Exam 7: Internal Control and Cash

Exam 1: Accounting and the Business Environment156 Questions

Exam 2: Recording Business Transactions156 Questions

Exam 3: The Adjusting Process160 Questions

Exam 4: Completing the Accounting Cycle165 Questions

Exam 5: Merchandising Operations168 Questions

Exam 6: Merchandising Inventory155 Questions

Exam 7: Internal Control and Cash161 Questions

Exam 8: Receivables166 Questions

Exam 9: Plant Assets and Intangibles170 Questions

Exam 10: Current Liabilities and Payroll159 Questions

Exam 11: Long-Term Liabilities, Bonds Payable, and Classification of Liabilities on the Balance Sheet161 Questions

Exam 12: Corporations: Paid-In Capital and the Balance Sheet167 Questions

Exam 13: Corporations: Effects on Retained Earnings and the Income Statement164 Questions

Exam 14: The Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis163 Questions

Exam 16: Introduction to Management Accounting163 Questions

Exam 17: Job Order and Process Costing172 Questions

Exam 18: Activity-Based Costing and Other Cost Management Tools162 Questions

Exam 19: Cost-Volume-Profit Analysis165 Questions

Exam 20: Short-Term Business Decisions163 Questions

Exam 21: Capital Investment Decisions and the Time Value of Money153 Questions

Exam 22: The Master Budget and Responsibility Accounting157 Questions

Exam 23: Flexible Budgets and Standard Costs166 Questions

Exam 24: Performance Evaluation and the Balanced Scorecard166 Questions

Select questions type

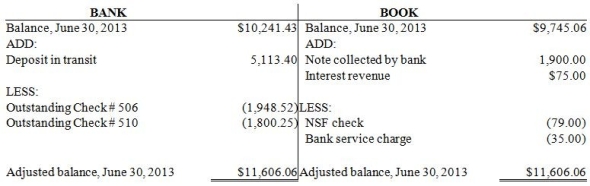

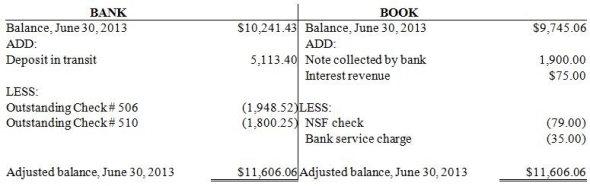

Please refer to the following bank reconciliation:

Please prepare the adjusting entry for the fourth reconciling item (bank service charge.)

Please prepare the adjusting entry for the fourth reconciling item (bank service charge.)

(Essay)

4.8/5  (38)

(38)

In a bank reconciliation, a deposit in transit will be shown on the bank side of the reconciliation.

(True/False)

4.9/5  (39)

(39)

In the following situation, which internal control procedure needs strengthening? At Hofstra Services, the operations accountant is responsible for safeguarding and maintaining the pipe inventory and also to record inventory transactions into the journal. A separate accounting clerk keeps records of the cash receipts and payments. The treasurer signs checks and approves contracts.

(Multiple Choice)

4.8/5  (43)

(43)

A point-of-sale terminal (cash register)provides control over cash in the form of a tape record of sales which is compared to the count of the drawer.

(True/False)

4.8/5  (39)

(39)

Which of the following is NOT one of the purposes of internal control?

(Multiple Choice)

4.9/5  (39)

(39)

Which of the following is a security procedure designed for e-commerce?

(Multiple Choice)

4.8/5  (41)

(41)

If a single person is authorized to both order goods and approve payments, the company may be defrauded in several ways. Which of the following scenarios would NOT be a possible consequence of this control weakness?

(Multiple Choice)

4.8/5  (38)

(38)

If a system of internal controls is too strict or complex, it may harm efficiency and not be cost-effective.

(True/False)

4.7/5  (34)

(34)

In the following situation, which internal control procedure needs strengthening? Hofstra Services hired a new clerk to keep custody of and maintain all the equipment in the equipment yard. That employee has not yet been adequately trained on the maintenance needs of the equipment.

(Multiple Choice)

4.8/5  (34)

(34)

Regarding controls over cash receipts by mail, the bank deposit slip should be compared to the remittance advices by the accounting department.

(True/False)

4.7/5  (39)

(39)

As part of the internal control over cash receipts by mail, the mailroom sends both the customer checks and the remittance advices to the accounting department.

(True/False)

4.7/5  (35)

(35)

A check was written by a business for $205, but was recorded in the cash payments journal as $502. How would this error be included on the bank reconciliation?

(Multiple Choice)

4.9/5  (32)

(32)

In a bank reconciliation, outstanding checks will be shown on the bank side of the reconciliation.

(True/False)

4.7/5  (42)

(42)

Which of the following would be included in a journal to record an NSF check?

(Multiple Choice)

4.8/5  (40)

(40)

The following information is needed to reconcile the cash balance for Woods Paper Products.

• A deposit of $5,794.62 is in transit.

• Outstanding checks total $1,533.25.

• The book balance is $5,695.62.

• The bookkeeper recorded a $1,524.00 check as $15,240 in payment of the current month's rent.

• The bank balance at February 28, 2008 was $16,500.25.

• A deposit of $300 was credited by the bank for $3,000.

• A customer's check for $1,280 was returned for nonsufficient funds.

• The bank service charge is $70.

Based on this information, complete a bank reconciliation, in the format below, for Woods Paper Products as of February 28, 2013.

(Essay)

4.9/5  (37)

(37)

Which of the following is a common tactic to overcome internal controls?

(Multiple Choice)

4.9/5  (33)

(33)

For good controls over cash payments, the company officer approving a payment voucher should be the same as the person who ordered the goods, to ensure that the correct amount of cash is paid.

(True/False)

4.9/5  (41)

(41)

Please refer to the following bank reconciliation:

Please prepare the adjusting entry for the second reconciling item (interest revenue.)

Please prepare the adjusting entry for the second reconciling item (interest revenue.)

(Essay)

4.8/5  (36)

(36)

A company has a petty cash fund amount of $200. When replenished, it has petty cash receipts of $15 for gas expense, $23 for postage expense, $18 for supplies expense and $12 for miscellaneous expenses. In the journal entry, Cash would be credited for:

(Multiple Choice)

4.9/5  (39)

(39)

In the following situation, which internal control procedure needs strengthening? The controller's duties include approving bank reconciliations, approving general journal entries, hiring administrative staff, and approving various types of administrative expenses. She needs new computer equipment for the accounting office, but there are no guidelines specifying whether she can approve purchases of office equipment.

(Multiple Choice)

4.8/5  (32)

(32)

Showing 61 - 80 of 161

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)