Exam 2: Introduction to Cost Behavior and Cost-Volume Relationships

Exam 1: Managerial Accounting, the Business Organization129 Questions

Exam 2: Introduction to Cost Behavior and Cost-Volume Relationships152 Questions

Exam 3: Measurement of Cost Behavior141 Questions

Exam 4: Cost Management Systems and Activity-Based Costing129 Questions

Exam 5: Relevant Information for Decision Making With a Focus128 Questions

Exam 6: Relevant Information for Decision Making With a Focus148 Questions

Exam 7: Introduction to Budgets and Preparing the Master Budget144 Questions

Exam 8: Flexible Budgets and Variance Analysis143 Questions

Exam 9: Management Control Systems and Responsibility Accounting147 Questions

Exam 10: Management Control in Decentralized Organizations160 Questions

Exam 11: Capital Budgeting141 Questions

Exam 12: Cost Allocation125 Questions

Exam 13: Accounting for Overhead Costs127 Questions

Exam 14: Job-Order Costing and Process-Costing Systems157 Questions

Exam 15: Basic Accounting: Concepts, techniques, and Conventions154 Questions

Exam 16: Understanding Corporate Annual Reports: Basic Financial Statements149 Questions

Exam 17: Understanding and Analyzing Consolidated Financial Statements122 Questions

Select questions type

Assume the sales price is $100 per unit and the total fixed costs are $75,000.The break-even volume in dollar sales is $250,000.What is the variable cost per unit?

(Multiple Choice)

4.8/5  (39)

(39)

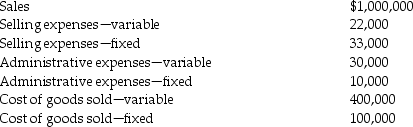

The following information is available for Company ZZ:  If sales increase to $1,500,000,what is operating income?

If sales increase to $1,500,000,what is operating income?

(Multiple Choice)

4.8/5  (31)

(31)

The benefits of using a computer model in CVP analysis always exceed the costs.

(True/False)

4.7/5  (38)

(38)

Cherry Wood Company sells desks at $480 per desk.The variable costs are $372 per desk.Total fixed costs for the period are $456,840.The contribution margin ratio is ________.

(Multiple Choice)

4.8/5  (34)

(34)

What happens when the cost-driver activity level increases within the relevant range?

(Multiple Choice)

5.0/5  (36)

(36)

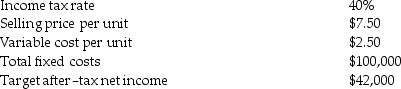

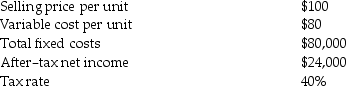

ADEL Company has the following information:  Assume the tax rate decreases to 30%.How many fewer units can be sold to retain the same after-tax net income of $42,000?

Assume the tax rate decreases to 30%.How many fewer units can be sold to retain the same after-tax net income of $42,000?

(Multiple Choice)

4.8/5  (34)

(34)

An accountant may have difficulty classifying costs as fixed or variable because ________.

(Multiple Choice)

4.7/5  (32)

(32)

When changes occur in the sales mix,there is no effect on the cost-volume-profit relationships.

(True/False)

4.8/5  (33)

(33)

The horizontal axis on the CVP graph is the dollars of cost and revenue.

(True/False)

4.9/5  (30)

(30)

Which of the following statements about highly leveraged companies is true?

(Multiple Choice)

4.9/5  (34)

(34)

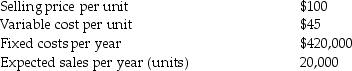

YY Company has the following information available:  If variable costs increase to $65 per unit and fixed costs increase $200,000,what is the break-even point in units?

If variable costs increase to $65 per unit and fixed costs increase $200,000,what is the break-even point in units?

(Multiple Choice)

4.7/5  (36)

(36)

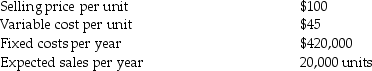

Assume ZZZ Company has the following information available:  If variable costs increase to $65 per unit,what is the expected net income for one year?

If variable costs increase to $65 per unit,what is the expected net income for one year?

(Multiple Choice)

4.8/5  (32)

(32)

Assume the following information for Marie Company:  To achieve the targeted after-tax net income,what amount of sales in dollars is necessary?

To achieve the targeted after-tax net income,what amount of sales in dollars is necessary?

(Multiple Choice)

5.0/5  (31)

(31)

An increase in total variable costs usually indicates ________.

(Multiple Choice)

4.8/5  (35)

(35)

Suppose a Holiday Inn Hotel has annual fixed costs applicable to its rooms of $1.2 million for its 300-room hotel.Average daily room rents are $50 per room and average variable costs are $10 for each room rented.It operates 365 days per year.What percent of occupancy is needed to breakeven?

(Multiple Choice)

4.8/5  (33)

(33)

The break-even point may be reduced by increasing the per unit variable cost.

(True/False)

4.7/5  (33)

(33)

Consider the following activity: Several product and process engineers are working to make improvements to several existing products.These improvements revolve around safety and durability issues.What is an appropriate cost driver for this activity?

(Multiple Choice)

4.8/5  (44)

(44)

The Eastman Family Restaurant is open 24 hours per day.Fixed costs are $24,000 per month.Variable costs are estimated at $9.60 per meal.The average revenue is $12 per meal.The restaurant wished to earn a profit before taxes of $6,000 per month.

Required:

A)Compute the number of meals that must be served to earn a profit before taxes of $6,000 per month.

B)Assume that fixed costs increase to $30,000 per month.How many additional meals must be served to earn a profit before taxes of $6,000 per month?

(Essay)

4.8/5  (39)

(39)

Showing 121 - 140 of 152

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)