Exam 17: Understanding and Analyzing Consolidated Financial Statements

Exam 1: Managerial Accounting, the Business Organization129 Questions

Exam 2: Introduction to Cost Behavior and Cost-Volume Relationships152 Questions

Exam 3: Measurement of Cost Behavior141 Questions

Exam 4: Cost Management Systems and Activity-Based Costing129 Questions

Exam 5: Relevant Information for Decision Making With a Focus128 Questions

Exam 6: Relevant Information for Decision Making With a Focus148 Questions

Exam 7: Introduction to Budgets and Preparing the Master Budget144 Questions

Exam 8: Flexible Budgets and Variance Analysis143 Questions

Exam 9: Management Control Systems and Responsibility Accounting147 Questions

Exam 10: Management Control in Decentralized Organizations160 Questions

Exam 11: Capital Budgeting141 Questions

Exam 12: Cost Allocation125 Questions

Exam 13: Accounting for Overhead Costs127 Questions

Exam 14: Job-Order Costing and Process-Costing Systems157 Questions

Exam 15: Basic Accounting: Concepts, techniques, and Conventions154 Questions

Exam 16: Understanding Corporate Annual Reports: Basic Financial Statements149 Questions

Exam 17: Understanding and Analyzing Consolidated Financial Statements122 Questions

Select questions type

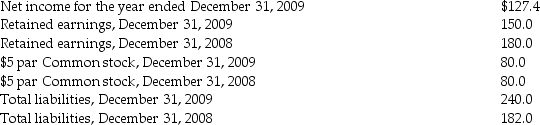

The following information is available for the Marvin Company:  What is the earnings per share for the year ended December 31,2009?

What is the earnings per share for the year ended December 31,2009?

(Multiple Choice)

4.9/5  (26)

(26)

Which of the following statements about efficient capital markets is FALSE?

(Multiple Choice)

4.8/5  (29)

(29)

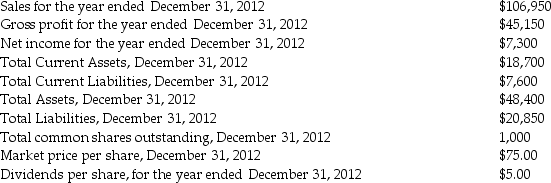

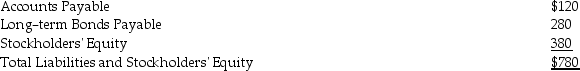

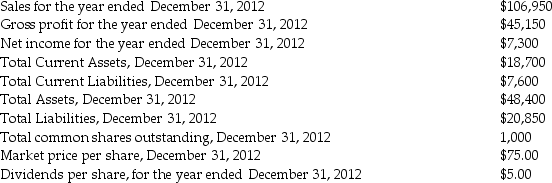

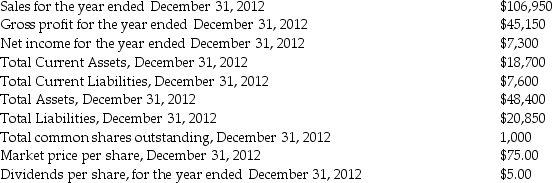

The Barneveld Company reports the following information:  What is the earnings per share for the year ended December 31,2012?

What is the earnings per share for the year ended December 31,2012?

(Multiple Choice)

4.8/5  (32)

(32)

Noncontrolling interests appear on a consolidated balance sheet when a parent company owns more than 50 percent but less than 100 percent of a subsidiary's common stock.

(True/False)

4.9/5  (29)

(29)

The Investment in Subsidiary account appears on a consolidated balance sheet.

(True/False)

4.7/5  (29)

(29)

Noncontrolling interests affect only the balance sheet of consolidated financial statements.

(True/False)

4.9/5  (23)

(23)

A subsidiary is a company that owns more than 50 percent of another company's outstanding common stock.

(True/False)

4.9/5  (46)

(46)

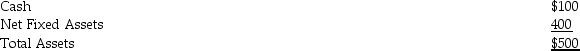

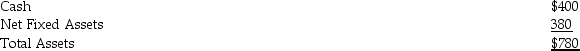

Presented below is the balance sheet of Hal Company at January 1,2015:

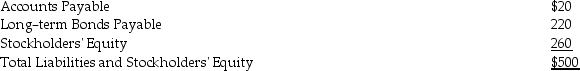

The balance sheet of Monty Company at January 1,2015 is below:

The balance sheet of Monty Company at January 1,2015 is below:

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Assets on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

On January 1,2015,Monty Company acquired 100 percent of the outstanding common stock of Hal Company for $260 cash.What is the amount of Total Assets on the consolidated balance sheet immediately after the acquisition of Hal Company's stock? (Assume elimination entries are completed.)

(Multiple Choice)

4.9/5  (27)

(27)

Bobby Company purchased 40% of the outstanding shares of Wilson Company as a long-term investment.At the end of the year,the market value of the shares increased.The increase in market value of Wilson Company's shares will affect Bobby Company by ________.

(Multiple Choice)

4.9/5  (40)

(40)

On January 1,2015,Parent Company acquired 80 percent of the outstanding shares of Subsidiary Company.At the time of the acquisition,Parent Company's total liabilities were $210.At the time of the acquisition,Subsidiary Company's total liabilities were $280.What is the amount of total liabilities on the consolidated balance sheet immediately after the acquisition of Subsidiary Company's stock? (Assume elimination entries are completed.)

(Multiple Choice)

4.9/5  (32)

(32)

Line items on common-size financial statements are expressed in percentages of some base such as total assets.

(True/False)

4.9/5  (35)

(35)

The debt-to-equity ratio is used to judge a company's ________.

(Multiple Choice)

4.9/5  (43)

(43)

A parent company purchases 100 percent of the outstanding common stock in a subsidiary.What happens to the subsidiary the day after the purchase? Which of the following statements is FALSE?

(Multiple Choice)

4.8/5  (31)

(31)

Brian Company purchased 10% of the outstanding shares of Wilson Company.Brian Company classifies the investments as trading securities.At the end of the year,the market value of the shares increased.The increase in market value of Wilson Company's shares will affect Brian Company by ________.

(Multiple Choice)

4.8/5  (41)

(41)

Goodwill is recognized when one company purchases another company and ________.

(Multiple Choice)

4.8/5  (30)

(30)

The Barnum Company reports the following information:  What is the debt-to-equity ratio at December 31,2012?

What is the debt-to-equity ratio at December 31,2012?

(Multiple Choice)

4.8/5  (34)

(34)

If an investor uses the equity method to account for a long-term equity investment,then the investor records income when the investee reports net income.

(True/False)

4.8/5  (38)

(38)

The Bailey Company reports the following information:  What is the return on sales for the year ended December 31,2012?

What is the return on sales for the year ended December 31,2012?

(Multiple Choice)

4.9/5  (36)

(36)

The company that owns 100 percent of another company's stock is called the ________.The company that is controlled by another company is called the ________.

(Multiple Choice)

4.8/5  (40)

(40)

Showing 41 - 60 of 122

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)