Exam 16: Current Liabilities Management

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

________ are liabilities for services received for which payment has yet to be made. The most common accounts are taxes and wages.

(Multiple Choice)

4.9/5  (31)

(31)

Seasonal build-ups of inventory and receivables are generally financed with

(Multiple Choice)

4.7/5  (39)

(39)

Under the floating inventory lien, the borrower is free to sell the merchandise and is expected to remit the amount lent against each item, along with accrued interest, to the lender immediately after the sale. The lender then releases the lien on the appropriate item.

(True/False)

4.8/5  (40)

(40)

A firm is offered credit terms of 2/10 net 45 by most of its suppliers but frequently does not have the cash available to take the discount. The firm has a credit line available at a local bank at an interest rate of 12 percent. The firm should

(Multiple Choice)

4.7/5  (35)

(35)

Aunt Tilly's Feeds, Inc. is considering obtaining funding through advances against receivables. Total annual credit sales are $600,000, terms are net 30 days, and payment is made on the average of 30 days. Western National Bank will advance funds under a pledging arrangement for 13 percent annual interest. On average, 75 percent of credit sales will be accepted as collateral. Commodity Finance offers factoring on a nonrecourse basis for a 1 percent factoring commission, charging 1.5 percent per month on advances and requiring a 15 percent factor's reserve. Under this plan, the firm would factor all accounts and close its credit and collections department, saving $10,000 per year.

(a) What is the effective interest rate and the average amount of funds available under pledging and under factoring?

(b) Which plan do you recommend? Why?

(Essay)

4.8/5  (35)

(35)

A short-term self-liquidating loan is a secured short-term loan in which the use to which the borrowed money is put provides the mechanism through which the loan is repaid.

(True/False)

4.7/5  (35)

(35)

Accruals are liabilities for services received for which payment has yet to be made.

(True/False)

4.9/5  (35)

(35)

In pledging accounts receivable, the percentage advanced against the adjusted collateral is determined by the borrower based on its overall evaluation of the quality of the acceptable receivables and the expected cost of their liquidation.

(True/False)

4.7/5  (36)

(36)

A firm should take the cash discount if the firm's cost of borrowing from the bank is greater than the cost of giving up a cash discount.

(True/False)

4.9/5  (36)

(36)

Self-liquidating loans are mainly invested in productive assets (i.e., fixed assets) which provide the mechanism through which the loan is repaid.

(True/False)

5.0/5  (44)

(44)

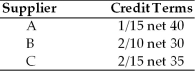

Ashley's Delivery Service is analyzing the credit terms of each of three suppliers, A, B, and C.  (a) Determine the approximate cost of giving up the cash discount.

(b) Assuming the firm needs short-term financing, recommend whether or not the firm should give up the cash discount or borrow from the bank at 10 percent annual interest. Evaluate each supplier separately.

(a) Determine the approximate cost of giving up the cash discount.

(b) Assuming the firm needs short-term financing, recommend whether or not the firm should give up the cash discount or borrow from the bank at 10 percent annual interest. Evaluate each supplier separately.

(Essay)

4.8/5  (29)

(29)

The risk to a U.S. importer with foreign-currency-denominated accounts payable is that the dollar will depreciate.

(True/False)

4.8/5  (35)

(35)

The cost of giving up a cash discount is the implied rate of interest paid in order to delay payment of an account payable for an additional number of days.

(True/False)

5.0/5  (34)

(34)

Self-liquidating loans are intended merely to carry the firm through seasonal peaks in financing needs, mainly buildups of accounts receivable and inventory.

(True/False)

4.9/5  (39)

(39)

Lines of credit are non-guaranteed loans that specify the maximum amount that a firm can owe the bank at any point in time.

(True/False)

4.8/5  (30)

(30)

A firm arranged for a 120-day bank loan at an annual rate of interest of 10 percent. If the loan is for $100,000, how much interest in dollars will the firm pay? (Assume a 360-day year.)

(Multiple Choice)

4.8/5  (30)

(30)

Loans on which the interest is paid in advance are often called

(Multiple Choice)

4.9/5  (27)

(27)

Nonrecourse basis is the basis on which accounts receivable are sold to a factor with the understanding that the factor accepts all credit risks on the purchased accounts.

(True/False)

4.9/5  (35)

(35)

Showing 121 - 140 of 171

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)