Exam 2: Cost Terms, Concepts, and Classifications

Exam 1: Managerial Accounting and the Business Environment49 Questions

Exam 2: Cost Terms, Concepts, and Classifications103 Questions

Exam 3: Cost Behaviour: Analysis and Use106 Questions

Exam 4: Cost-Volume-Profit Relationships401 Questions

Exam 5: Systems Design: Job-Order Costing108 Questions

Exam 6: Systems Design: Process Costing130 Questions

Exam 7: Activity-Based Costing: a Tool to Aid Decision Making120 Questions

Exam 8: Variable Costing: a Tool for Management135 Questions

Exam 9: Budgeting128 Questions

Exam 10: Standard Costs and Overhead Analysis223 Questions

Exam 11: Reporting for Control193 Questions

Exam 12: Relevant Costs for Decision Making88 Questions

Exam 13: Capital Budgeting Decisions180 Questions

Exam 14: Financial Statement Analysis Online200 Questions

Select questions type

Manufacturing overhead combined with direct materials is known as conversion cost.

(True/False)

4.9/5  (39)

(39)

What was the cost of goods manufactured (finished)for the year (in thousands of dollars)?

(Multiple Choice)

4.8/5  (40)

(40)

Williams Company's direct labour cost is 25% of its conversion cost.If the manufacturing overhead cost for the last period is $45,000 and the direct materials cost is $25,000,what is the direct labour cost?

(Multiple Choice)

4.9/5  (46)

(46)

Manufacturing overhead is one of the three elements of manufacturing costs.Unlike direct materials and direct labour costs,assigning manufacturing overhead cost to products can be a very difficult task.

Required:

Do you agree with this aspect of manufacturing overhead? Why or why not?

(Essay)

4.9/5  (44)

(44)

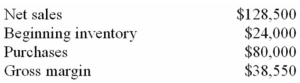

Delta Merchandising,Inc. ,has provided the following information for the year just ended:  What was the ending inventory for the company at year-end?

What was the ending inventory for the company at year-end?

(Multiple Choice)

4.8/5  (40)

(40)

Sally Smith is employed in the production of various electronic products,and she earns $8 per hour.She is paid time-and-a-half for work in excess of 40 hours per week.During a given week,she worked 45 hours and had no idle time.How much of her week's wages would be charged to manufacturing overhead?

(Multiple Choice)

4.9/5  (35)

(35)

Advertising costs are considered product costs for external financial reports since they are incurred in order to promote specific products.

(True/False)

4.7/5  (38)

(38)

When a decision is made among a number of alternatives,the benefit that is lost by choosing one alternative over another is called what?

(Multiple Choice)

4.8/5  (38)

(38)

For a lamp manufacturing company,the cost of the insurance on its vehicles that deliver lamps to customers is best described as a:

(Multiple Choice)

4.8/5  (41)

(41)

Which of the following statements regarding variable cost is true?

(Multiple Choice)

4.9/5  (35)

(35)

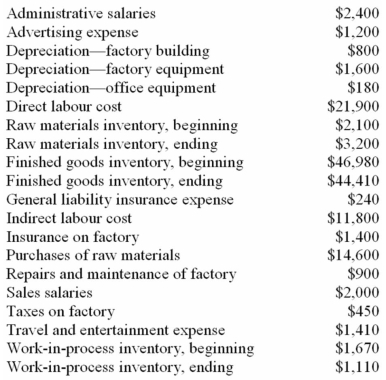

Logan Products,a small manufacturer,has submitted the items below concerning last year's operations.The president's secretary,trying to be helpful,has alphabetized the list.  Required:

a. )Prepare a schedule of cost of goods manufactured in good form for the year.

b. )Determine the cost of goods sold for the year.

Required:

a. )Prepare a schedule of cost of goods manufactured in good form for the year.

b. )Determine the cost of goods sold for the year.

(Essay)

4.8/5  (36)

(36)

When raw materials are used in production,their costs are transferred to the work in process inventory account as direct materials.

(True/False)

4.7/5  (38)

(38)

The following would typically be considered indirect costs of manufacturing a particular Boeing 747 to be delivered to Singapore Airlines: electricity to run production equipment,the factory manager's salary,and the cost of the General Electric jet engines installed on the aircraft.

(True/False)

4.8/5  (33)

(33)

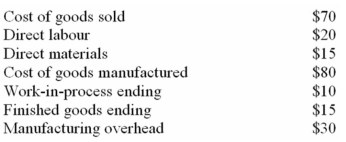

You have the following data:  Which of the following represents the beginning work-in-process inventory?

Which of the following represents the beginning work-in-process inventory?

(Multiple Choice)

4.7/5  (35)

(35)

In external financial reports,factory utilities costs may be included in an asset account on the balance sheet at the end of the period.

(True/False)

4.7/5  (27)

(27)

What would be the classification of corporate controller's salary?

(Multiple Choice)

4.8/5  (41)

(41)

Mary Tappin,an assistant Vice President at Galaxy Toys,was disturbed to find on her desk a memo from her boss,Gary Resnick,to the controller of the company.The memo appears below:

Galaxy Toys Internal Memo

Sept 15

To: Harry Wilson,Controller

Fm: Gary Resnick,Executive Vice President

As you know,we won't start recording many sales until October when stores start accepting shipments from us for the Christmas season.Meanwhile,we are producing flat-out and are building up our finished goods inventories so that we will be ready to ship next month.Unfortunately,we are in a bind right now since it looks like the net income for the quarter ending on Sept 30 is going to be pretty awful.This may get us in trouble with the bank since they always review the quarterly financial reports and may call in our loan if they don't like what they see.Is there any possibility that we could change the classification of some of our period costs to product costs--such as the rent on the finished goods warehouse?

Please let me know as soon as possible.The President is pushing for results.

Mary didn't know what to do about the memo.It wasn't intended for her,but its contents were alarming.

Required:

a.Why has Gary Resnick suggested reclassifying some period costs as product costs?

b.Why do you think Mary was alarmed about the memo?

(Essay)

4.8/5  (36)

(36)

Showing 81 - 100 of 103

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)