X6 and 20X7.