Exam 12: Derivatives and Foreign Currency: Concepts and Common Transactions

Exam 1: Business Combinations36 Questions

Exam 2: Stock Investments Investor Accounting and Reporting41 Questions

Exam 3: An Introduction to Consolidated Financial Statements39 Questions

Exam 4: Consolidated Techniques and Procedures38 Questions

Exam 5: Intercompany Profit Transactions - Inventories39 Questions

Exam 6: Intercompany Profit Transactions - Plant Assets39 Questions

Exam 7: Intercompany Profit Transactions - Bonds40 Questions

Exam 8: Consolidations - Changes in Ownership Interests38 Questions

Exam 9: Indirect and Mutual Holdings37 Questions

Exam 11: Consolidation Theories,push-Down Accounting,and Corporate Joint Ventures39 Questions

Exam 12: Derivatives and Foreign Currency: Concepts and Common Transactions40 Questions

Exam 13: Accounting for Derivatives and Hedging Activities40 Questions

Exam 14: Foreign Currency Financial Statements39 Questions

Exam 15: Segment and Interim Financial Reporting38 Questions

Exam 16: Partnerships - Formation,operations,and Changes in Ownership Interests38 Questions

Exam 17: Partnership Liquidation40 Questions

Exam 18: Corporate Liquidations and Reorganizations38 Questions

Exam 19: An Introduction to Accounting for State and Local Governmental Units38 Questions

Exam 20: Accounting for State and Local Governmental Units - Governmental Funds34 Questions

Exam 21: Accounting for State and Local Governmental Units - Proprietary and Fiduciary Funds39 Questions

Exam 22: Accounting for Not-For-Profit Organizations39 Questions

Exam 23: Estates and Trusts36 Questions

Select questions type

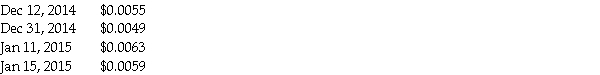

Blue Corporation,a U.S.manufacturer,sold goods to their customer in Hungary on December 12,2014 for 6,000,000 Hungarian forints.The customer agreed to pay in Hungarian forints in 30 days.When the customer wired the foreign currency to Blue on January 11,2015,Blue held them in their bank account until January 15 before selling them and converting them to U.S.dollars.The following exchange rates apply:  Required:

Record the journal entries that Blue would need related to the dates listed above.If no entry is required,state "no entry."

Required:

Record the journal entries that Blue would need related to the dates listed above.If no entry is required,state "no entry."

(Essay)

4.7/5  (37)

(37)

On October 15,2014,Napole Corporation,a French company,ordered merchandise listed on the internet for 20,000 Euros from Adams Corporation,a U.S.corporation.The euro rate was $1.20 (U.S.dollars)on October 15.On November 15,2014 Adams shipped the goods and billed Napole the purchase price of 20,000 Euros when the euro rate was $1.30.Napole paid the bill on December 10,2014,and Adams immediately exchanged the 20,000 Euros for US dollars when the Euro rate was $1.28 on December 10,2014.

Required:

Compute the foreign currency gain or loss on the December 31,2014 financial statements of Adams and show the related journal entries.

(Essay)

4.9/5  (35)

(35)

On September 1,2014,Bylin Company purchased merchandise from Himeji Company of Japan for 20,000,000 yen payable on October 1,2014.The spot rate for yen was $0.0079 on September 1 and the spot rate was $0.0077 on October 1.The purchase was paid on October 1,2014.

Required:

1.Did the U.S.dollar strengthen or weaken from September to October and what are the implications for Bylin's business?

2.What journal entry did Bylin record on September 1,2014?

3.What journal entry did Bylin record on October 1,2014?

(Essay)

4.9/5  (31)

(31)

Which of the following statements is true regarding forward contracts,futures contracts,options and swaps?

(Multiple Choice)

4.8/5  (40)

(40)

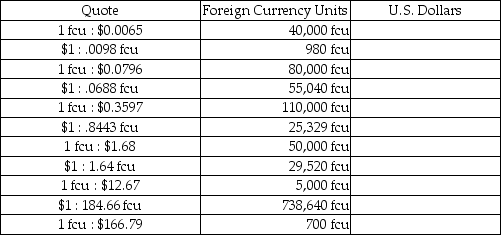

The table below provides either a direct or indirect quote for a given foreign currency unit,and the related units of that foreign currency.

Required:

Complete the table,indicating the amount of U.S.Dollars that is the equivalent of the foreign currency shown,based on the direct or indirect quote provided.

Required:

Complete the table,indicating the amount of U.S.Dollars that is the equivalent of the foreign currency shown,based on the direct or indirect quote provided.

(Essay)

4.7/5  (31)

(31)

The exchange rates between the Australian dollar and the U.S.dollar were as follows:  This chart shows a

This chart shows a

(Multiple Choice)

5.0/5  (27)

(27)

Slade Corporation,a U.S.company,purchased materials on account from a manufacturer in Mexico on June 15.The invoice was denominated in the shipper's currency for 480,000 pesos.The goods were paid for on July 18.Slade closes their fiscal year on June 30,and used the following indirect quotes to measure the amounts related to the transactions.

June 15 $1.00 = 12.50 pesos

June 30 $1.00 = 12.80 pesos

July 18 $1.00 = 12.00 pesos

Required:

Show all related journal entries for Slade Company.

(Essay)

4.9/5  (31)

(31)

If a U.S.company is preparing a journal entry for a recent purchase,foreign-currency-denominated purchases must be measured in ________ at the purchase date using the foreign currency ________ rate on the purchase date.

(Multiple Choice)

5.0/5  (38)

(38)

Ulysses Company purchases goods from China amounting to 372,372 Yuan (the transaction is denominated in the Chinese Yuan).Assume the Yuan is trading at $0.154 at the date the goods are ordered,and the Yuan is trading at $0.155 at the date the goods are received,and when the invoice is paid a month later,the Yuan is trading at $.156.Assume all three dates are in the same fiscal year.Which of the following is true?

(Multiple Choice)

4.9/5  (38)

(38)

Crabby Industries,a U.S.corporation,purchased inventory from a company in Sweden on November 18,2014 when the Swedish krona was trading at 1 krona = $0.161.The transaction was for 600,000 krona,and was to be paid in krona in 90 days.Crabby closed their books at December 31 for financial reporting purposes when the krona was trading at $0.167.On February 16,2012,Crabby paid the invoice when the krona was trading at $0.156.

Required:

Show the journal entries recorded by Crabby on November 18,2014,December 31,2014,and February 16,2015.

(Essay)

4.7/5  (37)

(37)

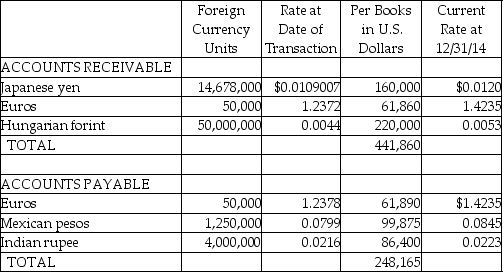

Lincoln Corporation,a U.S.manufacturer,both imports needed materials and exports finished products.Their receivables and payables are listed below,prior to year-end adjustments or preparation of the closing entries.

Required:

Determine the amount at which receivables and payables should be reported on December 31,2014,and the net exchange gain or loss that would be reported as a result of year-end adjustments.

Required:

Determine the amount at which receivables and payables should be reported on December 31,2014,and the net exchange gain or loss that would be reported as a result of year-end adjustments.

(Essay)

4.9/5  (39)

(39)

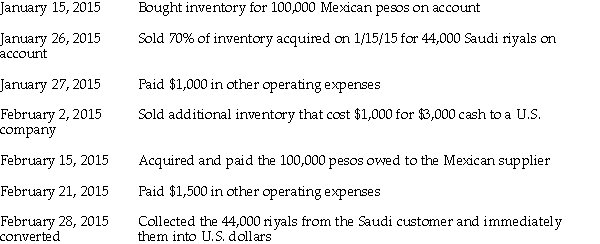

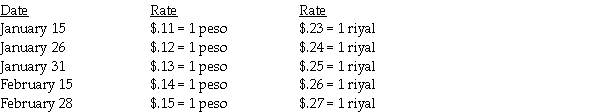

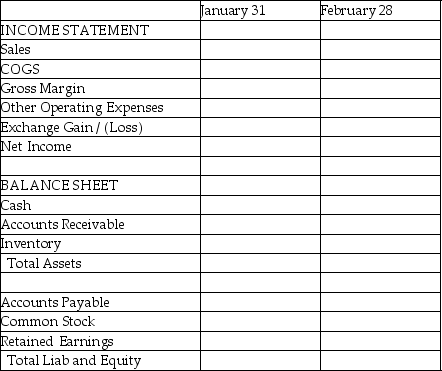

Piel Corporation (a U.S.company)began operations on January 1,2015,when common stock was issued for $250,000.In the first two months of operations,Piel had the following transactions:  The following exchange rates apply:

The following exchange rates apply:  Required:

Complete the summary income statement and balance sheet for the month ended January 31,2015 and February 28,2015,assuming there were no other transactions.

Required:

Complete the summary income statement and balance sheet for the month ended January 31,2015 and February 28,2015,assuming there were no other transactions.

(Essay)

4.8/5  (40)

(40)

When the billing for a U.S.company's sale to a company in a foreign country is denominated in U.S.dollars,________ is required when preparing journal entries for the sale.

(Multiple Choice)

4.9/5  (22)

(22)

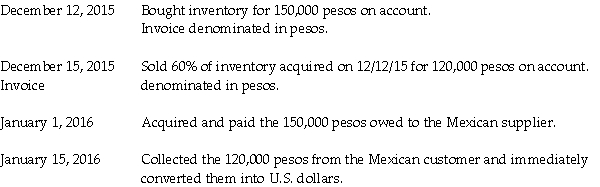

Johnson Corporation (a U.S.company)began operations on December 1,2014,when the owner contributed $100,000 of his own money to establish the business.Johnson then had the following import and export transactions with unaffiliated Mexican companies:  The following exchange rates apply:

The following exchange rates apply:  Required:

1.What were Sales in the income statement for the year ended December 31,2015?

2.What was the COGS associated with these sales?

3.What is the Accounts Payable balance in the balance sheet at December 31,2015?

4.What is the Inventory balance in the balance sheet at December 31,2015?

Required:

1.What were Sales in the income statement for the year ended December 31,2015?

2.What was the COGS associated with these sales?

3.What is the Accounts Payable balance in the balance sheet at December 31,2015?

4.What is the Inventory balance in the balance sheet at December 31,2015?

(Essay)

4.7/5  (34)

(34)

Use the following information to answer the question(s)below.

On October 4,2014,Sooty Corporation borrowed 250,000 British pounds from a London bank,evidenced by an interest-bearing note payable due in one year.The note was payable in pounds.Exchange rates for pounds were:  -What exchange gain or loss appeared on Sooty's 2015 income statement?

-What exchange gain or loss appeared on Sooty's 2015 income statement?

(Multiple Choice)

4.8/5  (40)

(40)

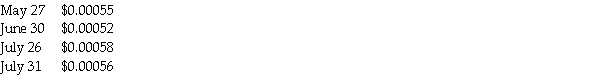

Tank Corporation,a U.S.manufacturer,has a June 30 fiscal year end.Tank sold goods to their customer in Columbia on May 27,2014 for 18,000,000 Columbian pesos.The customer agreed to pay pesos in 60 days.When the customer wired the funds to Tank on July 26,Tank held them in their bank account until July 31 before selling them and converting them to U.S.dollars.The following exchange rates apply:  Required:

Record the journal entries related to the dates listed above.If no entry is required,state "no entry."

Required:

Record the journal entries related to the dates listed above.If no entry is required,state "no entry."

(Essay)

4.8/5  (39)

(39)

A direct quote for the U.S.dollar is given at $1.45 per 1 foreign currency unit (fcu).The respective indirect quote for the U.S.dollar would be reported as

(Multiple Choice)

4.9/5  (36)

(36)

On May 1,2014,Deerfield Corporation purchased merchandise from a German firm for 78,000 euros when the spot rate for the euro was 1.48 euro per dollar.The account payable was denominated in the euro.Deerfield settled the account on August 1 when the spot rate for the euro was 1.39 euro per dollar.How much cash will Deerfield have to disburse to settle the account?

(Multiple Choice)

5.0/5  (35)

(35)

A U.S.importer that purchased merchandise from a South Korean firm would be exposed to a net exchange gain on the unpaid balance if the

(Multiple Choice)

4.9/5  (36)

(36)

Use the following information to answer the question(s)below.

On November 1,2014,Rolleks Corporation sold merchandise to Watchem Corporation,a Swiss firm.Rolleks measured and recorded the account receivable from the sale at $107,100.Watchem paid for this account on November 30,2014.Spot rates for Swiss francs on November 1 and November 30,respectively,were $1.05 and $1.02.

-If the sale of merchandise is denominated in dollars,the November 30 entry to record receipt of the payment from Watchem included a

(Multiple Choice)

4.9/5  (31)

(31)

Showing 21 - 40 of 40

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)