Exam 3: The Adjusting Process

Exam 1: Accounting and the Business Environment156 Questions

Exam 2: Recording Business Transactions156 Questions

Exam 3: The Adjusting Process160 Questions

Exam 4: Completing the Accounting Cycle165 Questions

Exam 5: Merchandising Operations168 Questions

Exam 6: Merchandising Inventory155 Questions

Exam 7: Internal Control and Cash161 Questions

Exam 8: Receivables166 Questions

Exam 9: Plant Assets and Intangibles170 Questions

Exam 10: Current Liabilities and Payroll159 Questions

Exam 11: Long-Term Liabilities, Bonds Payable, and Classification of Liabilities on the Balance Sheet161 Questions

Exam 12: Corporations: Paid-In Capital and the Balance Sheet167 Questions

Exam 13: Corporations: Effects on Retained Earnings and the Income Statement164 Questions

Exam 14: The Statement of Cash Flows162 Questions

Exam 15: Financial Statement Analysis163 Questions

Exam 16: Introduction to Management Accounting163 Questions

Exam 17: Job Order and Process Costing172 Questions

Exam 18: Activity-Based Costing and Other Cost Management Tools162 Questions

Exam 19: Cost-Volume-Profit Analysis165 Questions

Exam 20: Short-Term Business Decisions163 Questions

Exam 21: Capital Investment Decisions and the Time Value of Money153 Questions

Exam 22: The Master Budget and Responsibility Accounting157 Questions

Exam 23: Flexible Budgets and Standard Costs166 Questions

Exam 24: Performance Evaluation and the Balanced Scorecard166 Questions

Select questions type

The accountant for Jones Auto Repair Company failed to make an adjusting entry to record $5,000 of unpaid salaries for the last 2 weeks of the year. Which of the following is TRUE?

(Multiple Choice)

4.8/5  (46)

(46)

A company received $5,000 for 100 one-year subscriptions on July 1. The journal entry to record this cash receipt would include a:

(Multiple Choice)

4.9/5  (31)

(31)

At January 1, Smith has a beginning balance in Prepaid insurance expense of $1,200. Smith pays insurance premiums once a year, and his total premium is $4,800. As of the end of February, the balance in prepaid insurance is $2,000.

(True/False)

4.7/5  (32)

(32)

Double-A Public Relations Firm got a new client on September 1. Double-A will provide services to the new client at a rate of $250 per month for a three-month period beginning September 1. Double-A required the client to pay for the entire period in advance. Please show the journal entry for the cash collected by Double-A on September 1.

(Essay)

4.9/5  (39)

(39)

Which of the following reports a company's results of operations?

(Multiple Choice)

4.9/5  (40)

(40)

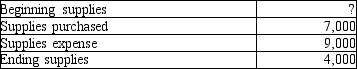

The table below represents Able Company's supplies account. Please supply the missing amount.

(Multiple Choice)

4.8/5  (38)

(38)

The revenue principle is the basis for recording revenues―both when to record revenue and the amount of revenue to record.

(True/False)

4.7/5  (31)

(31)

Chelsea Services Company pays its staff their wages every Friday. The staff works a five-day work week and the payroll amounts to $25,000 per week. The last day of January fell on a Tuesday, and an adjustment entry was made on that date to accrue wage expense. On Friday, February 3, Chelsea Company pays out $25,000 in wages as usual. Please provide the entry needed at the time the wages are paid.

(Essay)

4.8/5  (30)

(30)

The accountant for Noble Jewelry Repair Services forgot to make an adjusting entry for Depreciation expense for the current year. Which of the following is one of the effects of this error?

(Multiple Choice)

5.0/5  (37)

(37)

In the case of a prepaid expense, the adjusting entry required at the end of a period consists of a credit to Prepaid expense.

(True/False)

4.8/5  (45)

(45)

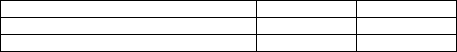

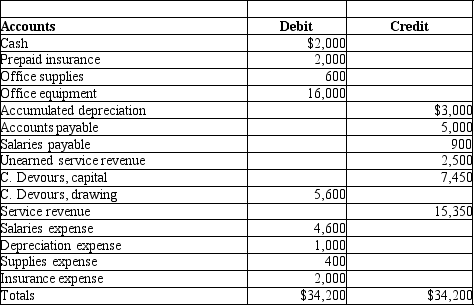

Prepare a statement of owner's equity for the year ended December 31, 2012 from the adjusted trial balance below.

(Essay)

4.8/5  (36)

(36)

A business acquires equipment for $140,000 on January 1, 2011. The equipment depreciation will be $20,000 each year for the seven years of the asset's expected life. The business records depreciation once a year on December 31. Which of the following is the adjusting entry required on December 31, 2011?

(Multiple Choice)

4.8/5  (37)

(37)

Pattie's Event Planning Service has just prepared the unadjusted trial balance, which shows the following balances:  Pattie's salaries are $2,000 per week and are paid out at the end of the day on Fridays. The end of the month falls on a Thursday. Patti will make the appropriate accrual adjustment and post to the ledger. The final adjusted balance of Salary payable, as shown on the adjusted trial balance, will be a:

Pattie's salaries are $2,000 per week and are paid out at the end of the day on Fridays. The end of the month falls on a Thursday. Patti will make the appropriate accrual adjustment and post to the ledger. The final adjusted balance of Salary payable, as shown on the adjusted trial balance, will be a:

(Multiple Choice)

4.9/5  (36)

(36)

The accountant for Noble Jewelry Repair Services forgot to make an adjusting entry for Depreciation expense for the current year. What is the effect of this error on total assets?

(Multiple Choice)

4.7/5  (42)

(42)

If a company is using the accrual method of accounting, when is revenue recorded?

(Multiple Choice)

4.7/5  (34)

(34)

A business pays its employees' monthly salaries of $20,000, half on the 15th day of each month, and half on the first day of the following month. It is now October 31, and the business must make an adjusting

entry to accrue salaries for the second half of October. Please provide that adjusting entry.

(Essay)

4.8/5  (36)

(36)

Smith Technical Services is working on a six-month job for a client, starting February 1. They will collect $48,000 from their customer when the job is finished. On March 1, their Accounts receivable account has a debit balance of $8,000. At the end of March, after monthly adjusting entries have been made, what will the balance in Accounts receivable be?

(Multiple Choice)

5.0/5  (38)

(38)

At January 1, Smith has $1,200 of supplies on hand. During January, Smith purchases $3,000 worth of new supplies. At the end of the month, a count reveals $500 worth of supplies remaining on the shelves. The adjustment entry needed will include a debit to Supply expense of $3,700.

(True/False)

4.8/5  (43)

(43)

Showing 81 - 100 of 160

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)