Exam 9: The Capital Asset Pricing Model Capm

Exam 1: An Introduction to Finance54 Questions

Exam 2: Business Corporatefinance74 Questions

Exam 3: Financial Statements53 Questions

Exam 4: Financial Statement Analysis and Forecasting93 Questions

Exam 5: Time Value of Money85 Questions

Exam 6: Bond Valuation and Interest Rates80 Questions

Exam 7: Equity Valuation103 Questions

Exam 8: Risk, return, and Portfolio Theory104 Questions

Exam 9: The Capital Asset Pricing Model Capm113 Questions

Exam 10: Market Efficiency49 Questions

Exam 11: Forwards,futures,and Swaps55 Questions

Exam 12: Options56 Questions

Exam 13: Capital Budgeting, risk Considerations, and Other Special Issues143 Questions

Exam 14: Cash Flow Estimation and Capital Budgeting Decisions124 Questions

Exam 15: Mergers and Acquisitions89 Questions

Exam 16: Leasing50 Questions

Exam 17: Investment Banking and Securities Law69 Questions

Exam 18: Debt Instruments52 Questions

Exam 19: Equity and Hybrid Instruments72 Questions

Exam 20: Cost of Capital64 Questions

Exam 21: Capital Structure Decisions81 Questions

Exam 22: Dividend Policy54 Questions

Exam 23: Working Capital Management: General Issues50 Questions

Exam 24: Working Capital Management: Current Assets and Current Liabilities80 Questions

Select questions type

The expected return on the market portfolio is 13 percent with a standard deviation of 16 percent.What are the expected return and standard deviation for a portfolio with 40 percent of the investment in the market portfolio borrowed at the risk-free rate of 5 percent?

Free

(Multiple Choice)

4.8/5  (47)

(47)

Correct Answer:

B

_____________ is a measure of the risk of a security that cannot be avoided through diversification.

Free

(Multiple Choice)

4.9/5  (26)

(26)

Correct Answer:

D

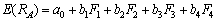

Suppose the returns on Security A are linearly related to four risk factors: F1,F2,F3,and F4.The required rate of return on Security A can be determined as follows:  .The risk-free rate is 4.5 percent.What is the required rate of return of Security A,where b1,b2,b3,and b4 are 0.4,0.8,0.6,and 0.7,respectively,and F1,F2,F3,and F4 are 5 percent,6 percent,10 percent,and 8 percent,respectively?

.The risk-free rate is 4.5 percent.What is the required rate of return of Security A,where b1,b2,b3,and b4 are 0.4,0.8,0.6,and 0.7,respectively,and F1,F2,F3,and F4 are 5 percent,6 percent,10 percent,and 8 percent,respectively?

Free

(Multiple Choice)

4.9/5  (42)

(42)

Correct Answer:

C

What is the expected return for a portfolio that has $2,500 invested in a risk-free asset with a 5 percent rate of return,and $7,500 invested in a risky asset with a 17 percent rate of return and a 28 percent standard deviation?

(Multiple Choice)

4.9/5  (29)

(29)

Assuming the CAPM is valid,_____________ securities lie _____________the security market line.

(Multiple Choice)

4.9/5  (38)

(38)

Stock A has a standard deviation of 20 percent and a correlation coefficient of 0.64 with market returns.The expected return of the market is 12 percent with a standard deviation of 15 percent.The risk-free rate is 5 percent.What is the beta of Stock A?

(Multiple Choice)

4.9/5  (30)

(30)

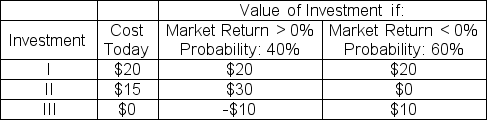

Which of the following investments would a risk-averse investor prefer if the risk-free rate is zero?

(Multiple Choice)

4.8/5  (36)

(36)

The expected return of Security A is 12 percent with a standard deviation of 15 percent.The expected return of Security B is 9 percent with a standard deviation of 10 percent.Securities A and B have a correlation of 0.4.The market return is 11 percent with a standard deviation of 13 percent and the risk-free rate is 4 percent.What is the Sharpe ratio of a portfolio if 35 percent of the portfolio is in Security A and the remainder in Security B?

(Multiple Choice)

4.9/5  (38)

(38)

In the above question,F1 F2, and F3 were reasonably accurate estimates based on previous analysis and F4 was not.Empirical data showed that the return on security A was actually 24.50%.What is a reasonable estimate for F4? (Assume reasonable values for n1,n2,n3,and n4)

(Multiple Choice)

4.9/5  (33)

(33)

The expected return of Security A is 12 percent with a standard deviation of 15 percent.The expected return of Security B is 9 percent with a standard deviation of 10 percent.Securities A and B have a correlation of 0.4.The market return is 11 percent with a standard deviation of 13 percent and the risk-free rate is 4 percent.Which one of the following is not an efficient portfolio,as determined by the lowest Sharpe ratio?

(Multiple Choice)

4.8/5  (44)

(44)

Which of the following is a FALSE statement about the Sharpe ratio?

(Multiple Choice)

4.8/5  (34)

(34)

Use the following three statements to answer this question:

(Multiple Choice)

4.8/5  (39)

(39)

The risk-free rate is 5.25 percent.The expected return on the market is 12 percent with a standard deviation of 18 percent.What is the standard deviation of an efficient portfolio with a 16 percent expected return?

(Multiple Choice)

4.8/5  (34)

(34)

What is the beta of a portfolio if 40 percent of the funds invested in the market portfolio are borrowed at the risk-free rate?

(Multiple Choice)

4.8/5  (31)

(31)

What is the expected return on an efficient portfolio with a standard deviation of 15 percent? Assume the risk-free rate is 6 percent and the expected return on the market portfolio is 14.8 percent with a standard deviation of 20 percent.

(Multiple Choice)

4.9/5  (28)

(28)

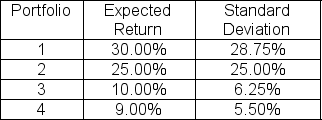

The expected return on the market is 15 percent with a standard deviation of 12.5 percent and the risk-free rate is 5 percent.Which of the following portfolios are correctly priced?

(Multiple Choice)

4.8/5  (44)

(44)

The market expected return is 14 percent with a standard deviation of 18 percent.The risk-free rate is 6 percent.Security XYZ has just paid a dividend of $1 and has a current price of $13.95.What is the beta of Security XYZ if its dividend is expected to grow at 6 percent per year indefinitely?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 1 - 20 of 113

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)