Exam 12: Flexible Budgets and Variance Analysis

Exam 1: Management Accounting and Management Decisions90 Questions

Exam 2: Cost Behaviour and Cost-Volume Relationships96 Questions

Exam 3: Measurement of Cost Behaviour97 Questions

Exam 4: Cost Management Systems134 Questions

Exam 5: Cost Allocation and Activity-Based Costing Systems128 Questions

Exam 6: Job-Costing Systems88 Questions

Exam 7: Process-Costing Systems82 Questions

Exam 8: Relevant Information and Decision Making: Marketing Decisions100 Questions

Exam 9: Relevant Information and Decision Making: Production Decisions111 Questions

Exam 10: Capital Budgeting Decisions116 Questions

Exam 11: The Master Budget112 Questions

Exam 12: Flexible Budgets and Variance Analysis106 Questions

Exam 13: Management Control Systems, the Balanced Scorecard, and Responsibility Accounting94 Questions

Exam 14: Management Control in Decentralized Organizations103 Questions

Select questions type

The only way to account for standard cost variances is to adjust income in the current period.

(True/False)

4.9/5  (38)

(38)

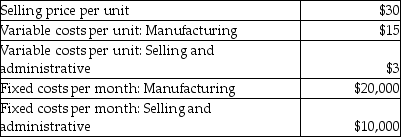

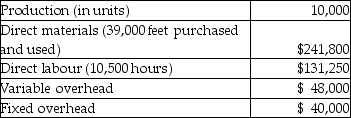

Harrison Company had the following information:

-What are the total manufacturing costs for 10,000 units?

-What are the total manufacturing costs for 10,000 units?

(Multiple Choice)

4.8/5  (34)

(34)

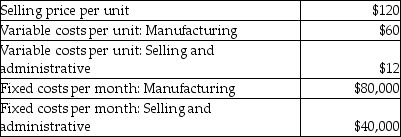

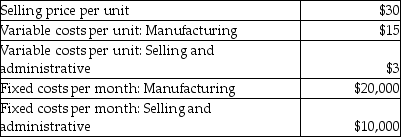

Woodlund Company had the following information:

-What is the net income for 15,000 units?

-What is the net income for 15,000 units?

(Multiple Choice)

4.8/5  (31)

(31)

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

-What is the cost function?

(Multiple Choice)

4.8/5  (37)

(37)

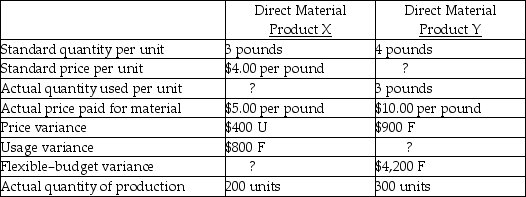

The following data apply to Walker Corporation for the year 20X4.

-For product X, the actual quantity used per unit was

-For product X, the actual quantity used per unit was

(Multiple Choice)

4.8/5  (30)

(30)

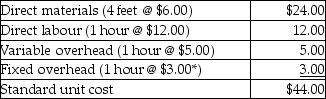

Use the following information to answer the next question(s):

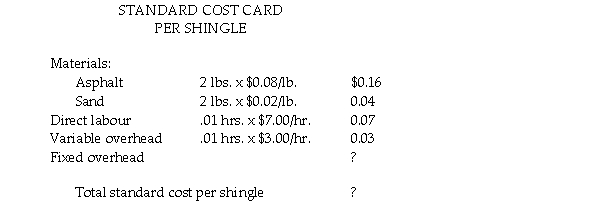

The standard cost sheet for one of the Vitton Company's products is presented below.

*Rate based on expected activity of 12,000 hours

The following results for last year were recorded.

*Rate based on expected activity of 12,000 hours

The following results for last year were recorded.

-The fixed overhead volume variance is

-The fixed overhead volume variance is

(Multiple Choice)

4.9/5  (32)

(32)

If actual revenues and expenses exceed expected revenues and expenses, all variances in the performance report will be favourable.

(True/False)

4.9/5  (44)

(44)

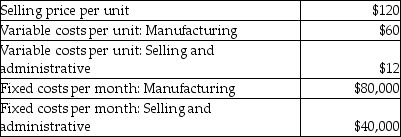

Woodlund Company had the following information:

-What are the total manufacturing costs for 10,000 units?

-What are the total manufacturing costs for 10,000 units?

(Multiple Choice)

4.7/5  (43)

(43)

Harrison Company had the following information:

-What is the net income for 15,000 units?

-What is the net income for 15,000 units?

(Multiple Choice)

4.8/5  (40)

(40)

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

-A favourable sales-activity variance means that

(Multiple Choice)

4.9/5  (33)

(33)

Washington, Inc. has budgeted fixed factory overhead costs at $150,000 per month and variable factory overhead at a rate of $6 per direct-labour hour. The standard direct-labour hours allowed for January production were 18,000. An analysis of the factory overhead indicates that during January there was an unfavourable flexible budget variance of $5,000 and a favourable production volume variance of $3,000.

Required:

a. Compute the actual factory overhead cost for January.

b. Calculate the applied overhead cost for January.

(Essay)

4.9/5  (35)

(35)

In a flexible budget, the fixed costs will remain constant regardless of different levels of activity shown in the budget.

(True/False)

4.9/5  (34)

(34)

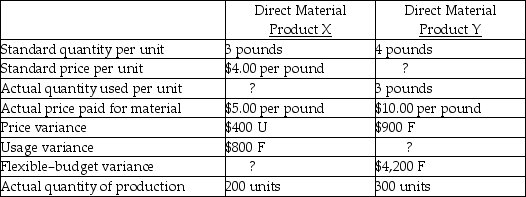

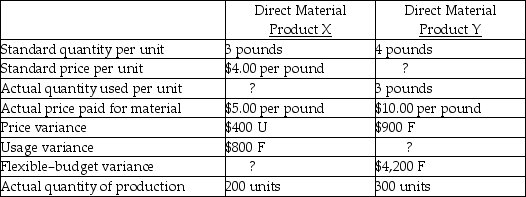

The following data apply to Walker Corporation for the year 20X4.

-When actual volume is less than expected volume, the fixed overhead volume variance is

-When actual volume is less than expected volume, the fixed overhead volume variance is

(Multiple Choice)

4.9/5  (36)

(36)

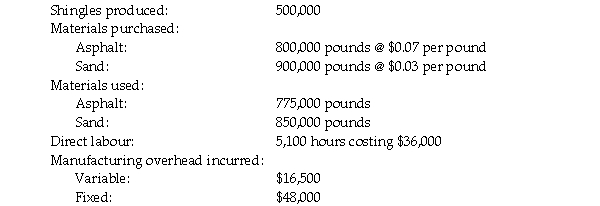

The Garson Company manufactures roofing shingles. The production process involves heating and compressing asphalt into sheets and then rolling coarse sand into the hot asphalt. The sheets are then cooled, cut into shingles, and packaged.

The following standard costs were developed:  The following information is available regarding the company's operations for the period.

The following information is available regarding the company's operations for the period.  Budgeted fixed manufacturing overhead for the period is $60,000 and the standard fixed overhead rate is based on expected capacity of 6,000 direct labour hours.

a. Calculate the standard fixed manufacturing overhead rate.

b. Complete the standard cost card for roofing shingles.

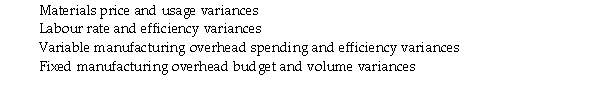

c. Calculate the following variances:

Budgeted fixed manufacturing overhead for the period is $60,000 and the standard fixed overhead rate is based on expected capacity of 6,000 direct labour hours.

a. Calculate the standard fixed manufacturing overhead rate.

b. Complete the standard cost card for roofing shingles.

c. Calculate the following variances:

(Essay)

4.8/5  (38)

(38)

The total traceable costs of the account billing activity centre is $245,000. Cost behaviour analysis indicates that fixed costs are $75,000. Activity analysis indicates that the cost driver for account billing activity is the number of lines printed, and the total lines printed is 2,500,000.

-Flexible-budget variances are designed to measure

(Multiple Choice)

4.9/5  (33)

(33)

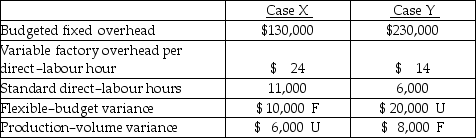

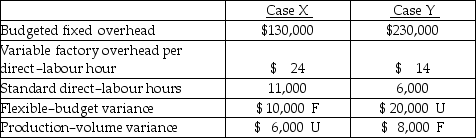

A company had the following information pertaining to two different cases:

-Actual factory overhead cost in Case X was

-Actual factory overhead cost in Case X was

(Multiple Choice)

4.9/5  (40)

(40)

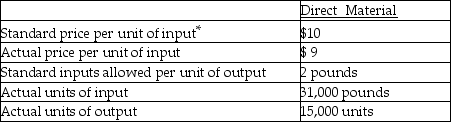

The following information is for Doran Corporation:

*Direct material is measured in pounds

-The usage variance for direct material is

*Direct material is measured in pounds

-The usage variance for direct material is

(Multiple Choice)

4.9/5  (31)

(31)

The following data apply to Walker Corporation for the year 20X4.

-Which costing methods generate fixed overhead volume variances?

-Which costing methods generate fixed overhead volume variances?

(Multiple Choice)

5.0/5  (37)

(37)

A company had the following information pertaining to two different cases:

-The applied factory overhead cost in Case X was

-The applied factory overhead cost in Case X was

(Multiple Choice)

4.8/5  (24)

(24)

The difference between the actual overhead incurred and the overhead applied.

(Short Answer)

4.8/5  (39)

(39)

Showing 61 - 80 of 106

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)