Exam 8: Risk, return, and Portfolio Theory

Exam 1: An Introduction to Finance54 Questions

Exam 2: Business Corporatefinance74 Questions

Exam 3: Financial Statements53 Questions

Exam 4: Financial Statement Analysis and Forecasting93 Questions

Exam 5: Time Value of Money85 Questions

Exam 6: Bond Valuation and Interest Rates80 Questions

Exam 7: Equity Valuation103 Questions

Exam 8: Risk, return, and Portfolio Theory104 Questions

Exam 9: The Capital Asset Pricing Model Capm113 Questions

Exam 10: Market Efficiency49 Questions

Exam 11: Forwards,futures,and Swaps55 Questions

Exam 12: Options56 Questions

Exam 13: Capital Budgeting, risk Considerations, and Other Special Issues143 Questions

Exam 14: Cash Flow Estimation and Capital Budgeting Decisions124 Questions

Exam 15: Mergers and Acquisitions89 Questions

Exam 16: Leasing50 Questions

Exam 17: Investment Banking and Securities Law69 Questions

Exam 18: Debt Instruments52 Questions

Exam 19: Equity and Hybrid Instruments72 Questions

Exam 20: Cost of Capital64 Questions

Exam 21: Capital Structure Decisions81 Questions

Exam 22: Dividend Policy54 Questions

Exam 23: Working Capital Management: General Issues50 Questions

Exam 24: Working Capital Management: Current Assets and Current Liabilities80 Questions

Select questions type

Which of the following statements is FALSE?

Free

(Multiple Choice)

4.7/5  (47)

(47)

Correct Answer:

D

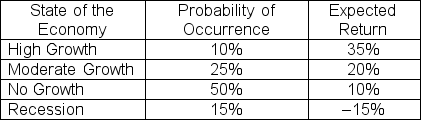

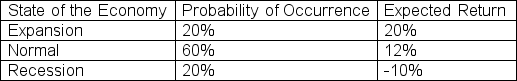

Given the information in the following table,what is the expected return of the security?

Free

(Multiple Choice)

4.8/5  (38)

(38)

Correct Answer:

A

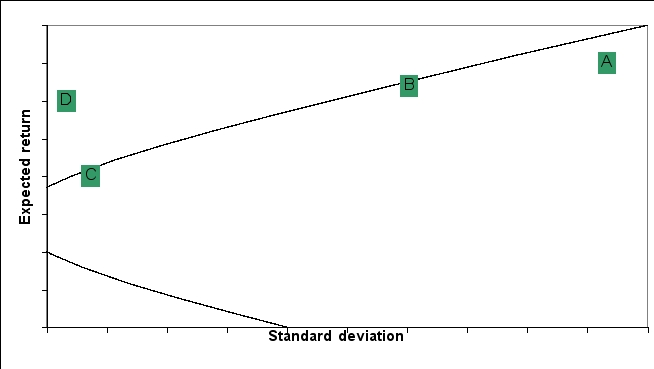

The standard deviation and expected returns for 4 portfolios (A,B,C,and D)are graphed on the following efficient frontier:  Which of the following portfolios (or combinations)are likely to be preferred by a risk-averse investor? Which of the following portfolios (or combinations)are likely to be preferred by a risk-loving investor? Explain your reasoning.

Which of the following portfolios (or combinations)are likely to be preferred by a risk-averse investor? Which of the following portfolios (or combinations)are likely to be preferred by a risk-loving investor? Explain your reasoning.

Free

(Essay)

4.8/5  (39)

(39)

Correct Answer:

Regardless of the risk-preferences of the investor,she will only be interested in portfolios B and C.A is inefficient and D is unattainable.

The risk-averse investor will tend to prefer less risk so is more likely to choose C; while the risk-loving investor is willing to take more risk to get more return so is more likely to choose B.

The income yield and capital gain yield of a stock are 4.90 percent and 7.37 percent,respectively.The stock paid a quarterly dividend of $0.65 per share during the year.What should the stock sell for today?

(Multiple Choice)

4.8/5  (49)

(49)

Indiana Jones intends to form a portfolio with two securities: Virtual and Real.Virtual has an expected return of 25 percent with a standard deviation of 5 percent.Real has an expected return of 12 percent with a standard deviation of 16 percent.The correlation between the two securities is 0.2.What is the portfolio standard deviation if the portfolio has an expected return of 20 percent?

(Multiple Choice)

4.8/5  (34)

(34)

Given the following forecasts,what is the expected return for a portfolio that has $2,200 invested in Stock X,$3,600 in Stock Y,and $4,200 invested in Stock Z?

(Multiple Choice)

4.8/5  (37)

(37)

In a two-security portfolio 25% of your money is invested in Security X and the remainder in Security Y.If the standard deviations of Securities X and Y are 22 % and 7 %,respectively,and the portfolio variance is 0.01155625,what is the correlation between the two securities?

(Multiple Choice)

4.8/5  (40)

(40)

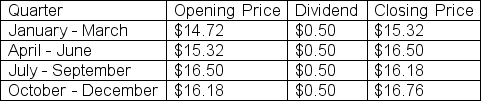

In question 18 above,what is the income yield (dividend yield)for the stock of Oedipus Construction Company?

(Multiple Choice)

4.7/5  (38)

(38)

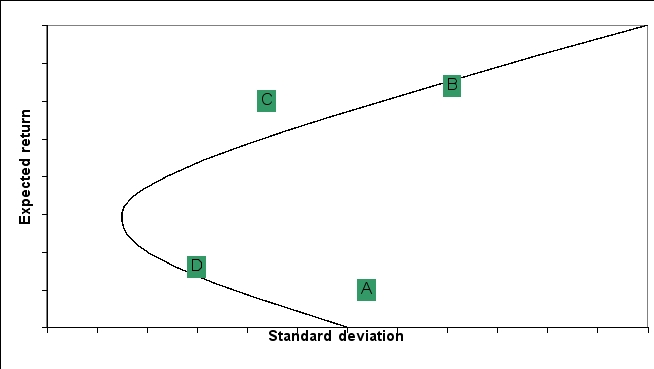

The standard deviation and expected returns for 4 portfolios (A,B,C,and D)are graphed on the following efficient frontier:  Which of the following portfolios are efficient?

Which of the following portfolios are efficient?

(Multiple Choice)

4.8/5  (31)

(31)

A stock selling for $12.00 today and expected to pay a $1.50 dividend and have a capital gain of 5% in one year will increase in price to sell at:

(Multiple Choice)

4.9/5  (34)

(34)

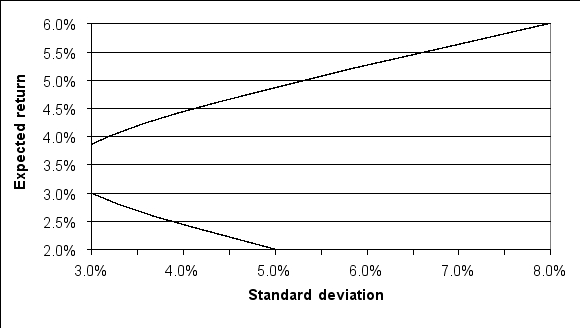

For the following efficient frontier,the standard deviation of the minimum variance portfolio is:

(Multiple Choice)

4.8/5  (35)

(35)

For the following efficient frontier,the expected return of the minimum variance portfolio is:

(Multiple Choice)

4.8/5  (42)

(42)

Suppose you are given the following forecasts for the economy and Sneezy Company at the beginning of the year:

During the year,you observed the following:

During the year,you observed the following:

A) Calculate the ex-ante expected return

B) Calculate the ex-ante standard deviation of returns

C) Calculate the ex-post average return

D) Calculate the ex-post standard deviation of returns

A) Calculate the ex-ante expected return

B) Calculate the ex-ante standard deviation of returns

C) Calculate the ex-post average return

D) Calculate the ex-post standard deviation of returns

(Essay)

4.8/5  (40)

(40)

No benefits of diversification with two stocks occur when  is:

is:

(Multiple Choice)

4.8/5  (41)

(41)

Define the term "risk" and explain how it is related to the expected return.

(Essay)

5.0/5  (37)

(37)

A portfolio consists of three securities: Treachery (T),Sleazy (S),and Felony (F).The expected returns for Treachery,Sleazy,and Felony are 10 percent,8 percent,and 16 percent,respectively.The standard deviation is 15 percent for Treachery,20 percent for Sleazy,and 25 percent for Felony.The covariance of the returns on the three securities is: COVTS = 0.0144,COVTF = 0.0084,and COVSF = 0.03.What is the portfolio standard deviation if 20 percent of the portfolio is in Treachery and 35 percent is in Sleazy?

(Multiple Choice)

4.9/5  (40)

(40)

Use the following three statements to answer this question:

(Multiple Choice)

5.0/5  (40)

(40)

Suppose you own a two-security portfolio.You have 35 percent of your money invested in Security X and the remainder in Security Y.The standard deviations of Securities X and Y are 10 percent and 15 percent,respectively.What is the correlation between the two securities if the portfolio variance is 0.013225?

(Multiple Choice)

4.7/5  (27)

(27)

Showing 1 - 20 of 104

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)