Exam 4: Financial Statement Analysis and Forecasting

Exam 1: An Introduction to Finance54 Questions

Exam 2: Business Corporatefinance74 Questions

Exam 3: Financial Statements53 Questions

Exam 4: Financial Statement Analysis and Forecasting93 Questions

Exam 5: Time Value of Money85 Questions

Exam 6: Bond Valuation and Interest Rates80 Questions

Exam 7: Equity Valuation103 Questions

Exam 8: Risk, return, and Portfolio Theory104 Questions

Exam 9: The Capital Asset Pricing Model Capm113 Questions

Exam 10: Market Efficiency49 Questions

Exam 11: Forwards,futures,and Swaps55 Questions

Exam 12: Options56 Questions

Exam 13: Capital Budgeting, risk Considerations, and Other Special Issues143 Questions

Exam 14: Cash Flow Estimation and Capital Budgeting Decisions124 Questions

Exam 15: Mergers and Acquisitions89 Questions

Exam 16: Leasing50 Questions

Exam 17: Investment Banking and Securities Law69 Questions

Exam 18: Debt Instruments52 Questions

Exam 19: Equity and Hybrid Instruments72 Questions

Exam 20: Cost of Capital64 Questions

Exam 21: Capital Structure Decisions81 Questions

Exam 22: Dividend Policy54 Questions

Exam 23: Working Capital Management: General Issues50 Questions

Exam 24: Working Capital Management: Current Assets and Current Liabilities80 Questions

Select questions type

Alberta High Skies Company has net income of $3 million.It issued 500,000 shares two years ago at an issue price of $20 per share,and the stock is now trading at $35 per share.What is Alberta High Skies' price-earnings ratio?

Free

(Multiple Choice)

4.9/5  (39)

(39)

Correct Answer:

C

Mr.B.Baggins has just computed the operating margin and the gross profit margin for Hoppit Company and has found that the operating margin is greater than the gross profit margin.Is this possible? Why or why not? Explain your reasoning.

Free

(Essay)

4.8/5  (40)

(40)

Correct Answer:

Gross profit margin = (Sales - Cost of goods sold)/ Sales

Operating margin = Net operating income / Sales

I would expect the gross profit margin to be greater than the operating margin as,usually,the net operating income is less than Sales - Cost of goods sold due to other fixed costs such as advertising and R&D.These costs are not included in the Cost of Goods Sold because,in the short run,they are not related to sales.

It is possible that Baggins' used EBITDA rather than NOI in his calculation.EBITDA would include investment income (i.e.,income from trade credit)and therefore could be greater than Sales - COGS.

Inventory turnover can be calculated as:

Free

(Multiple Choice)

4.8/5  (40)

(40)

Correct Answer:

A

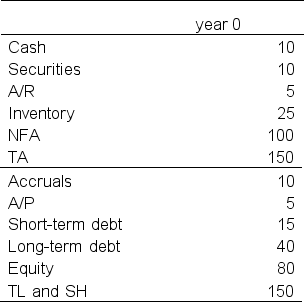

Company A's current sales are $120.The balance sheet is below.Suppose the sales growth rate is 10%.Short-term debt,long-term debt,and equity do not change.What is the external financing needed for next year?

(Multiple Choice)

4.8/5  (33)

(33)

On the balance sheet of last year,a company reports total assets of $8 million,common shares (book value)of $4 million,and retained earnings of $2 million.At the end of the current year,the net income was $ 1 million,and the whole amount was retained by the firm.Everything else (each of the aforementioned amounts other than retained earnings)was held constant.The debt-to-assets ratio at the end of the current year is:

(Multiple Choice)

4.9/5  (33)

(33)

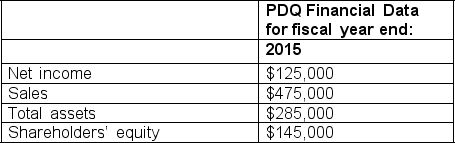

Igor the intern has obtained the following financial data for PDQ Corporation:

The return on equity for 2015 is:

The return on equity for 2015 is:

(Multiple Choice)

4.8/5  (32)

(32)

Which of the following people would be likely to calculate financial ratios for a company?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following ratios would be most useful for evaluating a firm's degree of leverage?

(Multiple Choice)

4.8/5  (38)

(38)

Igor the intern has obtained the following financial data for PDQ Corporation:

The turnover ratio for 2015 is:

The turnover ratio for 2015 is:

(Multiple Choice)

4.9/5  (44)

(44)

What is the difference between invested capital and spontaneous liabilities?

(Multiple Choice)

4.8/5  (39)

(39)

The following information has been obtained on Alberta Drilling Company for 2015.

The inventory turnover and average day's sales in inventory for Alberta Drilling Company are:

The inventory turnover and average day's sales in inventory for Alberta Drilling Company are:

(Multiple Choice)

4.9/5  (37)

(37)

Which of the following class(es)of ratios examines the ability of the firm to meet its short-term obligations?

(Multiple Choice)

4.9/5  (38)

(38)

Which of the following is not a step in the financial planning process?

(Multiple Choice)

4.8/5  (33)

(33)

The International Financial Reporting Standards apply to Canadian public companies.How does that affect comparability of financial statements across countries?

(Multiple Choice)

4.8/5  (31)

(31)

Showing 1 - 20 of 93

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)