Exam 11: Short-Term Operating Assets: Inventory

Exam 1: The Financial Reporting Environment63 Questions

Exam 2: Financial Reporting Theory178 Questions

Exam 3: Judgment and Applied Financial Accounting Research127 Questions

Exam 4: Review of the Accounting Cycle154 Questions

Exam 5: Statements of Net Income and Comprehensive Net Income125 Questions

Exam 6: Statements of Financial Position and Cash Flows and the Annual Report158 Questions

Exam 7: Accounting and the Time Value of Money120 Questions

Exam 8: Revenue Recognition159 Questions

Exam 9: OL: Revenue Recognition110 Questions

Exam 10: Short-Term Operating Assets: Cash and Receivables125 Questions

Exam 11: Short-Term Operating Assets: Inventory134 Questions

Exam 12: Long-Term Operating Assets: Acquisition, cost Allocation, and Derecognition156 Questions

Exam 13: Long-Term Operating Assets: Departures From Historical Cost126 Questions

Exam 14: Operating Liabilities and Contingencies95 Questions

Exam 15: OL: Operating Liabilities and Contingencies12 Questions

Exam 16: Financing Liabilities167 Questions

Exam 17: Accounting for Stockholders Equity114 Questions

Exam 18: Investing Assets189 Questions

Exam 19: Accounting for Income Taxes121 Questions

Exam 20: Accounting for Employee Compensation and Benefits106 Questions

Exam 22: Accounting Corrections and Error Analysis394 Questions

Select questions type

Sweet Treats is considering a change in its inventory valuation method.Sweet Treats currently uses the FIFO method and is considering a change to the LIFO method.Sweet Treats started the year on January 1 with inventory at a FIFO cost of $31,000 and a LIFO cost of $26,500.The ending inventory on December 31 is $29,650 at FIFO cost and $25,800 at LIFO cost.Cost of goods sold under the LIFO basis is $74,600 for the current year.The LIFO effect is ________.

(Multiple Choice)

4.8/5  (31)

(31)

The gross profit method may not be used for budgeting purposes.

(True/False)

4.9/5  (46)

(46)

The balance in the LIFO reserve account is the difference between the beginning inventory and ending inventory measured using FIFO.

(True/False)

4.8/5  (29)

(29)

On June 1,Addison Company purchased $5,000 of inventory on account from Garrison Company.Garrison offers a 3% discount if payment is received within 15 days.Addison records the purchase using the gross method and the perpetual inventory system.The journal entry on June 1 by Addison Company includes ________.

(Multiple Choice)

4.8/5  (47)

(47)

When following U.S.GAAP,which of the following statements is not correct regarding the LCM rule for inventory?

(Multiple Choice)

4.8/5  (37)

(37)

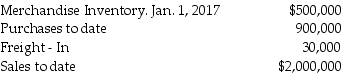

A fire destroyed the warehouse of Reed Enterprises,on August 31,2017.The books and records of Reed showed the following information on that date.  The gross profit ratio has averaged 40% of sales for the past six years.

Required:

Use the gross profit method to estimate the cost of inventory destroyed by fire.

The gross profit ratio has averaged 40% of sales for the past six years.

Required:

Use the gross profit method to estimate the cost of inventory destroyed by fire.

(Multiple Choice)

4.9/5  (42)

(42)

When following U.S.GAAP,the market value of inventory is always equal to the net realizable value.

(True/False)

4.8/5  (31)

(31)

When costs are increasing,and inventory levels are stable,a company will report ________.

(Multiple Choice)

4.7/5  (32)

(32)

On June 1,Johnson Company purchased $5,000 of inventory on account from Schmid Company on June 1.Schmid Company offers a 3% discount if payment is received within 15 days.Johnson Company records the purchase using the net method and the perpetual inventory system.Johnson Company paid for the inventory on June 30.The journal entry on June 30 by Johnson Company includes ________.

(Multiple Choice)

4.8/5  (27)

(27)

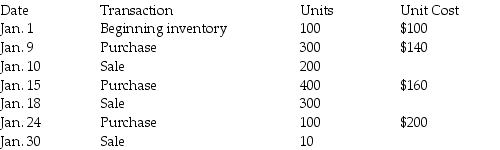

The Butters Company uses the FIFO perpetual inventory system.The company has the following data available for the month of January:

The selling price per unit is $1,000.Selling and administrative expenses for the month total $100,000.Interest expense for the month is $10,000.The tax rate is 30%.

Required:

Prepare the income statement for the month ending January 31,2015 using a multiple-step format.

The selling price per unit is $1,000.Selling and administrative expenses for the month total $100,000.Interest expense for the month is $10,000.The tax rate is 30%.

Required:

Prepare the income statement for the month ending January 31,2015 using a multiple-step format.

(Essay)

4.8/5  (38)

(38)

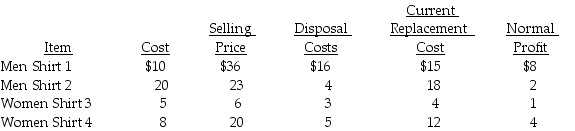

Hougton Company follows U.S.GAAP and has the following inventory data available:

The company has 1,000 shirts of each style in stock at year end.The company uses the indirect method to record the lower-of-cost-or-market rule.

Required:

1.a.Determine the value of inventory reported on the balance sheet at year end if the lower-of-cost-or-market rule is applied to each inventory item.

b.Prepare the journal entry required at year end.

2.a.Determine the value of inventory reported on the balance sheet at year end if the lower-of-cost-or-market rule is applied to the shirts as a group of items.Use gender to group the items.

b.Prepare the journal entry required at year end.

The company has 1,000 shirts of each style in stock at year end.The company uses the indirect method to record the lower-of-cost-or-market rule.

Required:

1.a.Determine the value of inventory reported on the balance sheet at year end if the lower-of-cost-or-market rule is applied to each inventory item.

b.Prepare the journal entry required at year end.

2.a.Determine the value of inventory reported on the balance sheet at year end if the lower-of-cost-or-market rule is applied to the shirts as a group of items.Use gender to group the items.

b.Prepare the journal entry required at year end.

(Essay)

4.8/5  (44)

(44)

Christian Company uses the gross method of recording purchase discounts on inventory and the perpetual inventory system.When Christian Company makes payment for the inventory within the discount period,the bookkeeper will ________.

(Multiple Choice)

5.0/5  (27)

(27)

When following U.S.GAAP,firms can use two methods to write down inventory to market,if needed.

Required:

1.What are the two methods called?

2.If there is a loss,describe the journal entry for both methods.

3.If there is a significant loss,which method is preferred? Why is this the case?

(Essay)

4.8/5  (37)

(37)

The inventory allocation method used for companies that maintain base stocks of inventory items is the ________.

(Multiple Choice)

4.8/5  (30)

(30)

The retail inventory method that estimates the lower-of-cost-or-market of ending inventory is the ________.

(Multiple Choice)

4.8/5  (34)

(34)

The first step in applying the gross profit method of determining inventory is to take a physical count of the goods.

(True/False)

4.9/5  (38)

(38)

If the LIFO Reserve increases during the year,Cost of Goods Sold will higher under LIFO than FIFO.

(True/False)

5.0/5  (38)

(38)

When following U.S.GAAP,the lower-of-cost-or-market rule for inventory requires a firm to report ________.

(Multiple Choice)

4.7/5  (34)

(34)

Basking Company adopted the dollar-value LIFO method in 2014.At December 31,2014,ending inventory was $100,000,with a price index of 1.00,using dollar-value LIFO.At December 31,2015,the ending inventory using FIFO is $120,000 and the price index is 1.15.Round all dollar amounts to the nearest dollar.Basking Company's ending inventory at December 31,2015 on a dollar-value LIFO basis is ________.

(Multiple Choice)

4.9/5  (35)

(35)

Showing 101 - 120 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)