Exam 8: Inventory

Exam 1: The Canadian Financial Reporting Environment74 Questions

Exam 2: Conceptual Framework Underlying Financial Reporting81 Questions

Exam 3: Measurement31 Questions

Exam 4: Reporting Financial Performance125 Questions

Exam 5: Financial Position and Cash Flows103 Questions

Exam 6: Revenue Recognition117 Questions

Exam 7: Cash and Receivables114 Questions

Exam 8: Inventory168 Questions

Exam 9: Investments128 Questions

Exam 10: Property, Plant, and Equipment: Accounting Model Basics99 Questions

Exam 11: Depreciation, Impairment, and Disposition88 Questions

Exam 12: Intangible Assets and Goodwill104 Questions

Exam 13: Accounting Information Systems and Adjusting Entries: A Comprehensive Guide86 Questions

Select questions type

When using the moving-average cost formula with a perpetual system,

(Multiple Choice)

4.9/5  (34)

(34)

For calendar 2020, cost of goods available for sale for Janus Corp. was $820,000. The average gross profit rate was 30%. Sales for the year were $600,000. What is the estimated dollar value of the inventory at December 31?

(Multiple Choice)

4.8/5  (35)

(35)

Which of the following does NOT correctly describe a periodic inventory system?

(Multiple Choice)

4.9/5  (43)

(43)

Which of the following does NOT correctly describe the concept of net realizable value (NRV)?

(Multiple Choice)

4.8/5  (47)

(47)

The following information was reported by Belleville Inc. for 2020: Merchandise purchased for resale \ 25,000 Freight-in 1,750 Freight-out 1,000 Purchase returns 500

Based on this data, Belleville's 2020 inventoriable cost was

(Multiple Choice)

4.7/5  (40)

(40)

Washington Distribution Co. has determined its December 31, 2020, inventory on a FIFO basis at $240,000. Information pertaining to that inventory follows: Etimated selling price \2 55,000 Estimated cost of disposal 10,000 Normal profit margin 30,000

Washington records losses that result from applying the lower of cost and net realizable value rule. At December 31, 2020, the loss that Washington should recognize is

(Multiple Choice)

4.9/5  (35)

(35)

Maine Co. uses the retail inventory method to estimate its inventory for interim statement purposes. Data relating to the calculation of the inventory at July 31, 2020, are as follows: Cost Retail Inventory, July 1/20 \2 00,000 \3 60,000 Purchases 1,200,000 1,575,000 Markups, net 175,000 Sales 1,700,000 Estimated normal shoplifting losses 20,000 Markdowns, net 110,000 Maine's estimated inventory at July 31, 2020, using the retail method is

(Multiple Choice)

4.9/5  (35)

(35)

In a periodic inventory system, if the beginning inventory is overstated

(Multiple Choice)

4.9/5  (33)

(33)

The gross profit method of inventory valuation is NOT suitable when

(Multiple Choice)

4.8/5  (43)

(43)

To record a "basket purchase" or to allocate a joint product cost, which method is the most rational?

(Multiple Choice)

4.8/5  (36)

(36)

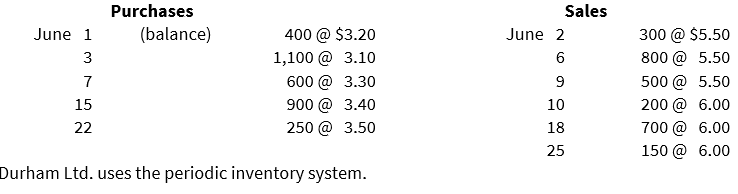

Use the following information for the following questions:

Transactions for Durham Ltd. for the month of June were:

-The ending inventory on a weighted average cost basis, rounded to the nearest dollar, is

-The ending inventory on a weighted average cost basis, rounded to the nearest dollar, is

(Multiple Choice)

5.0/5  (29)

(29)

Lower of cost and net realizable value (NRV)

The December 31, 2020, inventory of Rhode Inc. consisted of four products, for which certain information is provided below:

Replacement Estimated Expected Product Original Cost Cost Disposal cost Selling Price A \ 29.00 \ 22.00 \ 6.50 \ 40.00 B \ 44.00 \ 40.00 \8 .00 \4 8.00 C \ 145.00 \ 125.00 \ 25.00 \ 190.00 D \ 21.00 \ 15.80 \ 3.00 \ 28.00 Instructions

Using the lower of cost and NRV approach applied on an individual-item basis, calculate the inventory valuation that should be reported for each product on December 31, 2020.

(Essay)

4.8/5  (35)

(35)

Why are inventories included in the computation of net income?

(Multiple Choice)

4.9/5  (46)

(46)

Goods in transit that are shipped FOB destination should be included

(Multiple Choice)

4.8/5  (42)

(42)

The balance in Georgia Corp.'s accounts payable account at December 31, 2020, was $900,000 before any necessary year-end adjustments relating to the following:

1) Goods were in transit to Georgia from a vendor on December 31, 2020. The invoice cost was $75,000. The goods were shipped FOB shipping point on December 29, 2020 and were received on January 4, 2021.

2) Goods shipped FOB destination on December 21, 2020 from a vendor were received on January 6, 2021. The invoice cost was $37,500.

3) On December 27, 2020, Georgia wrote and recorded cheques to creditors totalling $45,000 that were mailed on January 10, 2021.

At December 31, 2020, what amount should Georgia report as total accounts payable?

(Multiple Choice)

4.8/5  (43)

(43)

Which of the following items would be inventory for a company like Marriott Hotel Corporation?

(Multiple Choice)

4.9/5  (38)

(38)

Year-end entries to update inventory under periodic system

The accountant for the Oswego chain of retail stores is getting ready to prepare the 2020 year-end inventory entries for its periodic inventory system. Her assistant has provided the following information:

Beginning inventory \8 8,000 Imentory purchase during year 900,000 Ending inventory 62,000\

Instructions

Record the journal entry(ies) that Oswego's accountant would prepare to bring the inventory and cost of goods sold up to date for 2020.

(Essay)

4.7/5  (45)

(45)

Showing 41 - 60 of 168

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)