Exam 4: The Time Value of Money

Exam 1: Corporate Finance and the Financial Manager93 Questions

Exam 2: Introduction to Financial Statement Analysis122 Questions

Exam 3: The Valuation Principle: the Foundation of Financial Decision Making120 Questions

Exam 4: The Time Value of Money101 Questions

Exam 5: Interest Rates118 Questions

Exam 6: Bonds122 Questions

Exam 7: Valuing Stocks122 Questions

Exam 8: Investment Decision Rules136 Questions

Exam 9: Fundamentals of Capital Budgeting108 Questions

Exam 10: Risk and Return in Capital Markets101 Questions

Exam 11: Systematic Risk and the Equity Risk Premium102 Questions

Exam 12: Determining the Cost of Capital107 Questions

Exam 13: Risk and the Pricing of Options112 Questions

Exam 14: Raising Equity Capital106 Questions

Exam 15: Debt Financing112 Questions

Exam 16: Capital Structure114 Questions

Exam 17: Payout Policy101 Questions

Exam 18: Financial Modelling and Pro Forma Analysis124 Questions

Exam 19: Working Capital Management122 Questions

Exam 20: Short-Term Financial Planning105 Questions

Exam 21: Risk Management111 Questions

Exam 22: International Corporate Finance113 Questions

Exam 23: Leasing88 Questions

Exam 24: Mergers and Acquisitions80 Questions

Exam 25: Corporate Governance53 Questions

Select questions type

How do the growth perpetuity results differ with negative and positive growths of similar magnitude,assuming everything else remains unchanged?

(Essay)

4.9/5  (32)

(32)

When evaluating investment opportunities,we can compare and combine cash flows that occur at different points in time.

(True/False)

4.9/5  (38)

(38)

A business promises to pay the investor of $2000 today a payment of $500 in one year's time,$1000 in two years' time and $1000 in three years' time.What is the present value of this business opportunity if the interest rate is 5% per year?

(Multiple Choice)

4.8/5  (41)

(41)

Given that the interest rate is 10% per annum,what is the present value of an investment that has 5 equal payments of $50,000 each year for 5 years,starting today?

(Multiple Choice)

4.9/5  (43)

(43)

Suppose a second entrepreneur approaches Joe and offers him $250,000 today for the business.Should Joe accept the new entrepreneur's offer or stick with the original offer of $100,000 and the series of payments over three years? Why?

(Essay)

4.9/5  (39)

(39)

The timeline below shows a $10,000 dollar investment that is being compounded at a set rate per year.What is that rate?

(Multiple Choice)

4.9/5  (32)

(32)

Since your first birthday,your grandparents have been depositing $1000 into a savings account on every one of your birthdays.The account pays 4% interest annually.Immediately after your grandparents make the deposit on your 18th birthday,the amount of money in your savings account will be closest to:

(Multiple Choice)

4.9/5  (46)

(46)

The present value (PV)of a stream of cash flows is just the sum of the present values of each individual cash flow.

(True/False)

4.9/5  (37)

(37)

What is the internal rate of return (IRR)of an investment that requires an initial investment of $10,000 today and pays $14,000 in one year's time?

(Multiple Choice)

4.9/5  (24)

(24)

An investor receives X dollars at the end of each of the next 3 years.If the present value of her investment is $10 million,what is her yearly cash flow,given that the interest rate is 5%?

(Multiple Choice)

4.9/5  (34)

(34)

An investor receives $250,000 at the end of each of the next 5 years.What is the present value of her investment,given that the interest rate is 5%?

(Multiple Choice)

4.9/5  (44)

(44)

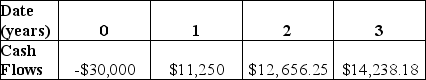

What is the Net Present Value of this investment,given that the interest rate is 5%?

What is the Net Present Value of this investment,given that the interest rate is 5%?

(Multiple Choice)

4.8/5  (38)

(38)

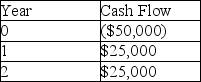

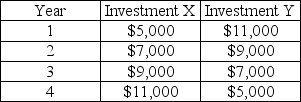

Which of the following investments has a higher present value,assuming the same (strictly positive)interest rate applies to both investments?

(Multiple Choice)

4.8/5  (37)

(37)

Assuming that college costs continue to increase an average of 4% per year and that all her college savings are invested in an account paying 7% interest,then the amount of money she will need to have available at age 18 to pay for all four years of her undergraduate education is closest to:

(Multiple Choice)

4.8/5  (35)

(35)

What is the PV of an investment that will pay you $1,500 every year,forever,starting in one year's time,if the interest rate is 8%?

(Multiple Choice)

4.8/5  (33)

(33)

Allan decides to invest in a new company which would allow him to receive $250,000 at the end of each year for the next 5 years.He purchases 100,000 shares at the price of $6.50.What is the NPV of a single share,if the interest rate is 15% per year?

(Multiple Choice)

4.7/5  (35)

(35)

A bank is negotiating a loan.The loan can either be paid off as a lump sum of $100,000 at the end of five years,or as equal annual payments at the end of each of the next five years.If the interest rate on the loan is 10%,what annual payments should be made so that both forms of payment are equivalent?

(Multiple Choice)

4.7/5  (40)

(40)

An investment of $6000 at the start of the year will pay $1000 at the end of the year for a set number of years.What is the minimum number of years these payments must be made for if the investment is to be worthwhile,given that the interest rate is 6%?

(Multiple Choice)

4.8/5  (33)

(33)

You are given two choices of investments,Investment A and Investment B.Both investments have the same future cash flows.Investment A has a discount rate of 4%,and Investment B has a discount rate of 5%.Which of the following is TRUE?

(Multiple Choice)

4.7/5  (29)

(29)

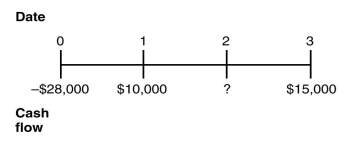

You are offered an investment opportunity that costs you $28,000,has a net present value (NPV)of $2278,lasts for three years,has interest rate of 10%,and produces the following cash flows:  The missing cash flow from year 2 is closest to:

The missing cash flow from year 2 is closest to:

(Multiple Choice)

4.9/5  (31)

(31)

Showing 81 - 100 of 101

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)