Exam 3: Adjusting Accounts for Financial Statements

Exam 1: Accounting in Business331 Questions

Exam 2: Analyzing for Business Transactions293 Questions

Exam 3: Adjusting Accounts for Financial Statements445 Questions

Exam 4: Accounting for Merchandising Operations267 Questions

Exam 5: Inventories and Cost of Sales258 Questions

Exam 6: Cash, fraud, and Internal Controls230 Questions

Exam 7: Accounting for Receivables237 Questions

Exam 8: Accounting for Long-Term Assets283 Questions

Exam 9: Accounting for Current Liabilities258 Questions

Exam 10: Accounting for Long-Term Liabilities250 Questions

Exam 11: Corporate Reporting and Analysis247 Questions

Exam 12: Reporting Cash Flows265 Questions

Exam 13: Analysis of Financial Statements263 Questions

Exam 14: Time Value of Money84 Questions

Exam 15: Investments228 Questions

Exam 16: Partnership Accounting189 Questions

Select questions type

Reversing entries are recorded in response to external transactions that were created in error during the prior accounting period.

(True/False)

4.9/5  (38)

(38)

At the beginning of the year,Sigma Company's balance sheet reported Total Assets of $195,000; Total Liabilities of $15,000; and Total Paid-in capital of $60,000.During the year,the company reported total revenues of $226,000 and expenses of $175,000.Also,dividends during the year totaled $48,000.Assuming no other changes to Retained earnings,the balance in the Retained earnings account at the end of the year would be:

(Multiple Choice)

4.9/5  (37)

(37)

For the year ended December 31,a company has revenues of $317,000 and expenses of $196,000.The company paid $50,000 in dividends during the year.The balance in the Retained earnings account before closing is $81,000.Which of the following entries would be used to close the dividends account?

(Multiple Choice)

4.8/5  (29)

(29)

Financial statements can be prepared directly from the information in the adjusted trial balance.

(True/False)

5.0/5  (40)

(40)

The expense recognition (matching)principle requires that expenses get recorded in the same accounting period as the revenues that are earned as a result of the expenses,not when cash is paid.

(True/False)

4.9/5  (39)

(39)

Palmer Company is at the end of its annual accounting period.The accountant has journalized and posted all external transactions and all adjusting entries,has prepared an adjusted trial balance,and completed the financial statements.The next step in the accounting cycle is:

(Multiple Choice)

4.8/5  (29)

(29)

A broad principle that requires identifying the activities of a business with specific time periods such as months,quarters,or years is the:

(Multiple Choice)

4.8/5  (29)

(29)

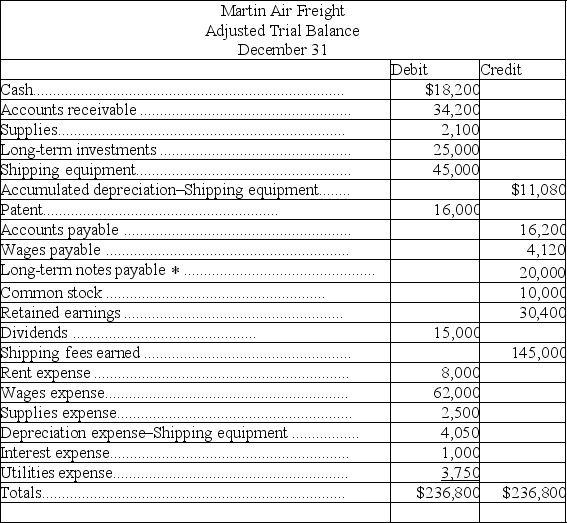

a)Prepare a classified balance sheet for Martin Air Freight based on the adjusted trial balance shown below.b)Prepare the required closing entries.

* $2,000 of the long-term note payable is due during the next year.

* $2,000 of the long-term note payable is due during the next year.

(Essay)

4.9/5  (29)

(29)

Closing entries result in the Dividends account being transferred into net income or net loss for the period ending.

(True/False)

4.8/5  (36)

(36)

A company made no adjusting entry for accrued and unpaid employee wages of $28,000 on December 31.This oversight would:

(Multiple Choice)

4.9/5  (36)

(36)

From the information provided,calculate Giuseppe's profit margin ratio for each of the three years.Comment on the results,assuming that the industry average for the profit margin ratio is 6% for each of the three years.

2017 2016 2015 Net income \ 2,630 \ 2,100 \ 1,850 Net Sales 36,500 32,850 31,200 Total Assets 400,000 385,000 350,000

(Essay)

4.8/5  (37)

(37)

Intangible assets are long-term resources that benefit business operations that usually lack physical form and have uncertain benefits.

(True/False)

4.9/5  (41)

(41)

Discuss how accrual accounting enhances the usefulness of financial statements.

(Essay)

4.8/5  (44)

(44)

A company's Office Supplies account shows a beginning balance of $600 and an ending balance of $400.If office supplies expense for the year is $3,100,what amount of office supplies was purchased during the period?

(Multiple Choice)

4.8/5  (42)

(42)

Explain how the owner of a company uses the accrual basis of accounting.

(Essay)

4.9/5  (37)

(37)

The first step in the accounting cycle is to analyze transactions and events to prepare for journalizing.

(True/False)

4.9/5  (37)

(37)

Showing 341 - 360 of 445

Filters

- Essay(0)

- Multiple Choice(0)

- Short Answer(0)

- True False(0)

- Matching(0)