Exam 5: The Time Value of Money

Exam 1: Introduction to Corporate Finance30 Questions

Exam 2: Accounting Statements and Cash Flow55 Questions

Exam 3: Financial Planning and Growth33 Questions

Exam 4: Financial Markets and Net Present Value: First Principles of Finance35 Questions

Exam 5: The Time Value of Money62 Questions

Exam 6: How to Value Bonds and Stocks68 Questions

Exam 7: Net Present Value and Other Investment Rules42 Questions

Exam 8: Net Present Value and Capital Budgeting39 Questions

Exam 9: Risk Analysis, Real Options, and Capital Budgeting24 Questions

Exam 10: Risk and Return: Lessons From Market History58 Questions

Exam 11: Risk and Return: the Capital Asset Pricing Model Capm58 Questions

Exam 12: An Alternative View of Risk and Return: The Arbitrage Pricing Theory36 Questions

Exam 13: Risk, Return, and Capital Budgeting57 Questions

Exam 14: Corporate Financing Decisions and Efficient Capital Markets39 Questions

Exam 15: Long-Term Financing: an Introduction40 Questions

Exam 16: Capital Structure: Basic Concepts44 Questions

Exam 17: Capital Structure: Limits to the Use of Debt44 Questions

Exam 18: Valuation and Capital Budgeting for the Levered Firm46 Questions

Exam 19: Dividends and Other Payouts42 Questions

Exam 20: Issuing Equity Securities to the Public43 Questions

Exam 21: Long-Term Debt51 Questions

Exam 22: Leasing37 Questions

Exam 23: Options and Corporate Finance: Basic Concepts52 Questions

Exam 24: Options and Corporate Finance: Extensions and Applications21 Questions

Exam 25: Warrants and Convertibles43 Questions

Exam 26: Derivatives and Hedging Risk48 Questions

Exam 27: Short-Term Finance and Planning48 Questions

Exam 28: Cash Management41 Questions

Exam 29: Credit Management29 Questions

Exam 30: Mergers and Acquisitions53 Questions

Exam 31: Financial Distress17 Questions

Exam 32: International Corporate Finance50 Questions

Select questions type

A sports team in an effort to solve the salary cap problem has offered a player a contract of $1 million dollars a year for the next season with the payments growing at 7% per year for the next 25 years. The player believes the discount rate for such payments is 13%. What is the value today of taking this contract?

Free

(Multiple Choice)

4.8/5  (41)

(41)

Correct Answer:

A

Which of the following amounts is closest to the end value of investing $7,500 for 2 1/2 years at an effective annual interest rate of 12.36%. Interest is compounded semiannually.

(Multiple Choice)

4.7/5  (33)

(33)

If you invest $100,000 today at 12% per year over the next 15 years, what is the most you can spend in equal amounts out of the fund each year over that time.

(Short Answer)

4.8/5  (34)

(34)

The interest rate charged per period multiplied by the number of periods per year is called the _____ rate.

(Multiple Choice)

4.9/5  (36)

(36)

You have deposited $1,500 in an account that promises to pay 8% compounded quarterly for the next five years. How much will you have in the account at the end?

(Multiple Choice)

4.9/5  (44)

(44)

Which of the following amounts is closest to the end value of investing $3,000 for 3/4 year at a continuously compounded rate of 12%?

(Multiple Choice)

4.9/5  (42)

(42)

Your aunt, in her will, left you the sum of $5,000 a year forever with payments starting immediately. However, the news is better. She has specified that the amount should grow at 5% per year to maintain purchasing power. Given an interest rate of 12%, what is the PV of the inheritance?

(Short Answer)

4.9/5  (40)

(40)

As the winner of the Housecleaners sweepstakes, you are entitled to one of the following prizes:

A. $999,999 immediately.

B. $100,000 per year forever.

C. $180,000 per year for the next 10 years starting immediately.

D. $400,000 payable every 2 years over 20 years.

E. $39,000 next year growing by 6% forever.

In terms of present values, which prize should be chosen if r = 9%?

(Short Answer)

4.7/5  (29)

(29)

There are three factors that affect the future value of an annuity. Explain what these three factors are and discuss how an increase in each will impact the future value of the annuity.

(Essay)

4.9/5  (38)

(38)

A mortgage instrument pays $1.5 million at the end of each of the next two years. An investor has an alternative investment with the same amount of risk that will pay interest at 8% compounded semiannually. Which of the following amounts is closest to what the investor should pay for the mortgage instrument?

(Multiple Choice)

4.8/5  (43)

(43)

The BobIU Computer Graphics Co. has just produced a new multimedia graphics chip which will cost $6,000,000 this year to put into production. They anticipate net cash flows of $3 million next year, $2million, $1 million, $.5 million, $.25 million and then $0 over each of the following years. The two owners require a 15% return on their investment. The value of this investment to the firm is:

(Multiple Choice)

4.7/5  (36)

(36)

A "little seven" accounting firm offers to pay you a year-end bonus of $5,000 for 3 years if you will accept employment with them and stay for the entire 3-year period. Which of the following amounts is closest to the present value of the bonus if the interest rate is 10%?

(Multiple Choice)

4.8/5  (42)

(42)

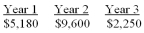

What is the future value of the following cash flows at the end of year 3 if the interest rate is 6%? The cash flows occur at the end of each year.

(Multiple Choice)

4.9/5  (41)

(41)

The potential owner/managers of the yet to be formed new In-Line Blade Company are evaluating the prospects for the business. The new equipment is expected to be $5.5 million and have after tax cashflows of $400,000 for the first two years, $750,000 in the next two years, and $1,200,000 thereafter indefinitely. The owners estimate that they require a 15% rate of return. What is the value of the In-Line Blade Company; should they go forward with the investment?

(Multiple Choice)

4.7/5  (33)

(33)

Showing 1 - 20 of 62

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)