Exam 11: Short-Term Operating Assets: Inventory

Exam 1: The Financial Reporting Environment63 Questions

Exam 2: Financial Reporting Theory178 Questions

Exam 3: Judgment and Applied Financial Accounting Research127 Questions

Exam 4: Review of the Accounting Cycle154 Questions

Exam 5: Statements of Net Income and Comprehensive Net Income125 Questions

Exam 6: Statements of Financial Position and Cash Flows and the Annual Report158 Questions

Exam 7: Accounting and the Time Value of Money120 Questions

Exam 8: Revenue Recognition159 Questions

Exam 9: OL: Revenue Recognition110 Questions

Exam 10: Short-Term Operating Assets: Cash and Receivables125 Questions

Exam 11: Short-Term Operating Assets: Inventory134 Questions

Exam 12: Long-Term Operating Assets: Acquisition, cost Allocation, and Derecognition156 Questions

Exam 13: Long-Term Operating Assets: Departures From Historical Cost126 Questions

Exam 14: Operating Liabilities and Contingencies95 Questions

Exam 15: OL: Operating Liabilities and Contingencies12 Questions

Exam 16: Financing Liabilities167 Questions

Exam 17: Accounting for Stockholders Equity114 Questions

Exam 18: Investing Assets189 Questions

Exam 19: Accounting for Income Taxes121 Questions

Exam 20: Accounting for Employee Compensation and Benefits106 Questions

Exam 22: Accounting Corrections and Error Analysis394 Questions

Select questions type

The work-in-process inventory is found on the books of a merchandising concern.

(True/False)

4.8/5  (33)

(33)

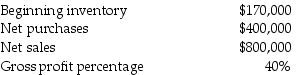

Lorna Company has the following data available:  The estimated cost of the ending inventory using the gross profit method is ________.

The estimated cost of the ending inventory using the gross profit method is ________.

(Multiple Choice)

4.8/5  (38)

(38)

Dombrose Company uses a perpetual inventory system.On January 1,inventory is $253,000.On April 5,Dombrose sells inventory with a selling price of $75,000 on account.The cost of the inventory sold is $50,000.The journal entry (entries)to record the sale is (are)________.

(Multiple Choice)

4.8/5  (35)

(35)

The total cost in dollars of ending inventory is equal to the number of units on hand multiplied by the cost per unit.

(True/False)

4.9/5  (43)

(43)

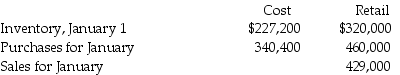

The Jensen Store has the following data for inventory:  The store uses the dollar-value LIFO retail method.The price index for the year is 1.08.The price index that pertains to the beginning inventory is 1.00.What is the retail value of the ending inventory at January 31?

The store uses the dollar-value LIFO retail method.The price index for the year is 1.08.The price index that pertains to the beginning inventory is 1.00.What is the retail value of the ending inventory at January 31?

(Multiple Choice)

5.0/5  (41)

(41)

The first-in,first-out inventory method assigns the most recent costs to the cost of goods sold.

(True/False)

4.8/5  (42)

(42)

On June 1,Atkinson Company purchased $5,000 of inventory on account from Donnie Company.Donnie Company offers a 3% discount if payment is received within 15 days.Atkinson Company records the purchase using the gross method and the perpetual inventory system.Atkinson Company makes the payment for the inventory on June 10.The journal entry on June 10 by Atkinson Company includes ________.

(Multiple Choice)

4.7/5  (32)

(32)

How do inventory disclosures following IFRS differ from those following U.S.GAAP?

(Multiple Choice)

4.7/5  (41)

(41)

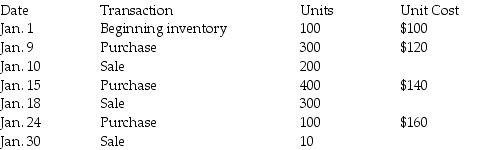

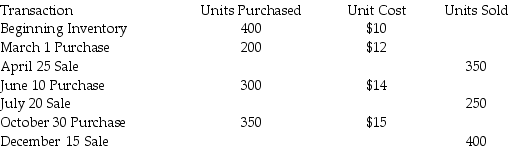

The Petrowski Company uses the perpetual inventory system.The Petrowski Company has the following data available for the month of January:

1.Determine the Cost of Goods Sold for January using the following methods:

a.FIFO

b.LIFO

c.Moving-average (Round per unit costs and all other dollar amounts to two decimal places.)

1.Determine the Cost of Goods Sold for January using the following methods:

a.FIFO

b.LIFO

c.Moving-average (Round per unit costs and all other dollar amounts to two decimal places.)

(Essay)

4.7/5  (46)

(46)

IFRS does not allow the LIFO inventory method because ________.

(Multiple Choice)

4.9/5  (43)

(43)

At December 31,the Postotnik Company has ending inventory with a historical cost of $630,000.Assume the company uses the perpetual inventory system.The current replacement cost of the inventory is $608,000.The net realizable value is $650,000.The normal profit on this inventory is $50,000.Before any adjustments at the end of the period,the cost of goods sold has a balance of $900,000.Following IFRS,which journal entry is required on December 31 to adjust the ending balance of inventory if the direct method is used?

(Multiple Choice)

4.9/5  (32)

(32)

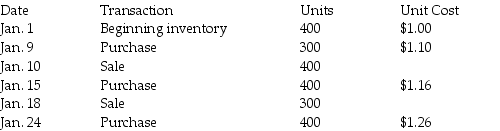

The Exclusive Company uses the perpetual inventory system.The Exclusive Company has the following data available for the month of January:  What is the cost of ending inventory on January 31 using LIFO?

What is the cost of ending inventory on January 31 using LIFO?

(Multiple Choice)

4.8/5  (32)

(32)

Firms using the periodic inventory system record purchases of inventory with a ________.

(Multiple Choice)

4.9/5  (36)

(36)

On August 10,Charles Company purchased 75 refrigerators for $650 each from Appliances Wholesalers.The purchase was on account with terms of 3/10,n/30.Charles Company paid for 50 of the refrigerators on August 18 and the remaining refrigerators on August 30.Charles Company uses the gross method for purchase discounts and the perpetual inventory system to record the transactions.On August 30,Charles Company recorded ________.

(Multiple Choice)

4.9/5  (34)

(34)

Following IFRS,which of the following statements is not correct?

(Multiple Choice)

4.9/5  (38)

(38)

Sampe Company has the following data available:  If Sampe Company uses a perpetual FIFO inventory system,the cost of goods sold for the year is ________.

If Sampe Company uses a perpetual FIFO inventory system,the cost of goods sold for the year is ________.

(Multiple Choice)

4.8/5  (37)

(37)

At December 31,the Selig Company has ending inventory with a historical cost of $630,000.Assume the company uses the perpetual inventory system.The current replacement cost of the inventory is $608,000.The net realizable value is $650,000.The normal profit on this inventory is $50,000.Before any adjustments at the end of the period,the cost of goods sold account has a balance of $900,000.Following U.S.GAAP,which journal entry is required on December 31 to adjust the ending balance of inventory if the direct method is used?

(Multiple Choice)

4.8/5  (40)

(40)

The LIFO reserve is disclosed in the footnotes to the financial statements.

(True/False)

4.9/5  (29)

(29)

Showing 21 - 40 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)