Exam 6: Cost Behavior

Exam 1: Introduction to Managerial Accounting201 Questions

Exam 2: Building Blocks of Managerial Accounting318 Questions

Exam 3: Job Costing333 Questions

Exam 4: Activity-Based Costing, Lean Operations, and the Costs of Quality262 Questions

Exam 5: Process Costing271 Questions

Exam 6: Cost Behavior307 Questions

Exam 7: Cost-Volume-Profit Analysis276 Questions

Exam 8: Relevant Costs for Short-Term Decisions270 Questions

Exam 9: The Master Budget219 Questions

Exam 10: Performance Evalulation232 Questions

Exam 11: Standard Costs and Variances254 Questions

Exam 12: Capital Investment Decisions and the Time Value of Money213 Questions

Exam 13: Statement of Cash Flows193 Questions

Exam 14: Financial Statement Analysis196 Questions

Exam 15: Sustainability123 Questions

Select questions type

It costs Homer's Manufacturing $0.65 to produce baseballs and Homer sells them for $5.00 a piece. Homer pays a sales commission of 5% of sales revenue to his sales staff. Homer also pays $17,000 a month rent for his factory and store, and also pays $78,000 a month to his staff in addition to the commissions. Homer sold 70,500 baseballs in June. If Homer prepares a contribution margin income statement for the month of June, what would be his operating income?

(Multiple Choice)

4.8/5  (43)

(43)

The manager at Screaming Trees has been trying to calculate the portion of the company's overhead expenses that is fixed and the portion that is variable. Over the past twelve months, the number of yards of processed was highest in July, when the total monthly overhead costs totaled $31,000 for 36,000 yards of mulch processed. The lowest number of yards of mulch processed in the last twelve months occurred in October, when total overhead costs were $25,000 for 24,000 yards of mulch processed. What is the fixed portion of the monthly overhead expenses?

(Multiple Choice)

4.9/5  (35)

(35)

Your boss wants you to analyze the relationship between the company's monthly operating costs and the current cost driver she has chosen. You run a regression analysis and receive the following information: Intercept Coefficient = 653,434

X Variable 1 Coefficient = 5.76

R-square = 0.3784

What is your company's monthly cost equation?

(Multiple Choice)

4.9/5  (40)

(40)

Sales revenue less variable expenses equals contribution margin.

(True/False)

4.9/5  (33)

(33)

Managers often approximate curvilinear costs and step costs as fixed costs.

(True/False)

4.8/5  (39)

(39)

If production increases by 25%, how will total fixed costs likely react?

(Multiple Choice)

4.9/5  (32)

(32)

The traditional income statement is considered by most companies to be a better management tool than the contribution margin income statement.

(True/False)

4.8/5  (39)

(39)

Which of the following represents the total cost equation?

(Multiple Choice)

4.9/5  (32)

(32)

When graphing total fixed costs, the cost line always begins at the origin.

(True/False)

4.8/5  (42)

(42)

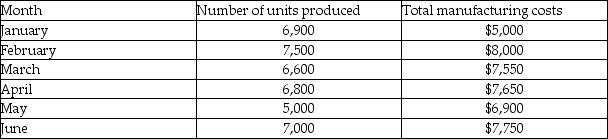

To follow is information about the units produced and total manufacturing costs for Pine Enterprises for the past six months.  Using the high-low method, what will the total monthly manufacturing costs be if the company produces 9200 units?

Using the high-low method, what will the total monthly manufacturing costs be if the company produces 9200 units?

(Multiple Choice)

4.9/5  (35)

(35)

What are three methods used to estimate cost behavior? What are the advantages and disadvantages of each method?

(Essay)

4.8/5  (44)

(44)

George Company has a relevant range of 150,000 units to 400,000 units. The company has total fixed costs of $525,000. Total fixed and variable costs are $612,500 at a production level of 175,000 units. The variable cost per unit at 300,000 units is

(Multiple Choice)

4.9/5  (24)

(24)

Total fixed costs for Toys and Trinkets Incorporated are $85,000. Total costs, including both fixed and variable, are $205,000 if 271,000 units are produced. The total variable costs at a level of 280,000 units would be

(Multiple Choice)

4.8/5  (39)

(39)

Total fixed costs for Taylor Incorporated are $260,000. Total costs, including both fixed and variable, are $500,000 if 156,000 units are produced. The variable cost per unit is

(Multiple Choice)

4.8/5  (32)

(32)

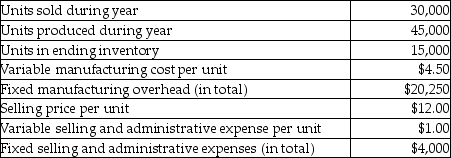

Snowy Mountain Company has the following selected data for the past year:

There were no units in beginning inventory.

Required:

a. Prepare an income statement for last year using absorption costing.

b. Calculate the value of the ending inventory using absorption costing.

c. Prepare an income statement for last year using variable costing.

d. Calculate the value of the ending inventory using variable costing.

There were no units in beginning inventory.

Required:

a. Prepare an income statement for last year using absorption costing.

b. Calculate the value of the ending inventory using absorption costing.

c. Prepare an income statement for last year using variable costing.

d. Calculate the value of the ending inventory using variable costing.

(Essay)

4.8/5  (41)

(41)

Variable costs are described by which of the following statements?

(Multiple Choice)

4.8/5  (47)

(47)

Showing 161 - 180 of 307

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)