Exam 15: Working Capital and Current Assets Management

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

Short-term instruments issued by the Federal Home Loan Bank, the Federal National Mortgage Association, and the Federal Land Bank are examples of

(Multiple Choice)

5.0/5  (34)

(34)

The philosophy of the ________ is that the firm would have only work-in-process inventory.

(Multiple Choice)

4.9/5  (38)

(38)

Inventory insurance costs are an example of ________ costs.

(Multiple Choice)

4.8/5  (42)

(42)

One of the key inputs to the final credit decision is the credit analyst's subjective judgment of a firm's creditworthiness since it can provide a better feel of a firm's operation than any quantitative figures.

(True/False)

4.9/5  (28)

(28)

Commercial paper is a short-term loan issued by commercial banks that have variable yields based on size, maturity, and prevailing money market conditions.

(True/False)

4.8/5  (29)

(29)

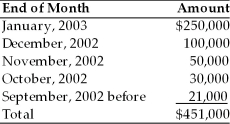

Ashley's Ad Agency's accounts receivable totaled $451,000 on January 30, 2003. An aging summary of receivables at this date follows:  The firm extends 30-day credit terms to all its credit customers.

(a) Prepare an aging schedule for Ashley's Ad Agency.

(b) Evaluate the firm's collection performance.

The firm extends 30-day credit terms to all its credit customers.

(a) Prepare an aging schedule for Ashley's Ad Agency.

(b) Evaluate the firm's collection performance.

(Essay)

4.8/5  (35)

(35)

The cash conversion cycle is the difference between the number of days resources are tied up in the operating cycle and the average number of days the firm can delay making payment on the production inputs purchased on credit.

(True/False)

4.8/5  (31)

(31)

As the ratio of current assets to total assets increases, the firm's risk increases.

(True/False)

4.7/5  (27)

(27)

________ is a procedure resulting in a number reflecting the applicant's credit strength, derived as a weighted average of the scores obtained on a variety of key financial and credit characteristics.

(Multiple Choice)

4.9/5  (39)

(39)

Nongovernmental issues typically have slightly higher yields than government issues with similar maturities due to the slightly ________ associated with them.

(Multiple Choice)

4.8/5  (41)

(41)

The ________ is the time period that elapses from the point when the firm sells a finished good on account to the point when the receivable is collected.

(Multiple Choice)

4.8/5  (42)

(42)

Because firms are unable to match cash inflows to outflows with certainty, most of them need current liabilities that more than cover outflows for current assets.

(True/False)

4.8/5  (33)

(33)

Most federal agency issues have short maturities and offer slightly higher yields than U.S. Treasury issues having similar maturities.

(True/False)

4.8/5  (33)

(33)

The cost of marginal bad debts is found by multiplying the firm's opportunity cost by the difference between the level of bad debts before and after the relaxation of credit standards.

(True/False)

4.9/5  (42)

(42)

The effect of a decrease in the ratio of current assets to total assets and the effect of an increase in the ratio of current liabilities to total assets are increases in the firm's profits and, correspondingly, its risk.

(True/False)

5.0/5  (36)

(36)

________ float results from the delay between the time when a customer deducts a payment from the checking account ledger and the time when the vendor actually receives the funds in a spendable form.

(Multiple Choice)

4.7/5  (30)

(30)

The principal nongovernmental marketable securities are all of the following EXCEPT

(Multiple Choice)

4.7/5  (27)

(27)

Showing 121 - 140 of 340

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)