Exam 5: Cost Allocation and Activity-Based Costing Systems

Exam 1: Management Accounting and Management Decisions90 Questions

Exam 2: Cost Behaviour and Cost-Volume Relationships96 Questions

Exam 3: Measurement of Cost Behaviour97 Questions

Exam 4: Cost Management Systems134 Questions

Exam 5: Cost Allocation and Activity-Based Costing Systems128 Questions

Exam 6: Job-Costing Systems88 Questions

Exam 7: Process-Costing Systems82 Questions

Exam 8: Relevant Information and Decision Making: Marketing Decisions100 Questions

Exam 9: Relevant Information and Decision Making: Production Decisions111 Questions

Exam 10: Capital Budgeting Decisions116 Questions

Exam 11: The Master Budget112 Questions

Exam 12: Flexible Budgets and Variance Analysis106 Questions

Exam 13: Management Control Systems, the Balanced Scorecard, and Responsibility Accounting94 Questions

Exam 14: Management Control in Decentralized Organizations103 Questions

Select questions type

One of the main objectives of cost allocation is to value inventory.

Free

(True/False)

4.9/5  (40)

(40)

Correct Answer:

True

To allocate central costs, a company could use all of the following cost drivers EXCEPT the

Free

(Multiple Choice)

4.8/5  (27)

(27)

Correct Answer:

D

The cost pool should be a quantifiable measure of what causes costs.

Free

(True/False)

4.8/5  (30)

(30)

Correct Answer:

False

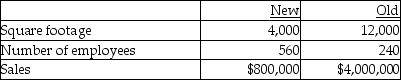

Stohr Company has two departments, New and Old. Central costs are allocated to the two departments in various ways. Relevant information is presented below:

-If total rent expense is $192,000 and it is allocated on the basis of square footage, the amount allocated to the Old Department should be

-If total rent expense is $192,000 and it is allocated on the basis of square footage, the amount allocated to the Old Department should be

(Multiple Choice)

4.8/5  (44)

(44)

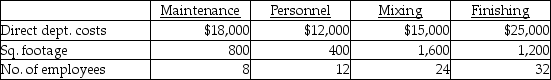

City Company has two service departments, Maintenance and Personnel, as well as two production departments, Mixing and Finishing. Maintenance costs are allocated based on square footage while personnel costs are allocated based on number of employees. The following information has been gathered for the current year:

-If the step-down method of allocating costs is used, and the Personnel Department renders the greatest service, then the total amount of overhead that would be allocated from Maintenance to Finishing is

-If the step-down method of allocating costs is used, and the Personnel Department renders the greatest service, then the total amount of overhead that would be allocated from Maintenance to Finishing is

(Multiple Choice)

4.8/5  (37)

(37)

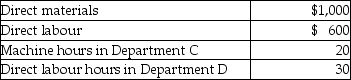

Estimates relating to a job that Meesen Inc. plans to bid on are as follows:  The estimate for the cost of the job would be

The estimate for the cost of the job would be

(Multiple Choice)

4.7/5  (38)

(38)

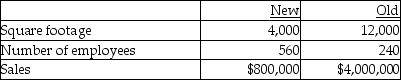

Stohr Company has two departments, New and Old. Central costs are allocated to the two departments in various ways. Relevant information is presented below:

-If total payroll processing costs are $40,000 and they are allocated on the basis of number of employees, the amount allocated to the Old Department should be

-If total payroll processing costs are $40,000 and they are allocated on the basis of number of employees, the amount allocated to the Old Department should be

(Multiple Choice)

4.7/5  (39)

(39)

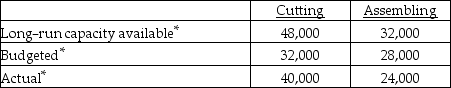

Stumbo Company has two production departments, Cutting and Assembling, served by one maintenance department. Budgeted fixed costs for the maintenance department for 20X3 were $60,000, and the variable cost per labour hour was $2.00. Other relevant data for 20X3 are as follows:

Actual maintenance department costs for 20X3 were $64,000 fixed and $120,000 variable.

*in labour hours

-The amount of variable maintenance costs allocated to the Assembling Department should be

Actual maintenance department costs for 20X3 were $64,000 fixed and $120,000 variable.

*in labour hours

-The amount of variable maintenance costs allocated to the Assembling Department should be

(Multiple Choice)

4.9/5  (34)

(34)

Which of the following statements regarding by-products is FALSE?

(Multiple Choice)

4.7/5  (42)

(42)

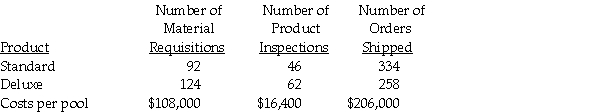

Berlau Corp. manufactures two models of its curling iron, a standard and a deluxe model. Three activities have been identified as cost drivers and the related costs pooled together to arrive at the following information:  Required: Assuming activity-based costing is used, allocate each cost pool to each model.

Required: Assuming activity-based costing is used, allocate each cost pool to each model.

(Essay)

4.9/5  (37)

(37)

Dorpinghaus Corp. manufactures two models of its telephones, a standard and a deluxe model. Three activities have been identified as cost drivers and the related costs pooled together to arrive at the following information:

-If activity-based costing is used, then the total amount of overhead allocated to the deluxe model would be

-If activity-based costing is used, then the total amount of overhead allocated to the deluxe model would be

(Multiple Choice)

4.9/5  (37)

(37)

A unit within an organization that provides essential support services for producing departments.

(Short Answer)

4.8/5  (38)

(38)

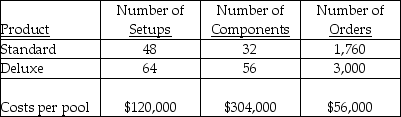

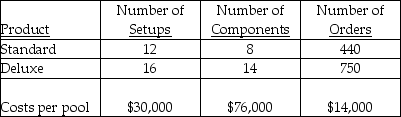

Stanley Corp. manufactures two models of its roasting pans, a standard and a deluxe model. Three activities have been identified as cost drivers and the related costs pooled together to arrive at the following information:

-If activity-based costing is used, then the product setup cost for the standard model would be

-If activity-based costing is used, then the product setup cost for the standard model would be

(Multiple Choice)

4.9/5  (41)

(41)

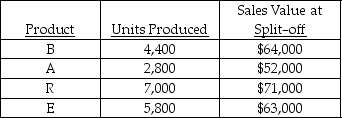

Bare Company manufactures four products from a joint process. Joint costs for the year amounted to $140,000. The following data are also available:

-Assuming the relative-sales-value method of allocating joint costs, the amount of joint costs allocated to product E would be

-Assuming the relative-sales-value method of allocating joint costs, the amount of joint costs allocated to product E would be

(Multiple Choice)

4.9/5  (43)

(43)

In activity-based costing, costs are classified as either direct or indirect.

(True/False)

4.9/5  (35)

(35)

A group of individual costs that is allocated to cost objectives using a single cost driver is known as a

(Multiple Choice)

4.9/5  (34)

(34)

Actual costs should always be used when allocating service department costs.

(True/False)

4.9/5  (39)

(39)

The goal of a cost accounting system is to measure the cost of developing, producing, selling and distributing particular products or services.

(True/False)

4.8/5  (34)

(34)

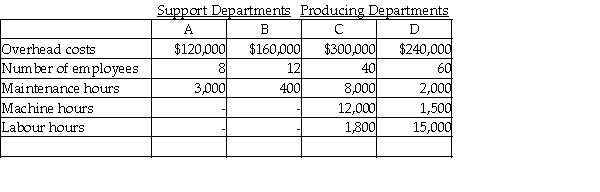

Use the following information to answer item(s) below.

Meesen Inc. operates two support departments (A and B) and two producing departments (C and D). Budgeted costs and normal activity levels are given below.  The costs of Department A are allocated on the basis of number of employees, and the costs of Department B are allocated on the basis of maintenance hours.

-If Department D uses direct labour hours to allocate overhead to units of product, the overhead rate per direct labour hour for Department D would be

The costs of Department A are allocated on the basis of number of employees, and the costs of Department B are allocated on the basis of maintenance hours.

-If Department D uses direct labour hours to allocate overhead to units of product, the overhead rate per direct labour hour for Department D would be

(Multiple Choice)

4.7/5  (38)

(38)

Showing 1 - 20 of 128

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)