Exam 15: Working Capital and Current Assets Management

Exam 1: The Role of Managerial Finance133 Questions

Exam 2: The Financial Market Environment91 Questions

Exam 3: Financial Statements and Ratio Analysis209 Questions

Exam 4: Cash Flow and Financial Planning183 Questions

Exam 5: Time Value of Money173 Questions

Exam 6: Interest Rates and Bond Valuation224 Questions

Exam 7: Stock Valuation188 Questions

Exam 8: Risk and Return190 Questions

Exam 9: The Cost of Capital137 Questions

Exam 10: Capital Budgeting Techniques167 Questions

Exam 11: Capital Budgeting Cash Flows117 Questions

Exam 12: Risk and Refinements in Capital Budgeting106 Questions

Exam 13: Leverage and Capital Structure217 Questions

Exam 14: Payout Policy130 Questions

Exam 15: Working Capital and Current Assets Management340 Questions

Exam 16: Current Liabilities Management171 Questions

Exam 17: Hybrid and Derivative Securities185 Questions

Exam 18: Mergers, Lbos, Divestitures, and Business Failure191 Questions

Exam 19: International Managerial Finance108 Questions

Select questions type

Too much investment in current assets reduces firm profitability, whereas too little investment in current assets increases the risk of not being able to pay debts as they come due.

(True/False)

4.8/5  (33)

(33)

The average investment in accounts receivable is equal to the firm's total variable cost of annual sales divided by its average collection period.

(True/False)

4.9/5  (28)

(28)

The firm's credit selection procedures must be established on a sound economic basis that considers the costs of investigating the creditworthiness of a customer and the expected size of its credit purchases.

(True/False)

4.8/5  (32)

(32)

The ________ is an inventory management technique that minimizes inventory investment by having materials inputs arrive at exactly the time they are needed for production.

(Multiple Choice)

5.0/5  (39)

(39)

Treasury notes are obligations of the U.S. Treasury that are issued weekly on an auction basis and have common maturities of 91 and 182 days. Due to the existence of a strong secondary market, these notes are quite attractive marketable security investments.

(True/False)

4.9/5  (36)

(36)

The ________ financing strategy requires the firm to pay interest on excess funds borrowed but not needed throughout the entire year.

(Multiple Choice)

4.7/5  (36)

(36)

An increase in the current liabilities to total assets ratio has the effects of ________ on profits and ________ on risk.

(Multiple Choice)

4.8/5  (40)

(40)

In the ABC system of inventory management, the red-line method or system could be utilized to control C items.

(True/False)

4.8/5  (25)

(25)

Disbursement float has all of the following basic components EXCEPT

(Multiple Choice)

4.8/5  (31)

(31)

When a firm's cash conversion cycle is negative, the firm should benefit by being able to use the financing provided by the suppliers of its production inputs to help support aspects of the business other than just the operating cycle.

(True/False)

4.8/5  (30)

(30)

Nellie's Finery

Credit Scoring Policy

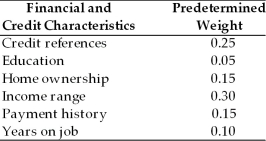

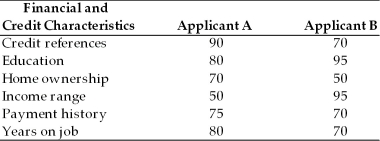

Jia's Jewelry uses the credit scoring technique to evaluate retail applications. The financial and credit characteristics considered and weights indicating their relative importance in the credit decision are shown above. The firm's credit standards are to accept all applicants with credit scores of 85 or more, to extend limited credit to applicants with scores ranging from 75 to 84, and to reject all applicants below 75. The firm is currently processing two applicants. The scores of each applicant on each of the financial and credit characteristics are summarized above. Would you recommend either of these applicants for credit extension?

Jia's Jewelry uses the credit scoring technique to evaluate retail applications. The financial and credit characteristics considered and weights indicating their relative importance in the credit decision are shown above. The firm's credit standards are to accept all applicants with credit scores of 85 or more, to extend limited credit to applicants with scores ranging from 75 to 84, and to reject all applicants below 75. The firm is currently processing two applicants. The scores of each applicant on each of the financial and credit characteristics are summarized above. Would you recommend either of these applicants for credit extension?

(Essay)

4.9/5  (39)

(39)

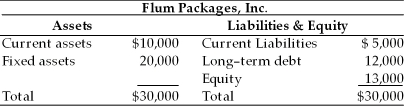

Table 15.2  The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

-If the firm was to shift $3,000 of current assets to fixed assets, the firm's net working capital would ________, the annual profits on total assets would ________, and the risk of technical insolvency would ________, respectively. (See Table 15.2)

The company earns 5 percent on current assets and 15 percent on fixed assets. The firm's current liabilities cost 7 percent to maintain and the average annual cost of long-term funds is 20 percent.

-If the firm was to shift $3,000 of current assets to fixed assets, the firm's net working capital would ________, the annual profits on total assets would ________, and the risk of technical insolvency would ________, respectively. (See Table 15.2)

(Multiple Choice)

4.8/5  (29)

(29)

If the cash discount period is increased, the firm's investment in accounts receivable due to discount takers still getting cash discounts but paying later is expected to increase.

(True/False)

4.9/5  (37)

(37)

The cash conversion cycle is the amount of time that elapses from the point when the firm inputs materials and labor into the production process to the point when cash is collected from the sale of the resulting finished product.

(True/False)

4.7/5  (32)

(32)

The increase in bad debts associated with tightening credit standards raises bad debt expenses and has a negative impact on profits.

(True/False)

4.7/5  (36)

(36)

All of the following securities are government issues EXCEPT

(Multiple Choice)

4.9/5  (33)

(33)

The goal of short-term financial management is to manage each of the firm's current assets and current liabilities in order to achieve a balance between profitability and risk that contributes to the firm's value.

(True/False)

4.9/5  (32)

(32)

Table 15.7

Dizzy Animators, Inc. currently makes all sales on credit and offers no cash discount. The firm is considering a 3 percent cash discount for payment within 10 days. The firm's current average collection period is 90 days, sales are 400 films per year, selling price is $25,000 per film, variable cost per film is $18,750 per film, and the average cost per film is $21,000. The firm expects that the change in credit terms will result in a minor increase in sales of 10 films per year, that 75 percent of the sales will take the discount, and the average collection period will drop to 30 days. The firm's bad debt expense is expected to become negligible under the proposed plan. The bad debt expense is currently 0.5 percent of sales. The firm's required return on equal-risk investments is 20 percent.

-What are the savings of marginal bad debts under the proposed plan? (See Table 15.7)

(Multiple Choice)

4.7/5  (25)

(25)

Showing 261 - 280 of 340

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)