Exam 22: Accounting Corrections and Error Analysis

Exam 1: The Financial Reporting Environment63 Questions

Exam 2: Financial Reporting Theory178 Questions

Exam 3: Judgment and Applied Financial Accounting Research127 Questions

Exam 4: Review of the Accounting Cycle154 Questions

Exam 5: Statements of Net Income and Comprehensive Net Income125 Questions

Exam 6: Statements of Financial Position and Cash Flows and the Annual Report158 Questions

Exam 7: Accounting and the Time Value of Money120 Questions

Exam 8: Revenue Recognition159 Questions

Exam 9: OL: Revenue Recognition110 Questions

Exam 10: Short-Term Operating Assets: Cash and Receivables125 Questions

Exam 11: Short-Term Operating Assets: Inventory134 Questions

Exam 12: Long-Term Operating Assets: Acquisition, cost Allocation, and Derecognition156 Questions

Exam 13: Long-Term Operating Assets: Departures From Historical Cost126 Questions

Exam 14: Operating Liabilities and Contingencies95 Questions

Exam 15: OL: Operating Liabilities and Contingencies12 Questions

Exam 16: Financing Liabilities167 Questions

Exam 17: Accounting for Stockholders Equity114 Questions

Exam 18: Investing Assets189 Questions

Exam 19: Accounting for Income Taxes121 Questions

Exam 20: Accounting for Employee Compensation and Benefits106 Questions

Exam 22: Accounting Corrections and Error Analysis394 Questions

Select questions type

Which one of the following would not be effected by a change in revenue recognition requiring a retrospective change?

(Multiple Choice)

4.9/5  (48)

(48)

Jackson Corporation leases equipment to Andrews Company for a five year period.At the beginning of the lease,Jackson records sales revenue.The lease to Andrews must ________.

(Multiple Choice)

4.8/5  (27)

(27)

Which of the following is not an advantage of leasing an asset for the lessee?

A)lower overall costs

B)risk of obsolescence is reduced

C)potential tax benefits

D)improved cash flows

(True/False)

4.9/5  (39)

(39)

Both U.S.GAAP and IFRS require that an entity disclose its policy regarding cash equivalents.

(True/False)

4.8/5  (38)

(38)

The total amount of share-based compensation expense and pension expense must be added to net income to determine cash flows from operations.

(True/False)

4.8/5  (40)

(40)

When accountants discover material errors,they must be corrected.

(True/False)

4.7/5  (38)

(38)

A lessee normally computes the liability on a lease as the ________.

(Multiple Choice)

4.8/5  (36)

(36)

How do the total expenses over the life of a capital lease compare with the total expenses over the life of an operating lease?

(Multiple Choice)

4.9/5  (34)

(34)

Under a direct-finance capital lease,a lessor recognizes both interest revenue and gross profit.

(True/False)

4.8/5  (37)

(37)

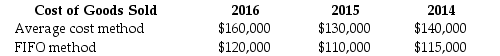

Machino,Inc.began operations on January 1,2014.During 2016,management decided to change from average-cost method to FIFO for its merchandise inventories.The change was effective at January 1,2016.Management determined that cost of goods sold for each method would be:

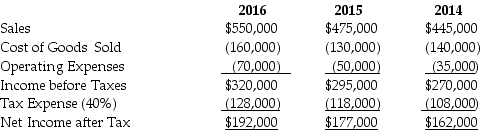

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

The company's statements as reported under average-cost before implementing the accounting change for 2016,2015,and 2014,respectively,are presented below.The income tax rate for Machino is 40%.

Required:

Required:

(Not Answered)

This question doesn't have any answer yet

In determining the present value of the minimum lease payments under U.S.GAAP,the discount rate used by the lessee is the lower of the lessor's implicit rate or the lessee's incremental borrowing rate.

(True/False)

4.9/5  (36)

(36)

Income statement errors in the current year that do not affect the balance sheet may ________.

(Multiple Choice)

4.8/5  (32)

(32)

Lessees generally depreciate leased assets over the lease term unless the lease includes a transfer of ownership or a bargain purchase option.

(True/False)

4.7/5  (44)

(44)

How is net income adjusted for pension costs under the indirect method?

(Multiple Choice)

4.8/5  (42)

(42)

A direct financing lease is classified in the lessor's balance sheet as ________.

(Multiple Choice)

4.8/5  (39)

(39)

Discuss the economic advantages and disadvantages of leasing assets.

(True/False)

4.8/5  (34)

(34)

Under the direct method,items included in the operating activities cash flow calculations include cash collected from customers and cash collected from the sale of operating assets.

(True/False)

4.8/5  (30)

(30)

What is a requirement for lease disclosures under IFRS?

A)IFRS requires disclosure of the fair value of all leased assets.

B)IFRS requires disclosure of future lease payments for each of the next five years.

C)IFRS requires that lessee companies disclose future lease payments for the first year,the total of years two through five,and the remaining aggregate payments.

D)IFRS requires disclosure of rent expense for the five year period.

(Essay)

4.9/5  (32)

(32)

The statement of cash flows is divided into three sections under U.S.GAAP and four sections under IFRS.

(True/False)

4.8/5  (38)

(38)

When preparing the financing activities section of the cash flow statement,firms dividends paid and dividends received as separate line items.

(True/False)

4.9/5  (43)

(43)

Showing 161 - 180 of 394

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)