Exam 10: The Share Market

Exam 1: Overview of the Financial System95 Questions

Exam 2: The Payments System102 Questions

Exam 3: Introduction to the Flow of Funds98 Questions

Exam 4: Funds Management113 Questions

Exam 5: Authorised Deposit-Taking Institutions116 Questions

Exam 6: The Stability of Deposit-Taking Institutions77 Questions

Exam 7: The Money Market95 Questions

Exam 8: The Bond Market124 Questions

Exam 11: Foreign Exchange and Global Capital Markets126 Questions

Exam 13: Financial Futures115 Questions

Exam 14: Swaps88 Questions

Exam 15: Exchange-Traded Options140 Questions

Select questions type

The advantage of crossings through 'dark pools' is they facilitate large trades with the least possible market price impact.

(True/False)

4.8/5  (35)

(35)

In the Australian market, large cap companies are those in the ASX200.

(True/False)

4.9/5  (39)

(39)

The turnover of shares in the market is much greater for large-cap firms than for smaller firms.

(True/False)

5.0/5  (39)

(39)

The ASX's continuous disclosure policy requires companies to advise the ASX of any new price-sensitive information in a timely fashion.

(True/False)

4.8/5  (43)

(43)

Good corporate governance ensures that members of a company's top management are held accountable for their actions.

(True/False)

4.9/5  (45)

(45)

The index level yesterday was 6000 points.At that time, the combined market capitalisation of the shares in the index was $800 billion.The next day the market capitalisation of the shares in the index was $825 billion.Given this information, calculate the new index level.

(Essay)

4.9/5  (34)

(34)

Explain how share price indices are calculated.Explain the difference between a price index and an accumulation index.Describe the set of indices based on the prices of ASX-listed stocks.

(Essay)

4.8/5  (41)

(41)

A share price index aims to measure the overall movement in the value of the shares included in the index.

(True/False)

4.9/5  (37)

(37)

Describe the trading and settlement arrangements used in the Australian share market.

(Essay)

4.9/5  (43)

(43)

Identify and briefly explain the competitive pressures faced by the ASX.

(Essay)

4.9/5  (28)

(28)

List some of the factors for which a company share registry is necessary.How do most companies now maintain their share registries?

(Essay)

4.8/5  (44)

(44)

The main investors in Australian shares are foreign investors, fund managers and retail investors.

(True/False)

4.9/5  (40)

(40)

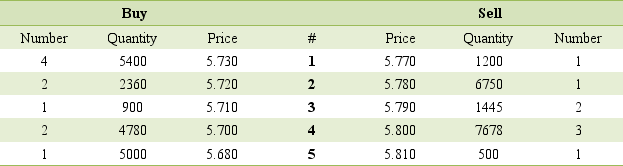

Consider the following market depth information for Fosters Group Ltd:  (a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(b)How much would you pay to buy 5000 Fosters shares 'at-market'?

(c)Explain what would happen to the order queue after the transactions in (a)and (b), assuming no other changes.(d)Explain what would happen to your order if you placed an order to sell 1500 Fosters shares at $5.78 (assuming the transactions in (a)and (b)do not take place).

(a)What would be the outcome if you placed an at-market order to sell 3000 Fosters shares?

(b)How much would you pay to buy 5000 Fosters shares 'at-market'?

(c)Explain what would happen to the order queue after the transactions in (a)and (b), assuming no other changes.(d)Explain what would happen to your order if you placed an order to sell 1500 Fosters shares at $5.78 (assuming the transactions in (a)and (b)do not take place).

(Essay)

4.7/5  (37)

(37)

Which of the following is NOT an admission requirement or rule of listing on the ASX?

(Multiple Choice)

4.9/5  (37)

(37)

Chi-X provides Australian retail and wholesale investors with an alternative trading venue to the ASX.

(True/False)

4.9/5  (34)

(34)

Companies no longer have to maintain their share registry because CHESS holds this information.

(True/False)

4.7/5  (44)

(44)

Showing 41 - 60 of 84

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)