Exam 4: Accounting for Governmental Operating Activitiesillustrative Transactions and Financial Statements

Exam 1: Introduction to Accounting and Financial Reporting for Governmental and Not-For-Profit Entities48 Questions

Exam 2: Principles of Accounting and Financial Reporting for State and Local Governments50 Questions

Exam 3: Governmental Operating Statement Accounts; Budgetary Accounting67 Questions

Exam 4: Accounting for Governmental Operating Activitiesillustrative Transactions and Financial Statements85 Questions

Exam 5: Accounting for General Capital Assets and Capital Projects87 Questions

Exam 6: Accounting for General Long-Term Liabilities and Debt Service82 Questions

Exam 7: Accounting for the Business-Type Activities of State and Local Governments85 Questions

Exam 8: Accounting for Fiduciary Activities Agency and Trust Funds56 Questions

Exam 9: Financial Reporting of State and Local Governments50 Questions

Exam 10: Analysis of Governmental Financial Performance48 Questions

Exam 11: Auditing of Governmental and Not-For-Profit Organizations51 Questions

Exam 12: Budgeting and Performance Measurement58 Questions

Exam 13: Accounting for Not-For-Profit Organizations65 Questions

Exam 14: Not-For-Profit Organizations Regulatory, taxation, and Performance Issues56 Questions

Exam 15: Accounting for Colleges and Universities41 Questions

Exam 16: Accounting for Health Care Organizations46 Questions

Exam 17: Accounting and Reporting for the Federal Government52 Questions

Select questions type

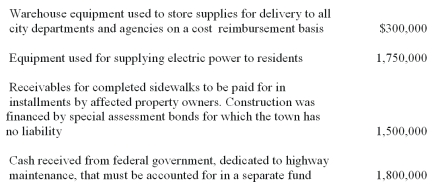

Using the information below,what amount should be accounted for in a special revenue fund or funds?

Free

(Multiple Choice)

4.8/5  (37)

(37)

Correct Answer:

A

The government-wide statement of net assets uses the same measurement focus and basis of accounting used by the General Fund balance sheet.

Free

(True/False)

4.9/5  (46)

(46)

Correct Answer:

False

Which of the following would be considered an internal exchange transaction?

Free

(Multiple Choice)

4.8/5  (44)

(44)

Correct Answer:

C

Equipment acquired several years ago by a capital projects fund and reported in the governmental activities statement of net assets at a net book value of $2,000 was sold for $1,000 cash.Journal entries are necessary in the general journals of the

(Multiple Choice)

5.0/5  (38)

(38)

The General Fund received $200,000 in lieu of taxes from the city owned water utility,an enterprise fund.This is an example of a(an)

(Multiple Choice)

4.8/5  (42)

(42)

Which of the following will require a debit to Fund Balance of a governmental fund when operating statement accounts are closed at the end of the year,assuming there are no other financing sources or uses?

(Multiple Choice)

4.9/5  (38)

(38)

When an enterprise fund pays the General Fund an amount in lieu of taxes,the account to be credited in the General Fund is

(Multiple Choice)

4.8/5  (41)

(41)

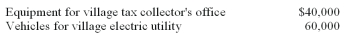

Cartier Village's capital expenditures during the year ended December 31 included:  What amounts should have been recorded in the General Fund and enterprise fund for the increase in equipment during the year ended December 31,assuming the electric utility is accounted for in an enterprise fund?

What amounts should have been recorded in the General Fund and enterprise fund for the increase in equipment during the year ended December 31,assuming the electric utility is accounted for in an enterprise fund?

(Multiple Choice)

4.8/5  (38)

(38)

Which of the following would be reported on the operating statement of a governmental fund?

(Multiple Choice)

4.8/5  (38)

(38)

Under the modified accrual basis of accounting applicable to governmental fund types,revenue from sources such as fines and forfeits is accrued and recorded at net realizable value.

(True/False)

4.8/5  (37)

(37)

The governmental funds operating statement presents all of the following except

(Multiple Choice)

4.9/5  (37)

(37)

A transfer of General Fund assets to create an internal service fund that is not expected to repay the assets is an example of an interfund transfer.

(True/False)

4.9/5  (48)

(48)

Whenever a tax or other significant revenue source is authorized by a legislative body to be used for a specified purpose only,a special revenue fund should be established.

(True/False)

4.8/5  (35)

(35)

On July 1,the first day of its fiscal year,the Town of Eldon levied a $1,000,000 property tax which is payable in full on December 1 of the same year.On September 15,the town decided to borrow $200,000 in 90-day tax anticipation notes to cover operating expenditures until the tax revenues are collected.The journal entry on September 15 to record the issuance of tax anticipation notes will include

(Multiple Choice)

4.8/5  (40)

(40)

All revenue and interfund transfers of the City of Fenton are accounted for on the modified accrual basis.Below is shown a list of Fenton's General Fund transactions of a revenue or transfer nature.State which ones should be recognized by the General Fund as a revenue or interfund transfer in the year of occurrence.If any item is neither a current revenue nor interfund transfer,state the proper treatment for that item.

1)Receipt of money from issue of tax anticipation notes.

2)Charge to a special revenue fund for supplies transferred to it at cost.

3)Collection of current-year property taxes.

4)Collection of prior years' taxes.

5)Receipt of money in prepayment of a property owner's next-year taxes.

6)Collection of taxes applicable to prior year that,due to an assessor's error,had not been recorded as receivable in that year.

7)Receipt of refund on prior year's expenditures.

8)Refund of current year's expenditures.

9)Collection of accounts receivable for charges for services.

10)Collection of taxes that had been written off in prior year.

(Essay)

5.0/5  (44)

(44)

Interfund transactions that would result in the recognition of revenues,expenditures,or expenses,if one of the parties were external to the government,should be reported as fund revenues,expenditures,or expenses.

(True/False)

4.9/5  (41)

(41)

Under current GASB standards the revenue from property taxes should be recorded in the amounts collected during the current period.

(True/False)

4.9/5  (37)

(37)

An interfund transfer should be reported in a governmental fund operating statement as a(an)

(Multiple Choice)

4.7/5  (42)

(42)

To properly account for the receipt of goods or services ordered in a prior fiscal year,it is necessary to know which appropriations were affected when the encumbrance documents were issued.

(True/False)

5.0/5  (45)

(45)

Which of the following should not be reported as a liability of the General Fund?

(Multiple Choice)

4.9/5  (36)

(36)

Showing 1 - 20 of 85

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)