Exam 11: Short-Term Operating Assets: Inventory

Exam 1: The Financial Reporting Environment63 Questions

Exam 2: Financial Reporting Theory178 Questions

Exam 3: Judgment and Applied Financial Accounting Research127 Questions

Exam 4: Review of the Accounting Cycle154 Questions

Exam 5: Statements of Net Income and Comprehensive Net Income125 Questions

Exam 6: Statements of Financial Position and Cash Flows and the Annual Report158 Questions

Exam 7: Accounting and the Time Value of Money120 Questions

Exam 8: Revenue Recognition159 Questions

Exam 9: OL: Revenue Recognition110 Questions

Exam 10: Short-Term Operating Assets: Cash and Receivables125 Questions

Exam 11: Short-Term Operating Assets: Inventory134 Questions

Exam 12: Long-Term Operating Assets: Acquisition, cost Allocation, and Derecognition156 Questions

Exam 13: Long-Term Operating Assets: Departures From Historical Cost126 Questions

Exam 14: Operating Liabilities and Contingencies95 Questions

Exam 15: OL: Operating Liabilities and Contingencies12 Questions

Exam 16: Financing Liabilities167 Questions

Exam 17: Accounting for Stockholders Equity114 Questions

Exam 18: Investing Assets189 Questions

Exam 19: Accounting for Income Taxes121 Questions

Exam 20: Accounting for Employee Compensation and Benefits106 Questions

Exam 22: Accounting Corrections and Error Analysis394 Questions

Select questions type

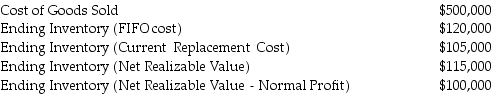

At the end of the year,Katerinos Company is applying the lower-of-cost-or-market rule to inventory.The company uses the perpetual inventory system.The company has the following data before year-end adjustments:

Required:

1.Following U.S.GAAP,prepare the required journal entry at year-end.The company uses the direct method when applying the lower-of-cost-or-market rule.

2.Following IFRS,prepare the required journal entry at year-end.The company uses the direct method when applying the lower-of-cost-or-market rule.

Required:

1.Following U.S.GAAP,prepare the required journal entry at year-end.The company uses the direct method when applying the lower-of-cost-or-market rule.

2.Following IFRS,prepare the required journal entry at year-end.The company uses the direct method when applying the lower-of-cost-or-market rule.

(Essay)

4.8/5  (46)

(46)

The Wysocki Company has undertaken a physical count of inventory on hand on December 31,2015.The cost of the inventory on hand is $445,993.

Additional information follows:

1.Wysocki Company received goods costing $32,000 on January 2,2016.The goods were shipped f.o.b.shipping point,and left the seller's business on December 30,2015.

2.Wysocki Company received goods costing $40,000 on January 3,2016.The goods were shipped f.o.b.destination,and left the seller's business on December 30,2015.

3.Wysocki Company sold goods costing $20,000 on December 29,2015.The goods were picked up by the common carrier on December 29 and shipped f.o.b.destination.The goods arrived on January 2,2016.The retail price of the goods was $30,000.

4.Wysocki Company sold goods costing $30,000 on December 31,2015.The goods were picked up by the common carrier on December 31 and shipped f.o.b.shipping point.The goods were not included in Wysocki's physical count at December 31,2015.The goods arrived on January 4,2016.The retail price of the goods was $60,000.Wysocki paid the shipping costs of $433 on December 31.

5.Wysocki Company was the consignee for some goods from Walmart.The goods cost Walmart $100,000 and had a retail price of $300,000.These goods were included in Wysocki's physical count on December 31,2015 at the retail price.

6.Wysocki Company had some goods on consignment at Walmart.The goods cost $50,000 and had a retail price of $100,000.These goods were not included in Wysocki's physical count at December 31,2015 because the goods were not on the company's premises.

7.Wysocki Company sold goods costing $22,000 on December 31,2015.The goods were not picked up by the common carrier until January 2,2016.The retail price of the goods was $42,000; the wholesale price was $33,000.The goods were included in the physical count at December 31,2015.The terms of the sale were f.o.b.shipping point.

Required:

1.For each item listed above,indicate the amount and sign of the adjustment to the inventory balance at December 31,2015.If no adjustment is required,for an item,enter 0.

2.Determine the correct amount of inventory for Wysocki Company at December 31,2015.

(Essay)

4.8/5  (43)

(43)

Following U.S.GAAP,required inventory disclosures in financial statements do not include ________.

(Multiple Choice)

4.8/5  (41)

(41)

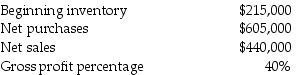

Jesse Company has the following data for January:  What is the company's estimated cost of goods sold for January using the gross profit method?

What is the company's estimated cost of goods sold for January using the gross profit method?

(Multiple Choice)

4.8/5  (33)

(33)

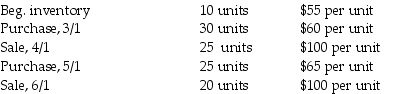

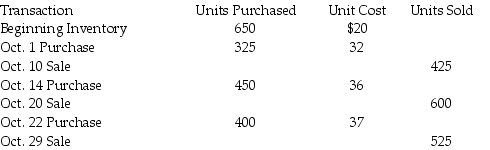

Carbondale Company had the following data available for the last six months:

Operating expenses are $2,000 per month.The income tax rate is 30%.

Required:

1.Compute Cost of Goods Sold for the six months ending June 30 using:

a.FIFO perpetual

b.LIFO perpetual

2.How much will the company save in income taxes if they use LIFO instead of FIFO?

Operating expenses are $2,000 per month.The income tax rate is 30%.

Required:

1.Compute Cost of Goods Sold for the six months ending June 30 using:

a.FIFO perpetual

b.LIFO perpetual

2.How much will the company save in income taxes if they use LIFO instead of FIFO?

(Essay)

4.8/5  (36)

(36)

Which inventory costing method most closely approximates current cost for each of the following line items on the financial statements?

(Multiple Choice)

4.7/5  (34)

(34)

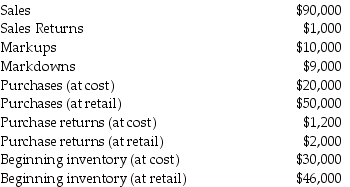

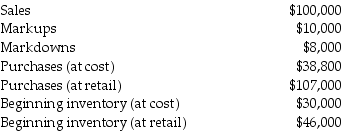

A department store wants to estimate the cost of ending inventory using the conventional retail method.Round ratios to four decimal places.For example,0.43677 equals 0.4368.The following data is available:

Required:

Using the conventional retail method,estimate the cost of ending inventory.

Required:

Using the conventional retail method,estimate the cost of ending inventory.

(Essay)

4.9/5  (34)

(34)

A perpetual inventory system always provides current information about inventory levels.

(True/False)

4.9/5  (34)

(34)

Smith-Miller Enterprises has inventory of $657,000 in its stores as of December 31.It also has two shipments in-transit that left the suppliers' warehouses by December 28.Both shipments are expected to arrive on January 5.The first shipment of $128,000 was sold f.o.b.destination and the second shipment of $76,000 was sold f.o.b.shipping point.What amount of inventory should Smith-Miller report on its balance sheet as of December 31?

(Multiple Choice)

4.9/5  (36)

(36)

When following U.S.GAAP,which of the following statements is not correct regarding inventory write-downs using the lower-of-cost-or-market rule?

(Multiple Choice)

4.9/5  (39)

(39)

Sikich Company has the following data available:  If Sikich Company uses a perpetual FIFO inventory system,the cost of goods sold for the month is ________.

If Sikich Company uses a perpetual FIFO inventory system,the cost of goods sold for the month is ________.

(Multiple Choice)

5.0/5  (33)

(33)

A company uses the conventional retail method to estimate the cost of ending inventory for interim financial statements.Which of the following responses describe the correct treatment of markups and markdowns in the calculation of the cost-to-retail ratio?

(Multiple Choice)

4.8/5  (45)

(45)

A markdown is the amount that the firm decreases the selling price below the initial markup.

(True/False)

4.8/5  (37)

(37)

The following information is available for the past month for a retail store:  What is the ending inventory at cost using the basic retail method? (Round cost-to-retail ratios to four decimal places.)

What is the ending inventory at cost using the basic retail method? (Round cost-to-retail ratios to four decimal places.)

(Multiple Choice)

4.9/5  (42)

(42)

The Henry Store has the following data for inventory:  The store uses the dollar-value LIFO retail method.The price index for the year is 1.08.The price index that pertains to the beginning inventory is 1.00.Round all ratios to four decimal places.What is the cost of the ending inventory at January 31?

The store uses the dollar-value LIFO retail method.The price index for the year is 1.08.The price index that pertains to the beginning inventory is 1.00.Round all ratios to four decimal places.What is the cost of the ending inventory at January 31?

(Multiple Choice)

4.8/5  (35)

(35)

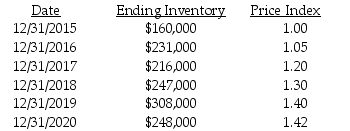

Information about the New Pace Company is presented below:

Required:

Compute the ending inventory for 2015 through 2020 using the dollar-value LIFO method.Round to the nearest dollar.

Required:

Compute the ending inventory for 2015 through 2020 using the dollar-value LIFO method.Round to the nearest dollar.

(Essay)

4.9/5  (43)

(43)

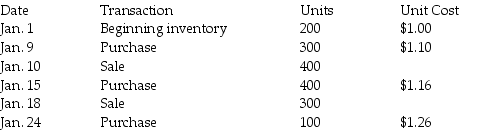

Excalibur Company uses the perpetual inventory method.Excalibur Company has the following data available for the month of January:  What is the Cost of Goods Sold for the month of January using LIFO?

What is the Cost of Goods Sold for the month of January using LIFO?

(Multiple Choice)

4.7/5  (34)

(34)

Explain the difference between the basic retail method and the conventional retail method.

(Essay)

4.9/5  (40)

(40)

The specific identification inventory method is used by companies that sell high-dollar products.

(True/False)

4.8/5  (38)

(38)

Yankee Company uses the net method of recording purchase discounts on inventory and the perpetual inventory system.Yankee Company records a payment within the discount period.Which journal entry is prepared?

(Multiple Choice)

4.7/5  (37)

(37)

Showing 61 - 80 of 134

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)