Exam 22: Accounting Corrections and Error Analysis

Exam 1: The Financial Reporting Environment63 Questions

Exam 2: Financial Reporting Theory178 Questions

Exam 3: Judgment and Applied Financial Accounting Research127 Questions

Exam 4: Review of the Accounting Cycle154 Questions

Exam 5: Statements of Net Income and Comprehensive Net Income125 Questions

Exam 6: Statements of Financial Position and Cash Flows and the Annual Report158 Questions

Exam 7: Accounting and the Time Value of Money120 Questions

Exam 8: Revenue Recognition159 Questions

Exam 9: OL: Revenue Recognition110 Questions

Exam 10: Short-Term Operating Assets: Cash and Receivables125 Questions

Exam 11: Short-Term Operating Assets: Inventory134 Questions

Exam 12: Long-Term Operating Assets: Acquisition, cost Allocation, and Derecognition156 Questions

Exam 13: Long-Term Operating Assets: Departures From Historical Cost126 Questions

Exam 14: Operating Liabilities and Contingencies95 Questions

Exam 15: OL: Operating Liabilities and Contingencies12 Questions

Exam 16: Financing Liabilities167 Questions

Exam 17: Accounting for Stockholders Equity114 Questions

Exam 18: Investing Assets189 Questions

Exam 19: Accounting for Income Taxes121 Questions

Exam 20: Accounting for Employee Compensation and Benefits106 Questions

Exam 22: Accounting Corrections and Error Analysis394 Questions

Select questions type

Bauer Corp.purchased an insurance policy on its plant with liability for harm to its employees in the case of a catastrophe in January,2015 and paid a five-year premium for $300,000.The whole amount was recorded as Insurance Expense.The error was discovered in early 2018 when the accountants were reconciling 2017 for adjusting entries.(The tax rate is 40% for all years.)Income before taxes for 2015 is $1,040,000 and 2016 is $1,220,000.

Required: Describe the steps to properly accounting for this error correction.

(Essay)

5.0/5  (31)

(31)

If a firm discovers a self-correcting error in the second year,and the books are still open,it ________.

(Multiple Choice)

5.0/5  (27)

(27)

The adjustment for unrealized gains and losses reported through other comprehensive income does not have any cash flow effects.

(True/False)

4.9/5  (46)

(46)

Under IFRS,the lessee must used the lessee's incremental borrowing rate in determining the present value of the minimum lease payments.

(True/False)

4.8/5  (37)

(37)

Typically,the lessee will pay for executory costs,expensing them as incurred.

(True/False)

4.8/5  (37)

(37)

In its first year of operations,Badonna Corp.reported Income Tax Expense of $41,000 and Income Tax Payable of $13,000.At the end of the year,Badonna reported a current Deferred Tax Asset of $14,000 and a noncurrent Deferred Tax Liability of $5,000.What is the amount of cash paid for income taxes during the year?

A)$37,000

B)$33,000

C)$19,000

D)$9,000

(Essay)

4.8/5  (33)

(33)

Describe the two methods for reporting accounting changes and how they differ.

(Essay)

4.8/5  (27)

(27)

If the lessor retains title to leased property under the terms of a lease and a guaranteed residual value is included,________.

A)the minimum lease payments will be reduced

B)the minimum lease payments will be increased

C)the minimum lease payment will remain unchanged

D)the lessor will depreciate the residual value on its books

(Essay)

4.9/5  (37)

(37)

Peoples Corporation purchased a building on December 29,2012 that cost $1,000,000 and occupied it on January 2,2013.The owner estimated that the building would last 40 years with a salvage value of $100,000 using straight-line depreciation.In early 2016,Mr.Peoples learned that due to a permanent highway closure,the company needs to relocate at the end of 2018.He believes that the salvage value at that time will be $700,000.Compute the amount of depreciation to record during 2016,and each of the two years thereafter.

(Multiple Choice)

4.9/5  (38)

(38)

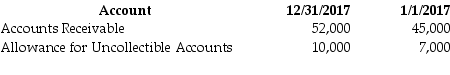

Horton Industries reported net income of $150,000 for the current year.The balances in its accounts receivable and allowance for bad debts accounts are shown below:

In addition,the company recorded $11,000 of bad debt expense and wrote off $5,500 of uncollectible accounts.There are no other relevant transactions or account balances.Prepare the operating section of the cash flow statement.

In addition,the company recorded $11,000 of bad debt expense and wrote off $5,500 of uncollectible accounts.There are no other relevant transactions or account balances.Prepare the operating section of the cash flow statement.

(True/False)

4.8/5  (36)

(36)

Changes in accounting principles can be mandatory or voluntary.

(True/False)

5.0/5  (33)

(33)

The investing cash flows section is based on an analysis of the balance sheet accounts for non-current assets and non-current liabilities.

(True/False)

4.9/5  (40)

(40)

In a direct-finance capital lease,the lessor capitalizes any initial direct costs as part of the lease receivable and expenses them over the term of the lease.

(True/False)

4.8/5  (39)

(39)

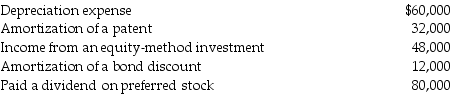

Tasbet Company reported net income of $340,000 for the current year.Included in the computation of net income were:

What is the amount of net cash provided by operating activities that would be reported as a result of these transactions?

A)$420,000

B)$396,000

C)$372,000

D)$316,000

What is the amount of net cash provided by operating activities that would be reported as a result of these transactions?

A)$420,000

B)$396,000

C)$372,000

D)$316,000

(Essay)

4.8/5  (39)

(39)

Changes in amortization,depletion,and depreciation effected by a change in accounting principle are are handled prospectively.

(True/False)

4.9/5  (34)

(34)

Under a capital lease,the lessee reports rent expense on the income statement.

(True/False)

4.8/5  (38)

(38)

Refer to Crest Industries.

Required:

1.Prepare the appropriate entries for Santa Fe Leasing through the second payment of the lease.

2.Show how Santa Fe Industries will present this lease on its financial statements at December 31.

(Essay)

5.0/5  (28)

(28)

The lessor's implicit rate is the rate that the lessor would incur in a debt agreement under similar terms and circumstances.

(True/False)

4.8/5  (32)

(32)

Which of the following is a true statement regarding treatment of leases under GAAP and IFRS?

A)Under IFRS,capital leases are referred to as finance leases.

B)Both GAAP and IFRS use bright-line tests as criteria for classifying leases.

C)Both GAAP and IFRS use qualitative tests to classify leases.

D)Both GAAP and IFRS require a specific number of criteria to be satisfied in order to classify a lease as a capital lease.

(Essay)

4.8/5  (32)

(32)

Johnston Controls began operation in 2014 using FIFO inventory methods.In 2015,management decided they should have chosen LIFO to more accurately portray financial position and performance.The beginning 2015 inventory using FIFO was $100,000.Under the LIFO method the beginning inventory would have been $120,000.The adjustment to inventory for the accounting principal change for 2014 would be ________.

(Multiple Choice)

5.0/5  (40)

(40)

Showing 241 - 260 of 394

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)