Exam 9: Financial Reporting of State and Local Governments

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Entities48 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments50 Questions

Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting67 Questions

Exam 4: Accounting for Governmental Operating Activitiesillustrative Transactions and Financial Statements85 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects87 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service82 Questions

Exam 7: Accounting for the Business-Type Activities of State and Local Governments85 Questions

Exam 8: Accounting for Fiduciary Activities Agency and Trust Funds56 Questions

Exam 9: Financial Reporting of State and Local Governments50 Questions

Exam 10: Analysis of Governmental Financial Performance48 Questions

Exam 11: Auditing of Governmental and Not-For-Profit Organizations51 Questions

Exam 12: Budgeting and Performance Measurement58 Questions

Exam 13: Accounting for Not-For-Profit Organizations65 Questions

Exam 14: Not-For-Profit Organizations Regulatory, taxation, and Performance Issues56 Questions

Exam 15: Accounting for Colleges and Universities41 Questions

Exam 16: Accounting for Health Care Organizations46 Questions

Exam 17: Accounting and Reporting for the Federal Government52 Questions

Select questions type

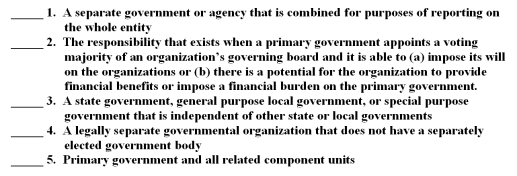

The following are key terms in Chapter 9 that relate to the reporting entity:

A.Component units

B.Financial reporting entity

C.Financial accountability

D.Joint venture

E.Other stand-alone governments

F.Primary governments  For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

For each of the following definitions,indicate the key term from the list above that best matches by placing the appropriate letter in the blank space next to the definition.

Free

(Short Answer)

4.7/5  (40)

(40)

Correct Answer:

1.A,2.C,3.F,4.E,5.B

GASB reporting objectives emphasize the role of accountability in external financial reporting,and describe accountability as the "paramount objective from which all other objectives must flow."

Free

(True/False)

4.7/5  (43)

(43)

Correct Answer:

True

In preparation of government-wide statements,converting information recorded using the modified accrual basis of accounting to the accrual basis,where appropriate,is conceptually preferable to using information directly from the accounting system to prepare the statements.

Free

(True/False)

4.8/5  (41)

(41)

Correct Answer:

False

The government-wide financial statements required by GASB standards are a

(Multiple Choice)

4.9/5  (32)

(32)

Which of the following is evidence of fiscal independence for the purpose of considering whether one legally separate organization is a component unit of another?

(Multiple Choice)

4.8/5  (42)

(42)

Combining financial statements for nonmajor funds of a government should be included in

(Multiple Choice)

4.8/5  (34)

(34)

What is meant by the term "reporting entity" in accounting for state and local governments?

(Essay)

4.8/5  (40)

(40)

What is the minimum level of detail required for expenditures presented in the governmental fund statement of revenues,expenditures,and changes in fund balance?

(Multiple Choice)

4.9/5  (43)

(43)

Some governments provide to their citizens highly condensed financial information,budget summaries,and narrative descriptions.This report is called a(an)

(Multiple Choice)

4.9/5  (36)

(36)

Most citizens and financial statement users do not have a clear understanding of the financial reporting entity whose financial position,results of operations,and cash flows are included in an annual financial report.

(True/False)

4.9/5  (45)

(45)

Which of the following kinds of information would not be provided by Management's discussion and analysis (MD&A)?

(Multiple Choice)

4.8/5  (43)

(43)

One of the required reconciliations in converting governmental fund financial statements to governmental activities statements at the government-wide level is to adjust for internal service funds' assets,liabilities,operating income (loss),and transfers.

(True/False)

4.8/5  (41)

(41)

A financial reporting entity is defined as a primary government,as well as all other organizations that have an operational relationship with the primary government.

(True/False)

4.8/5  (42)

(42)

For the following items that require reconciliation between governmental funds financial statements and governmental activities financial statements at the government-wide level according to GASBS 34,indicate whether the reconciliation will A)always be subtracted from fund balances-governmental funds,B)always be added to fund balances-governmental funds,or C)may be added to or subtracted from fund balances-governmental funds in arriving at net assets of governmental activities.

_____ 1.Capital assets used in governmental activities

_____ 2.Long-term liabilities that are not payable in the current period

_____ 3.Net assets of internal service funds that are primarily governmental in nature

_____ 4.Accrued interest payable not due in the current period

(Short Answer)

4.8/5  (39)

(39)

Statistical tables included in comprehensive annual financial reports should provide social and economic data,in addition to financial data,to assist financial statement users in better understanding the activities and condition of the government.

(True/False)

4.8/5  (30)

(30)

"Interim financial reports are needed for state and local governments even though external users of financial reports have no need to assess monthly or quarterly performance of the government." Do you agree? Why or why not?

(Essay)

5.0/5  (32)

(32)

Infrastructure assets and long-term liabilities issued to finance infrastructure should be reported in the

(Multiple Choice)

4.7/5  (36)

(36)

The MD&A should provide information that is prospective in nature.

(True/False)

4.8/5  (45)

(45)

Comprehensive annual financial reports of state and local governments should include (1)an introductory section, (2)a financial section,and (3)a supplemental section.

(True/False)

4.9/5  (32)

(32)

Showing 1 - 20 of 50

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)